The outlook for US financial markets has changed dramatically since the end of October as the impediments to a new bull market are increasingly being chipped away. A new investment cycle has started.

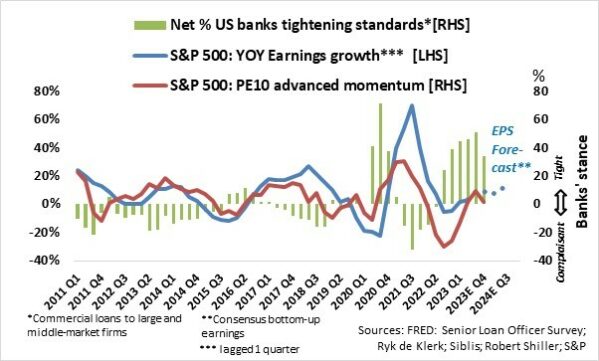

Although the US Federal Reserve remains hawkish by continuing to indicate that the Federal funds rate is likely to stay high for longer, it is evident that the Fed is done with hiking rates. The Fed’s recently released Senior Loan Officer Survey, perhaps the single most important economic and financial indicator, shows that US banks have turned less restrictive in their lending practices as the demand for business and consumer loans contracts.

The net percentage of banks tightening their lending standards for commercial loans to large and middle-market firms fell to 33% in the fourth quarter of this year from more 50% in the third quarter. Furthermore, the banks are less inclined to increase the spreads of their loan rates over their cost of funds.

Barring a few exceptions, such as the positive impact of AI sentiment on Mega stocks this year, a major turn in the net percentage of banks tightening their lending standards has historically coincided with a major turn in the valuation (Robert Shiller’s PE10 ratio) momentum of the US stock market (using the S&P 500 Index as a proxy), specifically cyclical stocks.

A declining trend in the number of banks tightening their lending standards (banks turning more accommodative) is associated with an uptrend in valuation momentum, and, conversely, a rising trend in banks tightening their lending standards is associated with a declining trend in valuation momentum.

Year-on-year earnings growth also tends to follow suit one quarter hence.

In my opinion, the fall in the net percentage of banks tightening their lending standards in the fourth quarter, published earlier this month, marked the beginning of a new bull market in US equities.

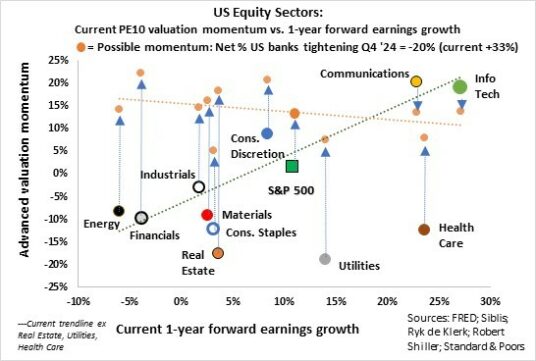

The valuation (PE10) momentum of the individual sectors is currently largely influenced by one-year forward earnings growth – high forward earnings growth equals strong valuation momentum, while weak earnings growth is associated with low to negative valuation momentum.

As things stand, the Information Technology and Communications sectors are topping the list, with advanced valuation momentum of 20% and 18% respectively, followed by Consumer Discretionary, with 9%. The worst sectors are Consumer Staples (-12%), Health Care (-12%), Real Estate (-18%), and Utilities (-19%). Considering the consensus earnings forecasts, the valuation momentum of Real Estate, Materials, and Consumer Staples is somewhat out of line with the trendline that excludes Health Care, Utilities, and Real Estate.

But a year from now, the picture will change significantly.

US banks are likely to soften their lending standards further.

It is not coincidental that, over the past few years, the tops and bottoms of the net percentage of banks tightening their lending standards cycle have corresponded with the tops and bottoms of the yield curve cycle as measured by the yield gap between US Treasury two- and 10-year bonds. A declining yield curve coincided with a downtrend in the number of banks tightening their lending standards (as what happened in early November) and, eventually, accommodation by the banks because of increased competition. Conversely, a steepening yield curve coincided with an increase in the number of banks tightening their lending standards.

A relatively weak US economy and the continued deceleration in US inflation are likely to see the yield gap between US Treasury two- and 10-year bonds continuing its downtrend. According to forecasts by Wells Fargo (Q4 2024 Annual Outlook, November 2023), the bank expects the yield gap to decline to minus 0.3% by the end of 2024 from +0.45% at last week’s close.

Yes, US banks could even turn accommodative (when the net percentage of banks tightening their lending standards falls below zero) as early as the second quarter 2024, and it could even fall to minus 20% by the end of 2024.

What does this mean for stocks?

My analysis indicates that the valuation momentum of the S&P 500 Index and the net percentage of US banks tightening their lending standards is linear, while the valuation momentum of the S&P 500 Index and that of the individual sectors is also linear, and most of the sectors have a direct relationship with the S&P 500 index.

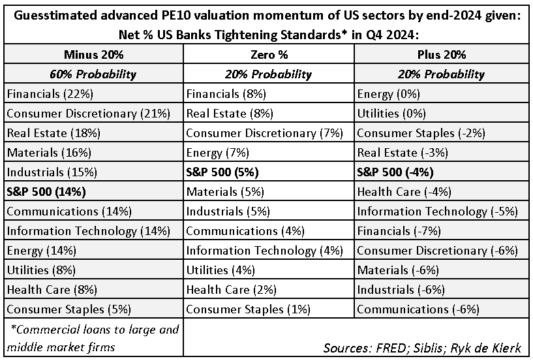

I assumed that the US Treasury yield gap will decline to minus 0.3% by the end of 2024 from +0.45% at last week’s close. From a historical point of view, it indicates a level of minus 20% for the net percentage of US banks tightening their lending standards in the fourth quarter of 2024. By applying historical relationships, it enabled me to guesstimate where the valuation momentum of the S&P 500 Index and its individual sectors could be at the end of 2024, as well as the potential capital returns for the said indexes. In my opinion, the probability of this scenario playing out is more than 50%.

I have also calculated or guesstimated the possible valuation momentums in two alternative scenarios – zero percent for the net percentage of banks tightening and +20% tightening, and I attributed a 20% probability to both.

As expected, economically cyclical sectors (Financials, Consumer Discretionary, and Real Estate) came out tops in scenarios where the banks become more lenient by not tightening their lending standards and lean to accommodate clients (base case). The numbers also indicate significant underperformance of the defensive sectors (Utilities, Health Care, and Consumer Staples) relative to the economically cyclical sectors and the S&P 500 Index.

A level of minus 20% for the net percentage of US banks tightening their lending standards in the fourth quarter of 2024 could see a valuation momentum of the S&P 500 Index at about 14% by the end of 2024. Yes, that means that the S&P 500 could move to beyond 5 100 by then.

From the outside, the behaviour of the US equity market over the next quarter or so will baffle many of investors and financial advisers, as it will look disjointed from what is happening in the US economy. The market looks forward, as demonstrated in the relative valuation momentum of the individual sectors in the accompanying graph. Yes, a new business up-cycle will follow in the not-too-distant future.

The time has arrived for a risk-on strategy that may last through to the end of 2024. I am particularly bullish on US financial stocks, as well as US materials (commodity-related) stocks. The positive sentiment is also likely to spill over worldwide.

Ryk de Klerk is an independent investment analyst.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute investment or financial planning advice that is appropriate for every individual’s needs and circumstances.