Discovery Life research finds a rising trend among South Africans towards offshore planning, with more clients securing a larger portion of their cover in United States dollars.

To mark the 10-year anniversary of Discovery Life’s Dollar Life Plan, Discovery Life released its 2024 Dollar Life research paper at a media roundtable this week. This research examines how South Africans are diversifying their risk cover to include life insurance that pays out offshore.

The research shows that, since the policy’s inception, the year-on-year increase in premium income from offshore risk planning has averaged more than 20%.

Premium volumes have more than doubled over the past five years compared to the first five years, and Discovery Life predicts the policy will soon make up 10% of its total annual premium income.

The paper further discloses that two in three Dollar Life policyholders (67%) also hold local policies, and where clients have both, they hold 40% in offshore cover.

“Traditionally, risk cover such as life insurance was held locally, through rand-denominated policies, but, as with investing, more South Africans are holding a mix of local and offshore portfolios to hedge against currency volatility,” said Gareth Friedlander, Discovery Life’s deputy chief executive.

“With increasing numbers of people living and studying overseas – or even working remotely but living locally – South Africans are more globalised than ever and seeking ways to diversify their risk cover. They are realising the importance of risk protection that meets their offshore needs, from business ventures to protecting children’s education and even for accessing specialised medical care. Importantly, they need risk cover that pays out in a stable currency, anywhere in the world,” Friedlander said.

The policy’s minimum monthly premium is $50 (R900), compared to Discovery Life’s average premium of R1 750 across new local and offshore risk policies. Only 30% of Dollar Life Plans have a premium of $100 (R1 800) or less.

The actual premiums and cover depend on an individual’s risk profile and whether the client’s policies are linked to other Discovery products.

There are currently 3 826 Dollar Life plans in force, with a total life cover sum assured of R34.6 billion (based on an exchange rate of R18 to the dollar). There is also R20bn assured in capital disability and severe illness benefits.

Currency volatility

The research shows that in the 10 years to January 2024, the US dollar strengthened by a cumulative 68% against the rand.

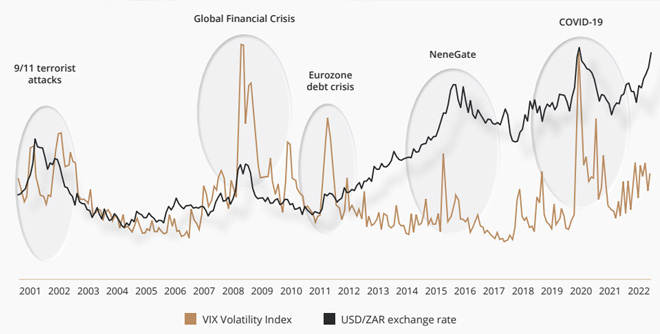

The table below shows the volatility of the US dollar-rand exchange rate and the corresponding Volatility Index, overlayed with key global and local shocks.

According to the research paper, if purchasing power parity holds based on the CPI growth rates of both countries, the US dollar would have been expected to appreciate by only 25% over this period. However, because of the dollar’s greater-than-expected appreciation against the rand, a policy member who took out a Dollar Life Plan when it was offered in 2014 and who claimed in 2024 would have had an effective 35% boost in their payout compared to local plans.

The paper states, assuming this is not the norm and purchasing power parity holds, the real value of rand and dollar risk protection should be equal in the long run. However, it is also expected that there will be fluctuations around this. Historically, this can be seen through major changes in exchange rates, which coincide with external factors beyond an individual’s control.

Simply put, Friedlander said, if you die “at the wrong time” – for example, the day after NeneGate – the buying power of the payout can be 30% less than it was the day before.

“You know how life insurance works. You get a lump sum on a single day. And I think that exposes you dramatically to that volatility if you aren’t hedged,” he said.

Growing offshore medical

Medical advancements often depend on overseas technologies and medications, which can be prohibitively expensive, making access highly dependent on currency strength.

Friedlander said Discovery Life is seeing a need for clients to match their highly specialised medical requirements.

“Complex treatments for cancer can cost in excess of R1 million a year, and medical devices can cost almost R2m, of which three in every four devices are imported into South Africa. These costs are growing at a much faster rate than South African inflation, as a lot of research and development occurs internationally,” he said.

According to Discovery Life, with many medicines and cutting-edge medical technologies yet to reach South Africa, the number of South Africans seeking cross-border medical treatment has increased, especially for conditions such as cancer.

The research paper shares some compelling facts:

- According to a report published by CancerAlliance and Fix The Patent Laws, there are 24 life-saving cancer medicines. Despite 10 of these medicines being on the WHO Essential Medicines List, only four of them are considered essential in South Africa.

- According to the Independent Clinical Oncology Network in South Africa, local treatment can cost anywhere between R10 000 and R1m a year.

- Drug prices have been increasing, far outpacing inflation, according to a recent report prepared for the American Hospital Association by Healthsperien, a public health consultancy.

