Many consumers mistrust insurance because they don’t understand insurance products, perceiving them as investments, research undertaken by the FSCA has found.

The Authority released its inaugural “South African Financial and Customer Behaviour and Sentiment Study” this month. The study sought to establish how customers engage with and view the financial sector, and whether their use of financial products and services indicates that financial institutions are upholding the Treating Customers Fairly outcomes.

The research was conducted among 1 200 respondents across all provinces and population groups. The primary research was supplemented by:

- A desktop analysis of existing survey data sources, notably FinScope 2021 and 2022, and the Human Sciences Research Council Financial Literacy in South Africa Baseline Survey 2020;

- Social media sentiment analysis, based on the DataEQ database; and

- An analysis of complaints data collated by the financial sector ombud schemes.

FSCA deputy commissioner Katherine Gibson said the study was the first time the Authority obtained a comprehensive sense of how consumers perceive the financial sector and the institutions with which they interact. To date, much of the FSCA’s customer-related data came from third-party sources rather than from customers themselves.

Low level of trust

Customer sentiment towards financial institutions is generally positive. Most types of institution, particularly banks, elicited favourable responses from respondents.

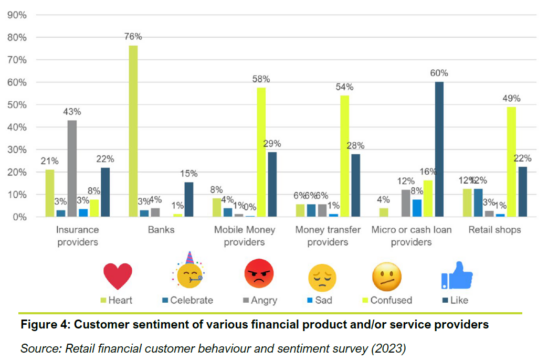

The survey asked respondents to respond to each provider type with an emoticon, within the ranges as depicted in the figure below.

Cash loan and insurance providers were the least popular, as they received the most “angry” emoticon responses (12% and 43% respectively). Data from the Office of the FAIS Ombud confirms negative sentiment towards insurance, as complaints about insurance products made up most of the complaints the office received last year. Interestingly, in contrast to the survey’s findings, social media analysis sourced from DataEQ shows that loans and insurance have a positive net sentiment.

There was correlation between sentiment towards financial institutions and levels of trust.

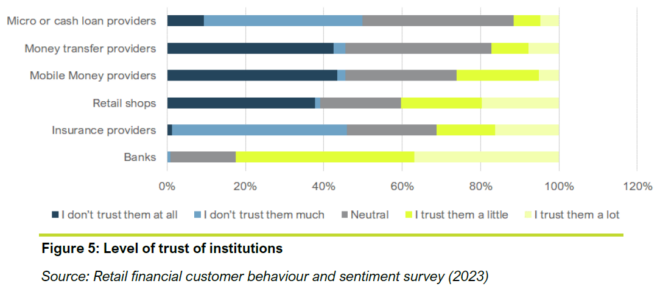

More than 80% of respondents indicated high levels of trust in banks. Conversely, cash loan, money transfer, mobile money, and insurance providers are the least trusted providers. The qualitative responses in the survey suggest that the high level of trust in banks is driven by a belief that banks “won’t steal my money”.

The low level of trust in cash loan providers is because of a belief that “they will trick you into taking out a bigger loan than you can afford”, and the terms and conditions of these loans are often unclear.

The low level of trust in insurance providers is driven by concerns about them paying out claims; several survey participants said they knew of instances, or had personal experience, where insurers denied a claim.

Perceived as an investment

The survey drew attention to the language respondents used when talking about insurance.

One participant said that “you think it is an investment, but then when you need it, it does not pay”. This language was fairly common when speaking of insurance, suggesting there may be a misalignment in the understanding of insurance when customers decide to take out an insurance product.

The perception that insurance is an investment, rather than risk protection, contributed to the mistrust of insurers. Consumers are under the impression they should receive back all their contributions, and their expectations are not met when this does not happen.

