South African life insurers paid R298 billion in claims and benefits to beneficiaries and policyholders in the first six months of 2024, according to the long-term insurance statistics released by the Association for Savings and Investment South Africa (ASISA) today (7 October).

Payouts were for retirement annuity (RA) and endowment policy benefits, as well as claims against life, disability, critical illness, and income protection policies.

At the end of June 2024, life insurers held 35.2 million risk policies for policyholders paying monthly premiums. Some 15 million were funeral policies, just over 7 million were credit life policies, and nearly 13 million were life, disability, severe illness, and income protection policies.

The ASISA statistics show a modest growth of 1.7% in recurring-premium risk policies in the first six months of 2024.

Although the increase in the number of recurring-premium risk policies was slight, the growth was a positive sign given the challenging economic environment, said Gareth Friedlander, a member of ASISA’s Life and Risk Board Committee.

“By the second quarter of 2024, the official unemployment rate had climbed to 33.5%. In addition, consumers faced high living costs driven by high interest rates and increasing fuel and food prices. Against that backdrop, the increase in risk policy sales was encouraging.”

According to Friedlander, any increase in life and disability policies is good news because most households are severely underinsured.

The 2022 ASISA Life and Disability Insurance Gap Study, conducted every three years, showed that South Africa’s 14.3 million income earners had only enough life and disability insurance to cover 45% of the total insurance needs of their households. The average household supported by at least one income earner would, therefore, be forced to drastically cut living expenses if the earner died or became disabled and no other source of income could be found.

Friedlander said it is concerning, therefore, that about 4.3 million recurring-premium risk policies lapsed in the first half of 2024. This means that 4.3 million policyholders and their beneficiaries are now living either without risk cover or with reduced cover. A lapse occurs when the policyholder stops paying premiums for a risk policy with no accumulated fund value.

At the end of June 2024, some 5.1 million individual recurring-premium savings policies (endowments and RAs) were in force.

Although consumers took out 294 138 new recurring-premium savings policies in the first six months of this year, policyholders surrendered 287 707 recurring-premium savings policies. A surrender occurs when the policyholder stops paying premiums and withdraws the fund value before maturity.

Message to consumers

For many families, job losses, rising living costs, and more expensive debt have meant that their monthly expenses equal or exceed the joint household income. Instead of taking a holistic approach to managing their finances by carefully considering all options and devising a realistic plan to reduce expenses, a panic reaction often leads to lapsing valuable risk cover, Friedlander said.

ASISA encouraged consumers who struggling to make ends meet to complete the financial health check assessment on SmartAboutMoney.co.za and use the Budget Planner and Debt Repayment Calculator to help with a viable financial plan. SmartAboutMoney.co.za is a consumer financial education website supported by ASISA.

Friedlander said policyholders often do not consider that they may no longer be eligible for risk cover because of age or medical reasons once they have cancelled their cover. Even if risk cover is an option at a later stage, it will almost always be more expensive because the policyholder is older.

He is cautiously optimistic that there is light at the end of the tunnel for consumers and encourages policyholders to hold on to their valuable insurance cover, if possible.

The recovery in the rand, if sustained, will positively impact fuel prices, while the 0.25% interest rate cut, although small, will hopefully be the first of many, bringing relief to indebted consumers and stimulating economic growth, he said.

Overall, sentiment seems to have changed for the positive following the peaceful transition to a Government of National Unity after the elections and the suspension of loadshedding, he added.

Strong reserves

Despite the sizeable pay-outs, life insurers remained well capitalised and in a solid position to honour the long-term contractual promises made to customers.

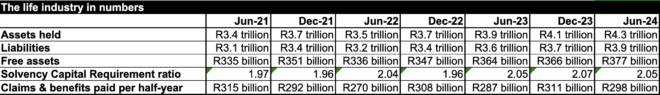

Friedlander said the life insurance industry held assets of R4.3 trillion at the end of June 2024, while liabilities amounted to R3.9 trillion. This left the industry with free assets of R377bn, more than double the reserve buffer required by the Solvency Capital Requirement (SCR). The SCR is regulated by the South African Reserve Bank’s Prudential Authority and is designed to protect policyholders.

“The life industry has maintained resilient capital strength and stable reserves, even during the Covid years,” Friedlander said. “Strong reserves provide policyholders with the peace of mind that the long-term insurance industry is in good health and that life insurers will be in a position to pay claims and policy benefits, even when extreme events like a pandemic result in unusually high claims.”