Healthcare brokers have been urged to avoid “any drastic actions” that could harm Sizwe Hosmed Medical Fund and its members, following the announcement that the open medical scheme has been placed under statutory management.

In a joint statement released yesterday, the Council for Medical Schemes (CMS) and the Sizwe Hosmed board of trustees said the decision to place the scheme under statutory management was driven by “the deterioration of financial reserves”.

In terms of regulation 29(2) of the Medical Schemes Act (MSA), a medical scheme must at any time maintain accumulated funds, expressed as a percentage of gross annual contributions, of at least 25%.

In November 2021, the merger of Sizwe Medical Fund and Hosmed Medical Scheme initially left the newly formed entity with combined reserves of R1.4 billion and a solvency level of 49.4%. However, just one year later, the scheme’s solvency ratio had dropped to 25.45%. The joint statement attributed the decline to “benefit under-pricing and historically unreliable budgetary and forecasting processes”, which continue to erode the scheme’s reserves.

The CMS emphasised that this process is not a curatorship, where a curator solely manages the scheme’s affairs. Instead, it is a statutory management intervention in which the CMS and the board of trustees will jointly run the scheme. The aim is for “the two parties to work together to stabilise the scheme, ensure its sustainability, and protect the interests of Sizwe Hosmed beneficiaries”.

Where did the reserves go?

The CMS 2022 Industry Report, released last December, ranked Sizwe Hosmed as the sixth-largest open medical scheme and the tenth largest overall in South Africa. With 3Sixty Health as its administrator, the scheme serves 63 577 members and 152 421 beneficiaries.

The CMS urged members to remain with the scheme as the regulatory intervention steers the scheme back into complying with the minimum statutory solvency requirements, stating that the scheme has “a solid and good member profile, many of whom are young”.

So, given all the scheme’s advantages, how did its solvency ratio decline by nearly 24% in just one year?

The first public indication of trouble came when the Industry Report showed that the scheme had recorded the fourth-highest operating deficit for 2022.

At the time, the CMS attributed the decline in solvency partly to the November 2021 merger with Hosmed, which resulted in a significant increase in annualised contributions – the key factor in the solvency calculation – in 2022.

“It is, however, of concern that the scheme incurred the fourth-highest operating deficit, given its low solvency level. This seems to suggest that the scheme has experienced much worse claims than anticipated at its pricing for its 2022 benefits.”

Read: All open medical schemes – except one – have solvency ratios far above the required minimum

The claims ratio is a key financial metric that measures the percentage of a medical scheme’s income (or contributions) spent on paying out claims. The open scheme industry average in 2022 was 93.11%. The Industry Report showed that Sizwe Hosmed had a 99.02% claims ratio in 2022 compared to 95.28% in 2021.

“It is interesting to note that of the eight schemes whose claims ratio exceeds the open scheme industry average of 93.11%, only Sizwe Hosmed Medical Funds’ average age is younger than that of the industry (33.13 years compared to 35.81 years),” the CMS said.

The report noted several higher-than-the-norm expenditures by Sizwe Hosmed that year.

Sizwe Hosmed was listed among the 10 open schemes with the highest net healthcare expenditure per average beneficiary per month (PABPM).

The average healthcare expenditure for open schemes was R1 860.68 PABPM, whereas Sizwe Hosmed’s was R2 232.22. This was despite the scheme having a below-average demographic profile. In addition to the young average age of its beneficiaries, the scheme’s pensioner ratio was 7.62%, compared to the industry average of 11.33%.

In 2022, the industry average for non-healthcare expenditure was R229.60 per average beneficiary per month (PABPM).

Sizwe Hosmed’s PABPM was R268.57.

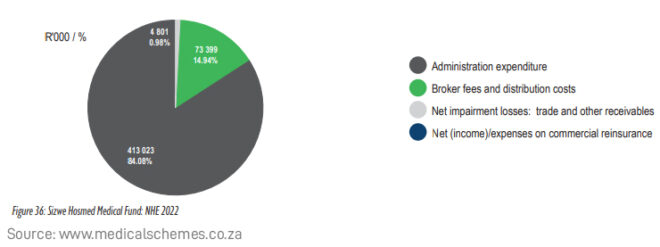

Non-healthcare expenditure generally includes costs that are not directly related to the provision of medical services or benefits to members, such as administrative costs, broker fees and distribution costs, net impairment losses (trade and other receivables), and net income/expenses on commercial reinsurance.

A pie chart published in the Industry Report shows Sizwe Hosmed’s administration expenditure represented 84.08% of its non-healthcare expenditure.

The report states that when adjusted for lives, the administration expenditure of R225.81 PABPM exceeds the open scheme industry average of R182.75. The report states that schemes need to operate with a certain number of lives for average operational costs to be lower and make the business more profitable and sustainable over the long term.

When comparing its marketing and advertising expenditure, the R120.84 per active member per month (PAMPM) exceeds the industry spend of R32.40 PAMPM, which is 273% more than the industry average.

