Ninety One, South Africa’s largest asset manager, this week reported a second consecutive year of negative net flows amid what it described as a difficult period for the asset management industry.

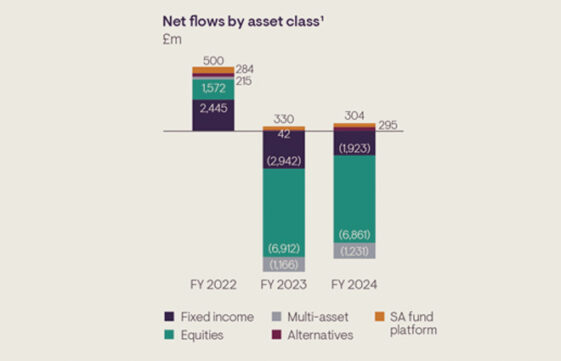

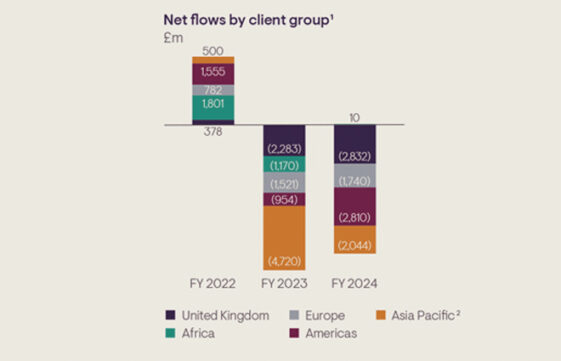

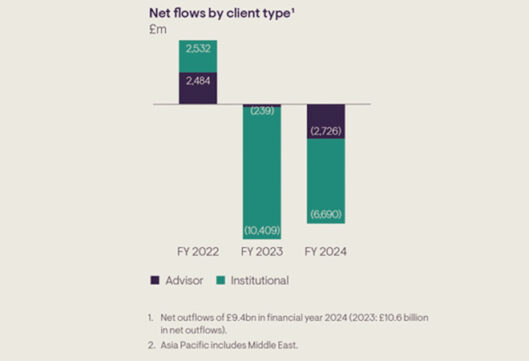

Assets under management (AUM) decreased by 3% to £126 billion at the end of March 2024, from £129.3bn at the end of the 2023 financial year. This reflected net outflows of £9.4bn, an 11% improvement from £10.6bn in 2023, and positive market and foreign exchange movements of £6.1bn (2023: negative £4bn).

Ninety One saw a steady increase in AUM between 2020 and 2022, from £103bn to R144bn.

Average AUM decreased by 8% in 2024, from £134.9bn to £123.9bn, the asset manager said in its 2024 integrated report.

“For the second consecutive year, conditions remained difficult for our industry and for Ninety One. The caution we signalled at the beginning of the financial year was justified,” chairman Gareth Penny and chief executive and founder Hendrik du Toit said in the report.

In the reporting period, the higher-for-longer interest rate scenario played out. This initially supported continued risk aversion and lowered the opportunity cost of not deploying capital into risk assets, they said.

“This interest rate environment has depressed the appetite for investment in emerging markets. In addition, equity market performance was extremely narrow for the first part of the year, favouring passive equity investment over active in developed markets.

“There are signs that market returns have been broadening towards the back end of the reporting period, which could restore demand for active equity investment in due course. At the time of writing this report, it was still too early to see evidence of returning demand for emerging-market investments.

“These circumstances have impacted our results – in particular, our net flows. However, it has not dampened our motivation,” Penny and Du Toit said.

At an investor presentation yesterday, Du Toit (pictured) said Ninety One’s offering is not in the “current demand sweet spot”.

Ninety One’s offering centres on publicly listed global and emerging-market equities, emerging-market debt, and sustainability solutions. The current demand is for developed-market fixed income and credit, the money market, passive equities, and private markets, he said.

Although interest rates are no longer rising, they have stabilised at higher levels than the consensus initially expected, and they may remain at these levels for longer. This has changed the risk calculus for clients: they can wait longer to allocate to risk assets, and they are paid while they wait. In addition, some of the most disruptive geopolitics since the end of the Cold War has produced an aversion to risk-taking, particularly in emerging markets, Du Toit said.

Despite the challenging environment, he said Ninety One delivered a solid financial performance.

The adjusted operating profit decreased by 8% to £190.5 million (2023: £206.9m), with an adjusted operating margin of 32% (2023: 32.7%). Profit after tax was flat at £163.9m (2023: £163.8m).

Adjusted earnings per share declined to 15.9 pence from 17.3p, while basic headline earnings per share increased by 1% to 18.4p.

Firm-wide investment performance deteriorated over the year.

“Style factors in a few of our large strategies have struggled to keep pace with broad benchmarks while remaining competitive against peers,” Penny and Du Toit said.

(“Firm-wide investment performance” is calculated as the sum of the total market values for individual portfolios that have positive active returns on a gross basis expressed as a percentage of total AUM.)

Net revenue from fees declined by 6% to £588.5m (2023: £627.1m). The 8% decline in average AUM saw management fees decreased by 8% to £557.9m (2023: £607.7m). The average management fee rate remained flat at 45 bps.

Revenue from performance fees surged by 58% to £30.6m (2023: £19.4m).

Du Toit said Ninety One has retained its “growth mindset” despite the past two challenging years.

“Our response to these conditions was to sharpen our focus. We are not chasing current momentum, but we are positioning ourselves for an eventual pick-up in demand in our areas of expertise […] We are resisting the urge to jump on the bandwagon of current demand without any guarantee of success against well-established competitors. Instead, we back ourselves to win by committing to our core competencies,” he said.