Offshore investing has dominated adviser-client conversations these past 18 months as the Covid-19 economic dislocation played havoc with emerging-market currencies such as the rand. While there are sub-themes around offshore investing, few have been as emotive as the conversation about offshore exposure in living annuity portfolios.

The aim of this article is to provide further insight into what the impact is on a living annuity when you increase the offshore exposure in the portfolio.

Our previous modelling work outlined best-practice offshore exposures for living annuities. However, given recent market developments, we felt it may be beneficial to test the sensitivity of living annuity success rates against different levels of offshore exposure.

Ideal offshore exposure – what does the modelling tell us?

In our annuity modelling work, we investigated best-practice guidelines for the responsible management of living annuities. We used investment models based on actual investment market returns since the early 1900s. These guidelines deal with key issues such as responsible income levels and portfolio construction for living annuities, in order to maximise the likelihood of delivering a successful, inflation-beating income over time.

Our previous work on responsible portfolio construction also explored ideal levels of offshore exposure.

When we determined the optimal offshore equity allocations, we used actual investment return data that included catastrophic investment periods such as the Great Depression, periods of war, as well as many market crashes and other economic crises.

The results of this modelling revealed an optimal offshore allocation of between 30% and 45% for all responsible annuity income levels (that is, starting income levels below 5.5%). It was remarkable to see that this 30-45% allocation remained quite stable over all these time frames.

But how sensitive are the results to extreme offshore exposure levels?

The important question we want to investigate in this article is whether a living annuity will experience a catastrophic outcome if there is a dramatic deviation from the ideal 30%-to-45% level of offshore exposure.

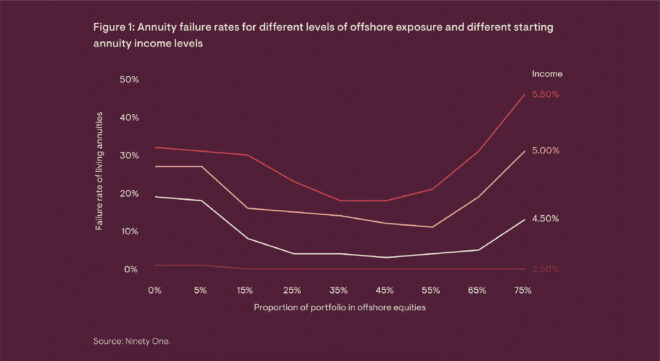

We modelled this question using our in-house living annuity simulation model, employing the same data set starting in the early 1900s. Readers interested in the mechanics of the model can refer to the model explanation on our website. Figure 1 summarises the results from this modelling exercise.

There are quite a few powerful conclusions from this summary graph:

- Your offshore portfolio exposure in a living annuity is much more critical for high-income-drawing living annuities compared to low-income living annuities.

- At the lowest income draw level of 2.5%, it makes no difference what level of offshore exposure you have in a living annuity. Offshore exposure anywhere between 0% and 75% of the total portfolio should deliver a successful living annuity.

- For higher-income-drawing living annuities, the following is evident:

- The offshore equity “sweet spot” of 30% to 45% of the total portfolio is once again confirmed.

- Exposure to offshore equity as low as 25% still delivers a very good result.

- Offshore equity exposures below 25% result in a virtual doubling in failure rates.

- Very high offshore exposures of more than 65% become dangerous – the failure rates increase sharply and reach levels of more than double the lowest failure rate by the time you get to an offshore equity exposure of 75%.

This exercise seems to suggest that very high and very low exposures to offshore equity potentially represent significant risks to pensioners. We expand more on the implications of this at the end of the article.

Are the results from our generic modelling still valid in today’s markets?

To deal with this question, we decided to verify the results from our generic living annuity model by investigating how living annuities with very high offshore equity exposures would have fared over the more recent past (since early 2000 and over the past 10 years).

We simulated living annuities for pensioners assuming that they were 100% invested in either:

- The Asisa Global Equity General sector average; or

- The Ninety One Global Franchise Feeder Fund.

The living annuities were set up to produce an initial income of 4.5%, and the income was increased with South African inflation annually. These annuities were then simulated for two cohorts of pensioners who retired at very different times in history:

- Pensioners who retired in January 2000; and

- Pensioners who retired in January 2011.