Gibson said this finding indicated that much work must be done to educate consumers about how insurance products work.

Consumers need to understand when they should be taking out insurance, their commitments, and how different types of insurance can benefit them and help them to become financially resilient, particularly in times of trouble.

Knock-on effect

The survey found that how customers perceive the way financial institutions – specifically, their bank – treat them has an impact on their uptake of insurance. Those who indicated they have had post-sale barriers resolved by their bank were 3% more likely to take up formal insurance than those who did not.

As with formal savings, increased disclosure of information seems to drive uptake of formal insurance. Adults who felt most positively about the information disclosed to them by their financial institution are 25% more likely to take up formal insurance relative to those who most negatively perceive information disclosure by their financial institution.

Drivers of insurance uptake

Income tops the self-reported reasons for not having insurance. In particular, 27.3% of the adults without insurance said they earned too little income to take up insurance, while 43.3% indicated that the main reason is unemployment.

Stability of income is as important as income level when it comes to taking out products with a monthly commitment, such as insurance. Consumers without a consistent income are anxious about committing to products with contractual obligations.

Being a salaried worker makes adults more likely to take up insurance, with salaried adults 10% more likely to take up formal insurance relative to non-salaried adults. Middle-income adults are 17% more likely to take up formal insurance products relative to lower income adults, and adults who own a motor vehicle are 8% more likely to take up formal insurance.

Age is an even more significant driver, with older adults being 20% more likely to take up formal insurance relative to younger adults.

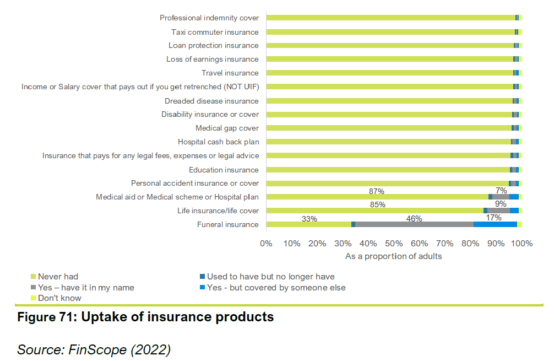

Funeral insurance dominates

Of South African adults, 52% have some form of insurance – formal or informal. There has been a slight increase, from 46% in 2021, in the percentage of South Africans without insurance.

The decline in insurance uptake between 2021 and 2022 was slightly higher for younger adults, adults who resided in urban areas, and among men. The decrease in the uptake of insurance between 2021 and 2022 was also primarily driven by the decline in customers who had taken up insurance through non-banking channels.

Among the adult population who have insurance, a significant proportion of them are primarily covered by funeral insurance (63.4%). This is followed by life insurance and medical/health-related insurance. The uptake of other types of insurance, such as dread disease and disability, as well as insurance to cover income losses, is very low.

Sometimes it is very easy to “deny” the facts .

Hi This is not strange…maybe the blame lays at the feet of insurance companies changing names of thing that is industry related and know for many years…..Yellow equipment vs Special vehicle …..Vehicles used to be private / work / business…..now is social use , private use, private 2work&back (what is that other than private use?) business , commercial , pensioners, lets just get a grip and have a uniformed language (used 2b MMIII) so everybody can understand the same thing, this is what “private” means …etc. and this is just ST….what about the rest?

I Agree with Riaan above……….made too complex AND people feel they need to get something back after years of paying a premium….a lot of my long time clients, example Agri policies with homes on their farms – have taken buildings and contents off cover……paying premiums for years and years, now needing to get COC’s etc and putting premiums in savings rather. Only insuring moving items and only when used like harvesters or planters.

After 40 + years in this industry, I discovered a long time ago , keep it simple . I live by keep it simple .some of our bigger companies have got so complexed with paybacks discounts for buying into another product and so on. that they have lost sight of this . client wants cover for himself, his goods, and his family , then of course the complexity of of terminology is a major problem, last but not least, the client does have selective hearing as the tend to tune in and out,

the broker must also remember we are there for the client , we do not work for the companies interests but OUR client interests only , therefore we must practice reassurance and reinforming of the product you sell