More consumers are changing their shopping patterns as they use rewards programmes to manage their daily living expenses, the latest Sanlam Benchmark Survey shows.

According to the 2023/24 South African Loyalty Landscape Whitepaper by Truth and BrandMapp, 76% of South Africans actively participate in loyalty programmes. Wealthier consumers engage in an average of 9.4 programmes, while lower-income groups use an average of 4.8 programmes to manage daily expenses, with cashback rewards being particularly popular.

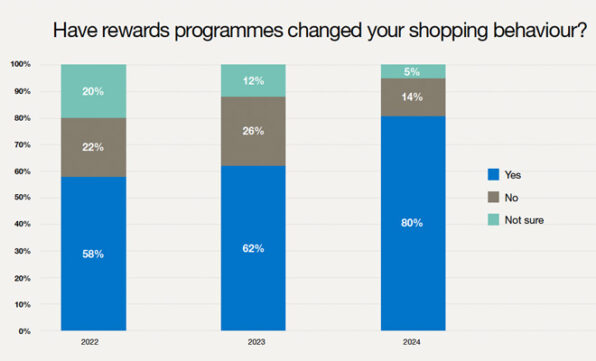

In the Benchmark Survey, respondents were asked about their reliance on rewards to manage daily expenses and their impact on shopping habits. Between 2022 and 2024, there was a significant increase in the use of rewards, with 80% of consumers reporting behaviour changes as a result.

Koketso Mahlalela, the head of Member-led Outcomes at Sanlam Corporate, says this aligns with the findings from Truth and BrandMapp.

“Rewards provided by grocery retailers were the most popular, followed closely by pharmaceutical retailers. Banking rewards were next. Those offered by insurers were on the lower scale,” she says.

Further insights from the Whitepaper underscore the influence of rewards and loyalty programmes on consumer behaviour. It showed that loyalty programmes significantly affected shopping decisions: 71% for groceries, 51% for banking, 35% for clothing, and 29% for health and pharmaceuticals.

“Employers, funds, and group arrangements providing these rewards, or access to discounts, also play a role in assisting employees in managing their living expenses,” adds Mahlalela.

Budgeting

Additionally, members can implement shifts in shopping behaviours, such as changes in lifestyle choices or opting for more cost-effective brands, alongside the use of budgeting tools.

“If we dial back to the 2022 Benchmark Survey, we saw close to three out of every five consumers beginning to live more frugally, cutting out luxuries as a means of managing their financial circumstances as a result of the pandemic. Fast forward to 2024, we see good financial well-being continuing to be a challenge for most consumers,” says Mahlalela.

Budgeting enables individuals to align their expenses with their income and identify areas where they can reduce daily costs or potentially increase monthly earnings. She highlights the crucial role employers can play in supporting employees.

“In the Benchmark Survey of 2022, many respondents (37%) indicated that this would even be a tool employees desired from employers in managing their day-to-day expenses.”

Interestingly, the most sought-after employee benefits were free doctor or nurse consultations (51%), followed by free will-drafting (44%).

Managing debt

Debt appears to be a primary motivator for individuals considering tapping into their retirement savings. According to Mahlalela, pension-backed home loans offer a distinctive approach to managing debt. This type of loan provides an alternative financing option for property, as long as it complies with the Pension Funds Act. It can be used to pay off home loans, finance renovations, or invest in energy-saving solutions such as solar systems.

She clarifies that utilising this loan does not diminish your retirement savings; they continue to grow through regular contributions.

“The only difference is that a portion of the funds will be used as security until the loan is paid up or one exits the fund prior to the loan being paid up.”

Repayments are typically deducted from your monthly salary, with conditions such as loan approval depending on available retirement savings.

“So, managing the instalments and ensuring an affordability assessment is done are key to ensure this is a tool that can be leveraged in a smart way. Favourable borrowing rates could be negotiated as a result of using the pension fund as collateral, which also begins to introduce some additional savings in managing debt,” she says.