South Africa’s long-term insurance industry has shown remarkable resilience, paying out nearly R3 trillion in claims and benefits over the past five years while maintaining a strong financial position.

According to the long-term insurance statistics released this week by the Association for Savings and Investment South Africa (ASISA), in 2024 alone, insurers paid out a record R639 billion in claims and benefits, covering everything from retirement annuities (RAs) and endowment policies to life, disability, critical illness, and income protection claims.

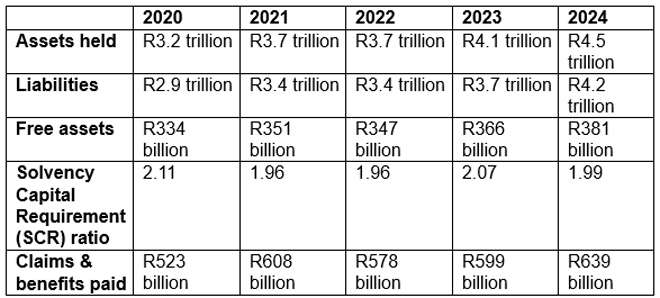

Despite the scale of these disbursements, the industry remains well capitalised. ASISA reports that the insurance sector ended 2024 with R4.5 trillion in assets under management and a solvency buffer of 1.99 – nearly double the Prudential Authority’s solvency capital requirement.

According to Gareth Friedlander, a member of ASISA’s Life and Risk Board Committee, this financial strength should reassure policyholders.

“Despite these sizeable payouts, our industry remains well capitalised and in a strong position to honour long-term contractual promises made to policyholders and their beneficiaries. The fact that this is on the back of a major catastrophe, namely the Covid-19 pandemic, shows just how resilient our industry is.”

The life industry in numbers

The number of in-force policies grew from 43.76 million at the end of 2023 to 44.43 million by 31 December 2024.

In 2024, consumers bought 10.39 million new individual recurring-premium risk policies, of which 6.24 million were funeral policies and 1.56 million were credit life policies.

This represents an increase of 4.2% in new recurring-premium risk business from 2023.

Friedlander reports a slow but steady recovery in new individual recurring-premium savings policies (endowments and RAs).

In 2024, 568 586 savings policies were bought, compared to 536 784 in 2023, representing a 5.9% increase.

New single-premium savings policies, on the other hand, showed a decline of 3.7% from 215 807 in 2023 to 207 744 in 2024.

Policy surrenders

Friedlander says a positive surprise was a marginal decline in risk policy lapses for the third consecutive year.

In 2024, some 8.20 million risk policies lapsed compared with 8.25 million in 2023 and 8.33 million in 2022.

Friedlander points out that savings policy surrenders also showed a decline over the past three years.

Policyholders surrendered 521 736 recurring-premium savings policies in 2024, compared with 563 326 in 2023 and 585 265 in 2022.

“The increase in new savings policies against a decrease in surrenders is a welcome development, especially in the current economic climate. It is encouraging that consumers recognise the importance of disciplined savings, even under difficult circumstances.”

Friedlander says although the drop in lapses and surrenders against an increase in new recurring-premium risk and savings policies bought in 2024 is encouraging, the lapse rate remains high.

“With every risk policy lapsed, South Africa’s sizeable insurance gap widens even further, leaving more families financially vulnerable should their breadwinner die or become disabled. While the surrender of a savings policy is also concerning because it signals the end of a disciplined savings journey for a consumer, at least the policyholder is paid a benefit.”

Addressing ongoing challenges, financial advisers are urged to engage proactively with clients.

“Once you lapse a risk policy, you not only lose valuable cover for you and your family, but you may also not be able to get the same cover for the same price later because you are older and may have developed health issues.”