But for a few exceptions, open medical schemes across the board seem to have come in with 2024 contribution adjustments higher than the 8% advised by the Council for Medical Schemes (CMS).

In a circular distributed in August, the CMS advised schemes to limit their contribution increases for 2024 to 5% – in line with headline inflation as measured by the Consumer Price Index (CPI) – plus “reasonable” utilisation estimates.

The CMS projected these estimates at 3.2% to 3.8% based on its analysis of cost increase assumptions for 2023. In other words, a recommended increase of just over 8%, give or take a percentage point or two.

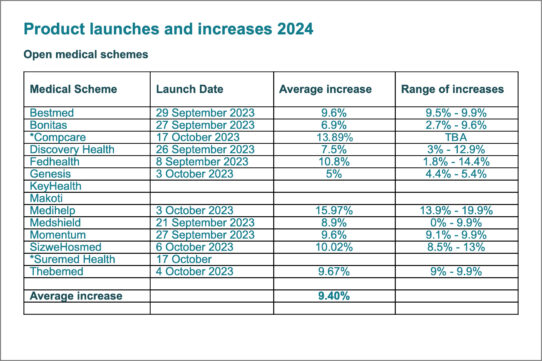

At the end of last month, South Africa’s top five medical schemes – Discovery Health Medical Scheme (DHMS), Bonitas Medical Fund, Momentum Medical Scheme, Bestmed Medical Scheme, and Medihelp Medical Aid – made public their respective contribution increases.

DHMS announced a weighted average contribution increase of 7.5%. Bonitas’s weighted increase for next year is 6.9%, and Momentum’s will be 9.6%. Bestmed announced a 9.6% average weighted contribution increase across all its benefit plans, while Medihelp’s weighted average adjustment is 15.96%.

Alexforbes, which is an adviser/broker for a range of medical schemes, recently shared the weighted average contribution increases for Fedhealth (10.8%), Genesis (5%), Medshield (8.9%), SizweHosmed (10.02%), and Thebemed (9.67%).

At first glance, that places Medshield slightly above the 8% prescribed increase, followed by Momentum, Bestmed, Thebemed, SizweHosmed, and Fedhealth.

Medihelp, with its weighted increase of 15.96%, tops the chart thus far, although Medihelp has stated that most of its options are priced the lowest in the market, “which provides a very low base for adjustment and ensures that the product range remains well positioned despite the increase”.

Read: Bestmed and Medihelp announce 2004 contribution increases

Going on “weighted average contributions” alone, the outlook might not seem that dire to some. This picture changes somewhat when the range of increases across the benefit options of the various open medical schemes are considered, many of which at the top end far exceed the 8% mark.

For example, Bonitas’s BonComprehensive will increase by 9.6%. Bestmed, Thebemed, and Medshield’s scale of increases top out at 9.9%, respectively. DHMS’s Executive plan has a 12.9% change. SizweHosmed’s highest contribution increase is 13%, while Fedhealth’s stands at 14.4%. Members of Medihelp’s MedAd savings plan will pay 19.9% more next year.

Directive withdrawn

When sharing these 2024 contribution increases, Alexforbes was quick to point out that the changes to medical scheme contributions and benefits are undergoing a review process by the CMS and are subject to approval.

Last week, Moonstone reported that the CMS had sent a directive to South Africa’s top five open medical schemes on 5 October, instructing them to withdraw their 2024 contribution announcements and publish them only once the regulator had formally approved the changes.

Read: Updated: Withdraw 2024 contribution increase announcements, regulator instructs medical schemes

In Circular 27 of 2023, distributed in August, the regulator noted that only contribution increases that had been approved by the Registrar may be implemented by medical schemes. It advised against communicating any benefit changes or contribution increases before obtaining the necessary approval from the regulator.

DHMS announced its proposed contribution increases and benefit changes for 2024 to members and brokers on 26 September 2023.

The medical scheme lodged an appeal in response to the directive, stating that “the practices and processes followed in 2023 were no different to prior years and fully compliant with all legal requirements”.

DHMS has since confirmed that the CMS, on 17 October, formally withdrew the directive for DHMS to retract year-end update communication about contribution and benefit changes for 2024, as well as the associated investigation into the conduct of DHMS.

Dr Ryan Noach, the chief executive of Discovery Health, the administrator of DHMS and 18 other schemes, confirmed that “DHMS is pleased that this matter between DHMS and the regulator has been amicably resolved. We are comforted that the regulator has prioritised the protection of the interests of members of DHMS, to ensure that the members are fully informed, empowered and able to seek timeous advice on year-end changes from their financial advisers.”

The scheme plans to implement the annual contribution increases and benefit changes on 1 January 2024, “subject to the specific approval by the CMS of the various changes”.

Medical inflation and medical scheme contributions have increased in the past and are increasing at a rate higher than inflation. The average South-African household has had to find an extra R9 000 “somewhere” since the start of the current interest rate cycle to maintain ther standard of living! Members often downgrade plans until medical aid membership is too expensive. I don’t see the medical aid schemes and health care providers solving for this and in my opinion the NHI is not a solution.