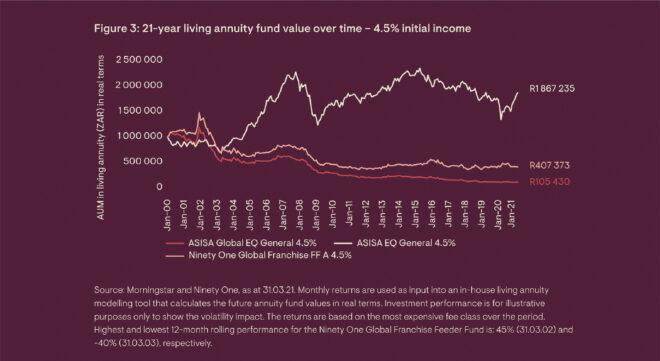

The graphs that follow highlight these living annuities’ fund values over the investment period in real terms (that is, all the fund values and investment growth numbers are expressed in January 2011 or January 2000 money terms). A graph where the annuity fund value finishes in line or better than the initial investment amount of R1 million represents a successful annuity.

Let us start with the pensioners who retired in January 2011.

As we suspected, a 100% exposure to offshore equities was, with the full benefit of hindsight, a very good investment strategy over the past decade. This extreme exposure delivered a strong inflation-linked income and doubled the assets in the living annuity in real terms. It doesn’t really get much better than this.

The Ninety One Global Franchise Feeder Fund’s higher value shows why performance matters when it comes to picking fund managers. Over the 10-year period, the Global Franchise Feeder Fund (A) outperformed the Asisa sector average by just over 1% a year. This highlights how small outperformance numbers on an annual basis can compound over time and result in a substantial difference in fund value.

However, let us now look at pensioners who retired in January 2000.

This time round, the picture is far less attractive for the two offshore-only living annuities.

Even though both these pensioners were invested in offshore equities for 21 years, their living annuities crashed quite precipitously in the international market volatility of the 2001 financial market crisis and never recovered. And this was over a period where the rand depreciated from just more than R6 to the US dollar in January 2000 to over R14.50 in 2021.

This is a classic illustration of sequence-of-return risk, whereby income-paying annuities are incredibly vulnerable to poor investment performance early on in their lifetime.

For illustrative purposes, we also included a living annuity in Figure 3 that was 100% invested in the Asisa Equity General sector average. In our previous article, we highlighted how South African equities in a living annuity portfolio underperformed from 2010 to 2021 but outperformed over the longer period from 2000 to 2021. The latter effect can be seen in Figure 3.

Granted, these are quite extreme cases with 100% offshore exposures. But they do illustrate the risk that our statistical modelling in the previous section also picked up – excessive exposure to a single, high-risk asset class (such as a 100% offshore equity portfolio) subjects pensioners to the impact of market and currency shocks shortly after retirement. This can lead to catastrophic outcomes.

The results from Figure 3 highlight why it makes sense to have both local and offshore equities in a living annuity.

Conclusion – theory meets practice

The results from the analysis of high offshore equity exposures in living annuities confirm just how important it is for a living annuity to have a portfolio that is both growth-oriented and well diversified. Annuities with high incomes and very high offshore equity exposure show a substantial increase in their failure risk. Such annuities are especially sensitive to market and currency corrections shortly after retirement. This risk should not be underestimated.

However, while the general rule would be to avoid offshore equity exposures larger than 60% or lower than 25% in living annuities, general rules don’t always work in financial planning where you deal with the financial complexities of individuals with very specific needs. In practice, there are a few situations where extreme offshore exposures in living annuities can work. For example:

- If a pensioner has already emigrated, or will emigrate shortly, and their future liabilities will no longer be in rands.

- If a pensioner is drawing the minimum of 2.5% income, a very high or low offshore equity exposure should not introduce catastrophic risk.

- If it is part of an overall portfolio diversification strategy where the living annuity is contained within a much larger estate, the bulk of which is invested locally.

We would encourage financial advisers who currently make large offshore allocations for high-income living annuity pensioners to keep careful records of the rationale for the investment strategy.

While such strategies can at times provide good outcomes (such as over the past 10 years), they can also produce very poor outcomes (for example, pensioners retiring in 2000). We believe the most robust solution remains a well-diversified portfolio that contains sizeable allocations to both local and offshore growth assets.

Jaco van Tonder is the head of Advisor Services in South Africa at Ninety One.

This article was first published in the Spring 2021 edition of Taking Stock and is republished with with the permission of Ninety One.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies.