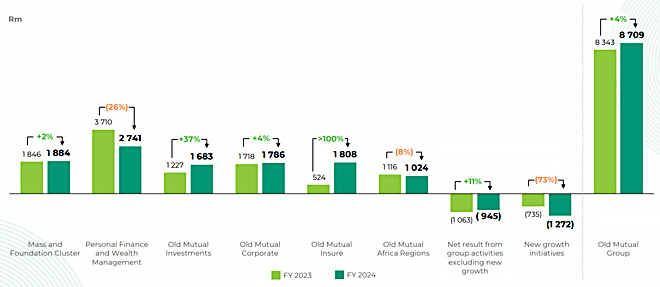

Old Mutual’s operating profit increased by 4% to R8.7 billion in the year to the end of December, despite “significant investments in new growth engines”, primarily OM Bank, the group said on Tuesday.

Headline earnings rose by 20% to R8.82bn and adjusted headline earnings, which exclude Old Mutual’s operations in Zimbabwe, by 14% to R6.68bn.

Headline earnings per share (HEPS) increased by 22% to 202.7 cents and adjusted headline earnings per share to 150.6 cents. HEPs were boosted by the company’s R1bn share repurchase programme in 2024, which contributed to a reduction in the weighted average number of ordinary shares.

Old Mutual declared a final dividend of 52 cents per share, with a total dividend of 86 cents per share for 2024, which is 6% higher than in 2023.

The group has returned R89bn to shareholders since the primary listing of Old Mutual on the JSE in 2018, Old Mutual’s chief executive, Iain Williamson, said in the Integrated Report for 2024. This includes a special dividend of R4.9bn, the Nedbank unbundling of R49.5bn, and cumulative share buybacks of R7.2bn. In addition, Old Mutual has distributed cumulative ordinary dividends of R27.4bn since 2018.

OM Bank to launch this year

Williamson said the Prudential Authority approved the banking licence for OM Bank in March.

The bank’s recently constituted board of directors, chaired by Nomkhita Nqweni, will oversee the execution of a “gradual and risk-based customer acquisition strategy”, which will culminate in a full national roll-out of OM Bank by the fourth quarter of 2025.

He said the launch of OM Bank is a realisation of the group’s strategic ambition to build an integrated financial services business.

Old Mutual spent R2.8bn between 2022 and 2024 to build the bank and secure a deposit-taking retail banking licence. A loss run rate of R1.1bn to R1.3bn a year is anticipated, which will reduce over time as revenue is generated, reaching break-even in 2028.

Williamson said OM Bank is designed to deliver “tangible value for our customers” and position the group for long-term competitive advantage in an intensely competitive marketplace.

“By leveraging our existing customer base, a highly trusted brand, and our expansive distribution network, we are uniquely positioned to deliver a digital-first bank at scale to the market and create value for our shareholders.”

Top-performing segments

Old Mutual has six operating segments:

- Mass and Foundation Cluster, which operates in the low-income and lower-middle-income markets (individuals who earn between R1 000 and R30 000 a month). It offers underwritten life and funeral insurance, savings, lending, funeral services and transactional banking.

- Personal Finance and Wealth Management, which offers a range of holistic financial advice and long-term risk, savings, income, and investment solutions. It targets the middle- and high-income (individuals earning between R25 000 and R100 000 a month).

- Old Mutual Investments, which offers investment solutions to institutional and retail customers.

- Old Mutual Corporate, which provides employee benefit solutions and consulting services, including pre- and post-retirement investments, group risk cover, and administration.

- Old Mutual Insure, which provides short-term insurance products to the personal, commercial, and corporate markets.

- Old Mutual Africa Regions, which offers a range of services, including life insurance and savings, asset management, banking and lending, and property and casualty insurance, in 10 countries.

Williamson said the strong financial performance in 2024 was driven by “exceptional” underwriting results in Old Mutual Insure and “strong” contributions from Wealth Management and Old Mutual Investments.

Read: Enhanced underwriting and pricing drive Old Mutual Insure’s performance

Wealth Management’s operating profit increased by 27% to R1bn from the prior year, but Personal Finance saw a 41% plunge in profits to R1.73bn, resulting in the segment’s overall profit declining by 26% to R2.74bn.

Old Mutual attributed Personal Finance’s lower profit to an increase in large death claims in the first half of 2024. Other factors were a strengthening of policy valuations and lower yields, which affected risk and guaranteed annuities.

Old Mutual Investments’ operating profit increased by 37% to R1.68bn. Old Mutual said the segment benefited from higher annuity and non-annuity revenue.

