The Ombudsman for Banking Services (OBS) recorded the most complaints received in a single year in 2023.

According to the scheme’s 2023 annual report, the total number of cases opened by the OBS totalled 21 894, an 11% increase on the 2022 figures. The number of cases closed in 2023 increased by 6% from 2022, with a total of R25 735 594.17 recovered for consumers in the year under review. The OBS recovered R30 350 173 for customers in 2022.

The categories of complaints that kept the OBS busiest were current accounts, personal loans, savings accounts, credit cards, and home loans, in that order. Within the current account category, digital banking received the highest number of complaints. This highlights that fraud – particularly internet banking fraud, phishing, vishing, and push payment fraud – remains the top category of complaints.

The recently released report marks the end of an era and the dawn of a new one. With its publication, the OBS has officially transitioned from a standalone entity to become part of the newly unified National Financial Ombud (NFO) scheme. This new entity encompasses the Credit Ombudsman, the Ombudsman for Short-term Insurance, and the Ombudsman for Long-term Insurance.

This report also signifies the end of Reana Steyn’s (pictured) tenure as Ombudsman for Banking Services. Steyn, who in 2017 became the first woman to hold the position, now leads the newly formed NFO as its inaugural head.

“In the year under review, one of our top priorities has been the amalgamation of the four voluntary schemes into a single new entity,” Steyn explains.

Commenting on the report’s findings, Steyn notes it’s crucial to interpret complaint statistics within the broader context of each bank’s operational landscape.

“Various factors, such as the size of the bank’s customer base, play a significant role. Larger banks naturally handle more transactions and interact with a broader spectrum of clients, which can result in a higher volume of complaints, simply due to their scale. Similarly, the growth trends within a bank’s customer base and the overall volume of daily banking transactions also influence complaint frequencies.”

Based on total assets per bank, the four banking giants in South Africa are Standard Bank with R1 901 407 182, FirstRand with R1 63 771 725.29, Absa with R1 533 059 035, and Nedbank with R1 275 894 226.

Number of formal cases reported

Formal cases reported by OBS increased by 12% to 8 521, while referrals – now termed premature complaints – went up by 11% to 13 373.

Formal cases are those where the ombudsman conducts a thorough investigation, scrutinising the issues, gathering evidence, and engaging with both the complainant and the bank, ultimately leading to a formal resolution or finding.

Referrals, on the other hand, are initially sent back to the bank, giving its dispute resolution department 20 days to resolve the matter directly with the complainant. If the issue remains unresolved or the bank fails to respond within 20 days, the referral is escalated to a formal case.

The 10 banks with the highest number of formal complaints in 2023 were Capitec (2 053), followed by Nedbank (1 563), Standard Bank (1 311), FNB (1 320), Absa (978), African Bank (616), Tyme Bank (312), Discovery (127), Bidvest Bank (99), and PostBank (42).

FNB had a 15.1% increase in complaints year on year; Capitec followed with a 12.4% increase, while Nedbank, despite having the second-highest number of complaints, only had a 3.6% increase. The number of Absa complaints decreased by 8%, while Standard Bank’s number of complaints decreased by 5.3%.

At the beginning of 2023, the OBS started reporting per product and not per category as it used to. In the report, the ombudsman states this caused a dramatic increase in current account cases because many of the previous categories, such as ATM and digital banking, now fall under the current account category.

Among the cases opened by product, current accounts led with 39%, followed by personal loans, and savings accounts each at 15%. Credit cards accounted for 9% of the cases. Home loans and car finance both represented 7%, and estates and trusts made up 3%. Insurance, and savings and investments each contributed 2%. Business transactional accounts comprised 1%, while business loans, and infrastructure and systems had no cases reported.

Conversion rate of referrals

An important measure of how effectively banks manage complaints is their conversion rate of premature cases to formal complaints.

In 2023, the OBS opened a total of 13 373 referrals. The 10 banks with the highest referrals were FNB (2 960), Capitec (2 690), Standard Bank (2 210), Nedbank (2 032), Absa (1 712), African Bank (733), Tyme Bank (420), Discovery Bank (176), Bidvest Bank (114), and Postbank (58).

