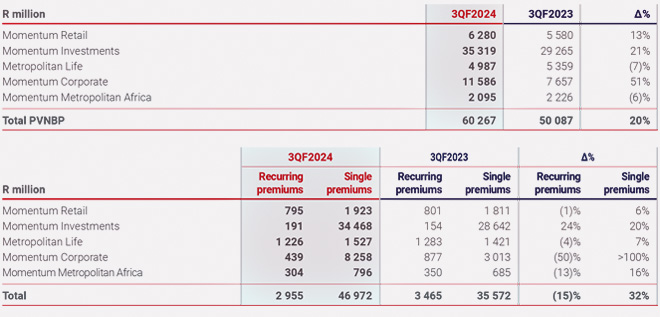

Momentum Metropolitan Holdings (MMH) this week reported a 20% increase, to R60.2 billion, in the value of new business in the nine months to the end of March compared with the same period last year.

The growth was enhanced by the reduction in the discount rate used to calculate the present value of premiums, to align with the risk-neutral valuation methodology used for IFRS 17 (insurance contracts), the group said in a voluntary operational update.

The group now calculates the present value of new business premiums (PVNBP) on a risk-free discount rate, whereas it was previously calculated at a risk discount rate. The risk-free discount rate is a benchmark rate devoid of risk, primarily used for discounting certain low-risk cash flows. In contrast, the risk discount rate includes a premium for risk and is used to discount riskier cash flows.

MMH said its “pleasing” performance over the nine months was supported by a favourable mortality experience and good investment income.

Income from single-premium policies increased by 32% to R46.9 bn, while income from recurring-premium business declined by 15% to R2.9bn.

Metropolitan Life, whose market are mainly low-income consumers, experienced a 7% decline in new business volumes (on a PVNBP basis).

The group attributed this to its decision to reduce the number of tied agents, which resulted in a decline in recurring-premium sales from protection and long-term savings business. This was offset somewhat by good growth in single-premium sales from annuities.

Productivity per agent deteriorated from 3 to 2.8 policies per week over the nine months.

Momentum Retail’s PVNBP improved by 13%, reflecting year-on-year growth of 21% in new protection business and 7% in long-term savings new business.

The division’s earnings were aided by a positive mortality experience, mainly driven by lower-than-expected average claim sizes, the group said.

Momentum Corporate’s PVNBP surged by 51% compared to the prior period, largely driven by strong growth in single-premium structured investment inflows. Recurring-premium new business declined by 50% because a large annuity deal onboarded in the prior period was not repeated in the current reporting period.

Momentum Insure experienced a 6% increase in gross written premiums to R2.4bn.

The group said the claims ratio improved from 77.6% in the prior period to 68%, which was indicative of the satisfactory progress made with the corrective actions taken to improve underwriting performance.

“These actions relate to ongoing new business price optimisation, targeted higher renewal increases on selected portfolios to reflect the underlying risk more accurately, together with focused underwriting action to correct underperforming portfolios.”

Persistency “deteriorated marginally” because of these corrective actions “but remained within appetite”.

Assets under management (AUM) on the Momentum Wealth investment platform improved by 14% to R265bn, benefiting from favourable market performance. Institutional and retail AUM improved by 15% to R602.6bn.

Momentum Metropolitan Health achieved year-on-year membership growth of 2% to 1.252 million, despite an otherwise flat market. This growth came from the public sector (5%) and Health4Me (20%).

Membership in the Momentum Medical Scheme and corporate market segment remains under pressure, indicative of tough economic conditions impacting affordability in the retail client base and employment numbers in the corporate client base.

Looking ahead, MMH said the operating environment is expected to remain under pressure given the weak economic growth, the political uncertainty following the election, and the impact of prolonged inflationary pressures and higher interest rates on clients’ disposable income.

The group said it will continue to focus on driving new business volumes to gain market share, improving the sales mix and margin, and reducing costs to improve the value of new business.