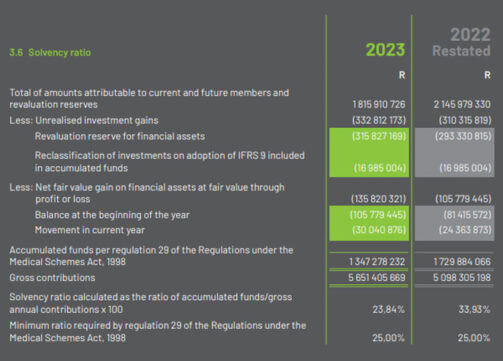

Medihelp, the fifth largest contender in South Africa’s “Big Five” open medical schemes, saw its solvency ratio decrease by 10 percentage points in 2023, falling 2% below the prescribed level of 25%.

In terms of regulation 29(2) of the Medical Schemes Act (MSA), a medical scheme must at any time maintain accumulated funds, expressed as a percentage of gross annual contributions, of minimum 25%. The scheme’s solvency ratio was 23.84% on 31 December 2023, down from 33.93% (restated) at the end of 2022 “due to continued high claims experienced by the scheme”.

Medihelp released its 2023 annual report on 20 June. In the report, Chris Klopper, chairperson of the board of trustees, stated that the scheme faced three major challenges in the past year: the death of principal officer Ettie da Silva in June, increased hospital admissions and medical costs, and a claims ratio of 100.8% (as at 31 December 2023), “which put pressure on the reserve level”.

Klopper said the latter required Medihelp’s trustees and executive team to submit a three-year plan to the Council for Medical Schemes (CMS) before the 2024 product launch in October 2023 to ensure the sustainability of the scheme.

“The plan is based on a set percentage by which member contributions need to increase over the three years for reserve levels to return to the 25% level prescribed by statute. The Council for Medical Schemes accepted and approved the plan and progress is being monitored throughout,” Klopper said.

2024 contribution increases

The scheme made headlines four years ago when it absorbed contribution increases. Medihelp decided at the end of 2021 to support the allocation of accumulated reserves to alleviate economic pressure on members – brought about by the Covid-19 pandemic – and introduced an overall weighted average premium reduction of 0.45% for 2022. This was followed by a hike of 7.5% in 2023.

In October last year, Medihelp announced the highest average weighted contribution increase for 2024 among the top five open medical schemes.

At the time, Medihelp said its membership growth had placed pressure on the scheme’s reserves, necessitating the 15.96% hike.

Discovery Health, the country’s largest open medical scheme, announced a weighted average contribution increase of 7.5%. Bonitas’s weighted increase for this year was 6.9%, and Momentum Health’s was 9.6%.

Read: Bestmed and Medihelp announce 2024 contribution increases

Moonstone contacted Medihelp to inquire about the average percentage contribution increases for the next two years, based on the three-year plan submitted to the CMS, and whether members could expect similar increases during this period.

Medihelp declined to comment.

High claims experienced in 2023

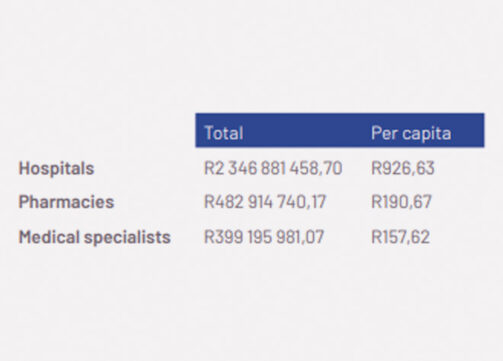

In 2023, total benefits paid to hospitals, pharmacies, and medical specialists exceeded R3.2 billion [compared to in 2022?], with the top 10 claims alone amounting to more than R42 million.

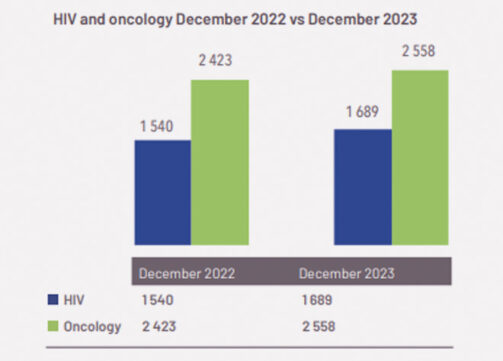

According to Medihelp’s claim statistics, the scheme specifically noted a high increase in HIV- and oncology-related claims.

In the report, Johan Viljoen, head of operations at Medihelp, stated it was the responsibility of the Medihelp board and management team to ensure benefits are managed fairly and judiciously in accordance with the Regulations to the MSA and the registered rules of Medihelp.

Viljoen filled Da Silva’s shoes as the acting principal officer until the end of March.

“With this goal in mind, Medihelp has adjusted its underwriting policies to bring them closer to those of the industry and carefully reviewed protocols for certain high-cost procedures to ensure that they benefit all beneficiaries,” Viljoen said.

He added that as a result, hospital audit savings amounted to about R77m (2022: R35m) and case management savings to R84.5m (2022: R60m).

The number of applications for chronic medication also decreased from about 75 000 in 2022 to 56 500 in 2023.

Claims ratio

In 2023, Medihelp recorded an investment income of R174m; however, the balance sheet was adversely affected by an increase in the claims ratio.

Claims ratio equals insurance service expenses as per the statement of profit and loss and comprehensive income, excluding directly attributable administration expenses and amounts attributable to future members, plus net income/(expense) from reinsurance contracts held, as a percentage of insurance revenue.