Of these referrals, 6 971 cases were converted into formal complaints. According to the report, African Bank had the highest conversion rate at 79%, followed by Bidvest Bank at 67%, Capitec and Nedbank both at 64%, and Tyme Bank at 63%. FNB had a conversion rate of 37%.

Outcomes of formal cases

The average turnaround time (referring to the number of days it took to close complaints, on average) increased to 78 days from 67 days in 2022.

According to the report, the increase in the turnaround time is attributable to the increased complexity of the matters, “since the banks, from an executive level, increased their focus on quickly resolving matters that are capable of such in the referral space”.

The bank with the quickest turnaround time was FNB at 74 days, while Discovery Bank, which has a lot fewer cases than some of the bigger banks on average, came in at 89 days.

Of the 8 521 formal cases opened, 8 008 were closed. The report stated that cases that remained unresolved were “only the most complicated and controversial ones, requiring more time to investigate, meet and negotiate, before resolution could be reached”.

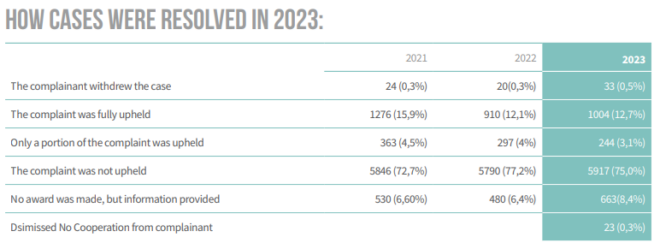

Of the cases closed, 1 004 (12.7%) were fully upheld, 244 (3.1%) were partially upheld, and 5 917 (75.0%) were not upheld.

In 2023, case outcomes consistently favoured banks over complainants across various product categories. For current accounts, 75% (2 408) of the 3 206 cases were resolved in favour of the bank. In personal loans, 77% (921) of the 1 192 cases saw the bank come out on top. Savings accounts fared similarly, with 80% (881) of the 1 108 cases resolved in favour of the bank. Credit card cases saw 68% (509) resolved in the bank’s favour out of 747, while home loans had an even higher rate, with 81% (435) of the 538 cases resolved in favour of the bank.

The only exception was in the estates and trusts category, where the outcome was more balanced. Of the 230 cases, 51% (117) were resolved in favour of the bank, and 49% (113) were resolved in favour of the complainant.

The highest percentage of cases being decided in its favour was Tyme Bank at 87%, while African Bank had the lowest (62% in its favour).

Of the banks with the most cases, Capitec did best in this section at 82%, followed by FNB at 77%.

Vulnerable consumers

In 2023, the OBS recognised 199 consumers as vulnerable. A vulnerable consumer is defined as “someone who, due to their personal circumstances, is especially susceptible to harm, particularly when a firm is not providing adequate care”.

The report highlights the OBS’s strong support for the growing global and local focus on identifying vulnerable consumers in the financial sector.

“We aim to ensure that this category of complainants receives the care, protection, and guidance they need,” the OBS states.

While a definitive list of criteria for identifying vulnerable consumers is still being developed, the OBS has based its categories on years of handling complaints and international standards. This evolving concept continues to shape how vulnerable consumers are recognised and supported.

Current categories of vulnerability include age, life events, disability, financial literacy, and discrimination. This year’s report shows that among the complaints from vulnerable consumers, the top five sub-categories were: age 65-75 (30%), age 75-85 (35%), life event of retrenchment (9%), life event of losing a partner/spouse (9%), and age 85+ (9%).

According to the OBS, failing to consider the needs of vulnerable customers can lead to significant harm, because these consumers may not have their needs met from the outset of any engagement.

The OBS points out that the inequality of bargaining power has been a key driver behind consumer protection legislation in the financial sector. The shift towards ensuring fair and appropriate outcomes for consumers reflects a growing recognition that a “one size fits all” approach is no longer adequate. Instead, financial service providers are now expected to tailor their offerings to the individual needs of their customers.

This means that the level of care that would be deemed appropriate for vulnerable consumers may be different from that which would suffice for other consumers.

“It is crucial that financial firms acknowledge this and implement processes and procedures to cater for the needs of vulnerable consumers, as these customers may face a significant risk of harm,” the OBS states.