Annuity revenue (management fees, commitment fees, and catch-up fees) was boosted by higher average fee-earning assets and successful capital raising.

Non-annuity revenue (carried interest, revaluation of fund co-investments, performance fees and mark-to-market impacts from changes to credit spreads and equity exposures) more than doubled, mainly because of fair value gains in the Alternatives business.

Life insurance sales slump in Old Mutual Corporate

Overall, the value of new life insurance business declined by 5%, with Life APE (Annual Premium Equivalent) sales falling to R13.88bn. Williamson attributed the decline to new business metrics coming off a high base in 2023, which included strong savings sales in Old Mutual Corporate.

The value of new business (VNB) was 8% lower, at R1.75bn. VNB estimates how much profit an insurance company anticipates earning over the lifetime of the new policies it has written, after accounting for costs such as claims, expenses, and the time value of money.

By segment, there was strong growth in life insurance sales the Mass and Foundation Cluster and modest gains in Personal Finance and Wealth Management, but Old Mutual Corporate experienced a significant decline.

Old Mutual Corporate’s new life insurance business slumped 42% to R1.84bn. The group attributed the fall to the “lumpy” nature of large corporate sales. These sales involve significant contracts with long and unpredictable lead times, resulting in volatility in year-on-year performance.

Despite the VNB falling by 18% to R224 million, the segment improved its VNB margin to 1.5%, driven by a shift towards more profitable risk business,

Personal Finance and Wealth Management achieved an increase of 3% (to R4.83bn) in Life APE sales, driven by higher investment sales and marginally higher recurring-premium sales. Total sales (including non-covered savings and investment products) increased by 9%, highlighting stronger performance in non-life offerings such as investment products and living annuities.

The Mass and Foundation Cluster saw growth of 9% (R5.24bn) in Life APE sales, propelled by a strong performance in high-margin retail risk products, which achieved a 21% increase. This positive result was tempered by a slowdown in credit life sales, caused by tightened lending criteria, which reduced loan disbursements and associated insurance sales.

Two-pot system impacts client flows

Old Mutual reported a 9% increase (to R216bn) in gross flows, driven by inflows in Wealth Management, Old Mutual Investments, and Old Mutual Africa Regions.

The two-pot retirement system was a key factor in shaping client cash flow dynamics in 2024, with the severity depending on each segment’s client base. Two-pot withdrawals across the group amounted to R3.4bnn.

Personal Finance and Wealth Management recorded gross flows of R94bn, a 15% increase from the prior year. This growth was propelled by strong inflows in Wealth Management, where offshore and local platforms, Private Clients, and the newly launched Cash and Liquidity Solutions business saw “significant client interest”.

Net client cash flow more than doubled, from an outflow of R8.2bn to a net inflow of R5.9bn, driven by Wealth Management’s performance, which offset outflows in Personal Finance. A key factor was the less severe-than-expected impact of the two-pot retirement system.

Assets under management and administration rose by 14% to R420.4bn.

The Mass and Foundation Cluster posted gross flows of R14.76bn, up by 4% from the prior year. This increase was fuelled by growth in the risk in-force book and contributions from the Two Mountains Group, a partner entity enhancing the segment’s reach.

Net client cash flow stood at R6bn, which was 3% lower than in 2023. The dip was attributed to customers tapping into their two-pot savings and other investments to meet liquidity needs amid challenging economic conditions.

Funds under management increased by 6% to R31.7bn.

Old Mutual Investments experienced gross flows of R31.94bn, a 15% increase from the prior year. This surge was driven by strong inflows into equity, multi-asset, and alternative asset products.

Net client cash flow remained negative at -R7.44bn, although this was a 38% improvement from last year’s -R11.97. The persistent outflows were linked to a large client shifting to self-management in the money market sector, low-margin indexation outflows from an offshore investor restructuring its mandate, and broader retirement fund market strains, including two-pot withdrawals.

Assets under management grew by 8% to R278.2bn, buoyed by an uplift in local equity markets in the second half of the year.

Old Mutual Corporate saw a 21% fall in gross flows to R29.92bn. This drop was primarily attributed to the non-repeat of a significant single premium deal worth R7.9bn from 2023.

Net client cash flow was worse than in 2023, with net outflows more than doubling from R3.5bn to R27.3bn. Old Mutual attributed the decline to increased terminations – including the exit of unprofitable business worth R5.5bn and a large client termination on the Absolute Growth product – as well as two-pot withdrawals totalling R2.6bn. These outflows were compounded by higher member retirement, retrenchment, and withdrawal benefits from SuperFund.

Despite these setbacks, funds under management edged up by 1% to R278.2bn, supported by good investment performance in smoothed bonus funds.