The total claims ratio across Medihelp’s eight options – MedPlus, MedElite, MedPrime, MedAdd, MedVital, MedElect, MedSaver, and MedMove! – increased by 1.8% from 99% in 2022 to 100.8% in 2023.

A closer look at the operational statistics for each insurance contract shows that the highest claims ratio increases occurred in basic plans with lower membership contributions.

- MedPrime: Insurance revenue per beneficiary per month was R2 578, with a claims ratio of 98.3%, up from 95.3% in 2022 – a 3% increase.

- MedAdd: Insurance revenue per beneficiary per month was R1 480, with a claims ratio of 104.1%, up from 100.9% in 2022 – a 3.2% increase.

- MedVital: Insurance revenue per beneficiary per month was R1 381, with a claims ratio of 100.9%, up from 98.1% in 2022 – a 2.8% increase.

- MedMove!: Insurance revenue per beneficiary per month was R1 211, with a claims ratio of 94.2%, up from 86.3% in 2022 – a 7.9% increase.

While, MedMove!, with 4 789 beneficiaries showed the highest rise (a 7.9% increase), what must have really hurt Medihelp’s pocket were the increases in the three plans with the highest beneficiary numbers: MedPrime (46 954 beneficiaries), MedAdd (43 843 beneficiaries) and MedVital (70 944 beneficiaries).

For example, with a claims ratio per beneficiary per month of R1 394 for MedVital, the total monthly spend across all beneficiaries is about R98 895 936. Multiplying the insurance revenue per beneficiary per month (R1 381) by the total number of beneficiaries (70 944) gives R97 973 664. This means Medihelp is paying out R922 272 more per month on the MedVital plan than it receives from its beneficiaries.

Three of the plans saw a decrease in claims ratio:

- MedElite: Insurance revenue per beneficiary per month was R5 234, with a claims ratio of 105% down from 2 in 2022 – a 0.2% decrease.

- MedElect: Insurance revenue per beneficiary per month was R1 641, with a claims ratio of 8%, down from 116.2% in 2022 – a 9.4% decrease.

- MedSaver: Insurance revenue per beneficiary per month was R1 632, with a claims ratio of 7%, down from 105% in 2022 – a 2.3% decrease.

Medihelp’s highest-paying plan, MedPrime, which generates R10 461 per beneficiary per month, also experienced a notable increase in its claims ratio, rising from 81.6% in 2022 to 85.7% in 2023 – a 4.1% increase. But unlike Medihelp’s other seven plans, it is still profit-generating.

For example, in 2023, the claims ratio per average beneficiary per month was R8 963. With 1 788 beneficiaries, Medihelp pays out R16 025 844 monthly on the MedPrime plan. Conversely, it receives R18 704 268 per month from its beneficiaries. This means Medihelp receives R2 678 424 more per month from MedPrime beneficiaries than it pays out.

In terms of section 33(2) of the MSA, each insurance contract option must be self-supporting in terms of membership and financial performance and must be financially sound.

Medihelp’s annual report stated that the MedElite, MedPrime, MedAdd, MedVital, MedElect, MedSaver, and MedMove! insurance contract options realised a negative insurance service result for the year to the end of December 2023.

Medihelp stated that each of these options are monitored and evaluated on an ongoing basis and specific counter measures are continuously implemented based on the risks, claim patterns, conditions, and procedures identified.

Counter measures include “managed care interventions, managing high-risk members, and benefit adaptations”.

To reduce the impact of the risks, Klopper shared that the board kept abreast of developments by requesting that claims be monitored continually and affirmative steps be implemented to ensure that service providers and members receive their rightful benefits.

“There was also a focus on control measures around authorisation procedures for hospital admissions, the scope and frequency of medical services, and the need for certain procedures,” he said.

Growth in membership

Despite the tough economic conditions, Medihelp maintained net organic growth above 7% in 2023 and expanded its membership base by 21 789.

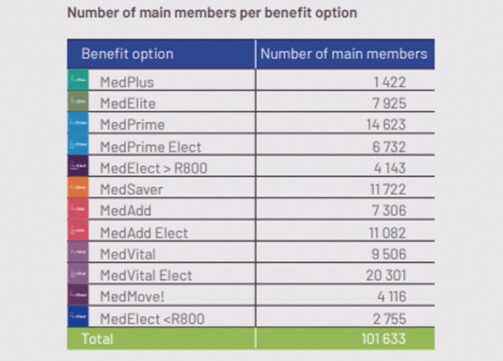

The total number of main members in 2023 was 101 633 with 216 786 beneficiaries covered.

The average age of beneficiaries in MedPlus and MedElite was 68 and 64, respectively. In contrast, the average age in the other plans was notably lower, averaging 38 across all eight plans.

The average pensioner ratio (beneficiaries over the age of 65) was 14.8% compared to 14.9% in 2022.

Klopper said it was equally important that growth comes from attracting members of the right profile to the desired benefit options. He said, over the past few years, the scheme continuously signed younger members and in so doing, counteracted a membership base with an ageing profile.

“The focus on promoting the use of digital platforms is supporting the attraction of younger, tech-savvy, and by design healthier individuals,” he said.

Because of the economic climate of the country, Klopper said, the lower-priced options are drawing the most members.

“So, it’s not surprising that the highest membership growth over the past three years was on Medihelp’s basic plans. The contributions of these options do, however, make it challenging to increase reserves,” he said.

Medical aid agrees to fees of hospitals and clinics and just pay without looking at the account.

It is their duty to lower the price and not increase membership amounts