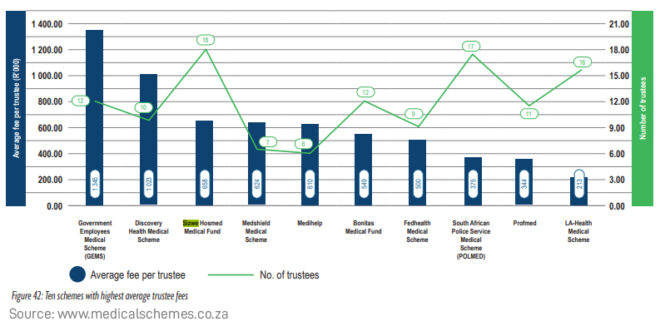

Trustees at Sizwe Hosmed, of which there were 18 in 2022, also seem to be exceptionally well paid. The scheme’s average fee per trustee of R658 000 far exceeds the industry average of R398 000. And despite being the tenth-largest scheme in South Africa, it is ranked third when schemes with the highest trustee fees are compared.

The principal officer at Sizwe Hosmed also saw a substantial 20.23% pay rise in 2022, with the annual salary climbing from R3 415 000 in 2021 to R4 106 000.

But wait, there’s more

The scheme’s name again popped up in January when the CMS published a new research report titled “Annual General Meetings of Medical Schemes: Importance and Challenges Associated with Limited Member Participation”.

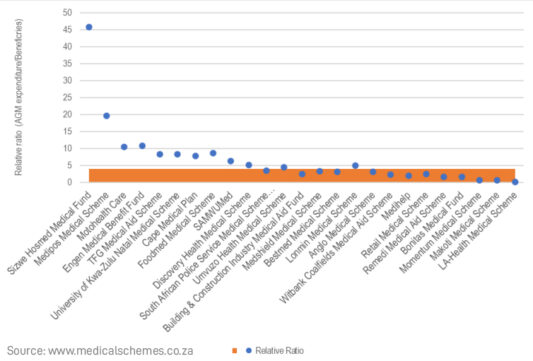

The research found that of the 71 registered medical schemes in South Africa, 33 incurred AGM-related expenses totalling R29.2 million in 2022. The CMS deemed this spending pattern “worrisome”.

Five medical schemes exhibited significantly higher spending than other schemes bearing a substantially higher proportion of the total AGM expenditure.

These schemes included Sizwe Hosmed, Medipos Medical Scheme, Engen Medical Benefit Fund, Motohealth Care, and Foodmed Medical Scheme.

The graph illustrates expenditure relative to the number of lives covered, revealing a pattern where some schemes exhibited significantly higher spending than others.

“Notably, Sizwe Medical Fund had an extreme value with a relative ratio of 46, a substantial deviation from the benchmark value of 4,” the research report read.

Read: Medical schemes regulator flags ‘extravagant’ AGM expenses

New man in charge

To get the scheme back on track, the CMS and the board of trustees have appointed Joe Seoloane as the scheme’s statutory manager with immediate effect.

With more than 30 years of experience, the healthcare business rescue specialist is known for his expertise in healthcare governance and ethics. Other medical schemes where he plied his skills in the past include KeyHealth, SAMWUMED, Sizwe, ProSano, POLMED, and Medicover 2000.

Seoloane, who is already working with the board of trustees on a turnaround strategy, will now assume a more pivotal role at Sizwe Hosmed.

Under section 5A(5) of the Financial Institutions Act, Seoloane must advise the Registrar’s office on the steps necessary to ensure the scheme’s legal compliance, financial soundness, and proper administration.

His responsibilities include helping the scheme comply with regulation 29 of the MSA, which involves measures to reconstitute its board of trustees according to the MSA and the scheme’s rules. Additionally, Seoloane will investigate and report on all circumstances that led to the non-compliance with regulation 29 to the Office of the Registrar.

To much of corruption in hosmed that is why very high expenditures in salaries sizwe hosmed is worst of now after joining hosmed.

Sizwe was better of on its own.

I wonder if there isn’t some fraud going on as well. For years now I have been receiving messages from a pharmacy about claims having been processed for various names. I have never been a member of this medical aid. I have e-mailed them and they assured me that the matter had been resolved but the messages about the claims received kept coming. It somehow feels fishy to me.

This is very concerning for members of other Medical Schemes administered by 3Sixty Health.

I was a member of sizee hosmed for over thirteen years I was socked in 2022 when they me a new card only to find I’ve got beneficiaries of a different surname I fought them I was corrected the next year samething happened, there’s lots of fraud or corruption in there, and other reason is the increase of membership twice every year.

I belong to Sizwe Hosmed and am on the Gold Ascend Plan. The Local Medical Center in Durban that I use for all my Doctors consultations used to claim on the customers behalf after a Doctors appointment, however about nine months back after a Doctors appointment I was stopped by the receptionist and asked to pay up front for the Doctors consultation, on being taken aback and asking why? I was told that the Medical Aid I was on had far to many outstanding claims that had not been paid & from then on all consultations must be paid upfront and I must process my own claims with Sizwe Hosmed.

I left Sizwe Hosmed as they had two increases last year. My instalment for January this year R6300 sans the Employer portion. I had to pay in on every script as well. TSEK. I’m so happy I made the right decision to go elsewhere. A pity, they WERE brilliant when joining in 2005, but still more expensive than the other medical aid offered at work. I really liked them then, the greed to syphon is apparent

Medical fee are going up every year but may salary stay the same because I am on pension

I will be going on pension Jan 2025 and this medical aid, although been good to me and my wife, I will not be able to afford the very high monthly contributions, especially with me been very good health not having had any operation at all, only hypertension, diabetes chronic description..I will have to find a more affordable medical aid very soon..