- While inflation was about 6.4% from January 2022 to 2023, the average price of cancer drugs increased by 15.2% in 2023 and by 32% in 2022.

The high cost of technology further adds to the burden. More than half of cancer patients now require radiation therapy. State-of-the-art radiation units offer precise, concentrated doses in shorter sessions with fewer side effects. However, these units are expensive, with only a few available in South Africa, each costing millions of rands to set up.

Robotic surgeries, such as those performed with the Da Vinci robot, illustrate another high-cost medical technology. These systems, manufactured in the US, cost about R21m each, and procedures using them are significantly more expensive than traditional surgeries. This exposes patients to costs that may exceed local medical scheme coverage.

The high cost of medical devices is another significant concern. According to the Public Broadcasting Service (PBS) and the Amputee Coalition in America, one in every 190 Americans lives with a lost limb. About 15% of amputees are cancer survivors or trauma victims who could benefit from advanced prostheses such as the myoelectric arm, which uses muscle contractions in the residual limb to control the device.

In South Africa, more than 76% of medical devices are imported, driving up costs. For instance, the myoelectric arm can cost up to $100 000, according to PBS.

“Therefore, South Africans might need to factor in currency fluctuations in the costs of these medicines and treatments, and a payout from a life insurance policy which is in US dollars can go a long way in matching these costs,” the paper states.

International education

Similarly, Friedlander said, there is a strong demand from clients to hedge against education costs where there is the possibility of a child studying overseas.

International education Data from the UNESCO Institute of Statistics shows that at least 12 000 South African students were studying abroad every year in the past five years. The reasons include oversubscription of local universities and the benefits of gaining cultural intelligence and expanding networks.

Again, the research paper shares some alarming facts:

- In South Africa, according to the South African Reserve Bank (SARB), education inflation is normally about 2.6% above inflation each year.

- Similarly, in the US, “from 2000 to 2022, the average annual tuition inflation was 4.8% at public four-year colleges. Over the same period, the consumer price index only rose by about 1.9% yearly on average17.”

- The top three universities in the 2024 Times Higher Education World University Rankings – University of Oxford, Stanford University and Massachusetts Institute of Technology (MIT) – cost multiples of what top local universities charge.

The top local university in the Times Higher Education World University Rankings is the University of Cape Town. First-year undergraduate fees for 2024 range from R40 000 to R102 470, depending on the course.

This is in comparison to the University of Oxford’s average undergraduate tuition fees for overseas students, which are between £33 050 and £48 620 for the 2024/25 academic year. Stanford University’s tuition fees currently stand at $65 127 for the 2024/25 academic year, and MIT charges an average of $30 995.

These amounts cover tuition only and exclude the costs for housing, food, and other related student expenses.

How the policy works

The Dollar Life Plan uses the Single Discretionary Allowance (SDA) to fund the premiums. This allows South African tax residents to take up to R1m offshore each year without SARB clearance. There is also an option to pay premiums directly in US dollars from offshore, for those who are no longer a tax resident in South Africa.

Harry Joffe, Discovery Life’s head of Legal Services, said the SDA simplifies the admin involved and helps policyholders to avoid South African forex restrictions when the policy proceeds are paid out.

The policy is already based offshore, so policyholders receive the full value of their payout without the risk of forex complications or any tax implications, said Joffe.

Dollar Life, classified as a non-domestic policy under the Long-term Insurance Act, is issued outside South Africa through Discovery Life’s Guernsey Branch in the Bailiwick of Guernsey, a British Crown dependency in the English Channel. The policy provides payouts worldwide excluding South Africa, requiring policyholders to have a foreign bank account in their chosen country for a funds transfer.

In South Africa, only domestic policies are subject to estate duty under the Estate Duty Act, exempting Dollar Life from this obligation. However, estate duty regulations vary internationally. Countries such as Australia and New Zealand do not impose estate duty, whereas the US and the United Kingdom do. To mitigate potential tax liabilities in countries where estate duty is applicable, Discovery Life advises clients to connect their policy to an offshore trust.

Discovery Life offers a solution through a partnership with a trust company in Mauritius, providing a specialised trust option known as a short-form or bottom-drawer trust. This trust, designated solely as a beneficiary of Dollar Life or Offshore Endowment policies, costs $450 a year, which, Discovery said, is significantly less than traditional trust structures, which can exceed $7 000 annually, with additional fees for extensive services.

By linking their policy to this trust, clients in the US, UK, and other jurisdictions can potentially avoid estate duty obligations under current definitions in those countries.

To protect premiums from movements in the exchange rate, Discovery Life introduced the Exchange Rate Protector feature. This benefit allows clients to secure long-term exchange rate certainty by locking in discounted rates every three years for the first nine years of the policy. The additional cost, 10% of the premium, provides stability against currency volatility and has an 86% adoption rate among clients.

Discovery Life’s statistics show that over the past 10 years, this feature has generated savings of 25% on Dollar Life Plan premiums.