OUTsurance Group Limited increased its ordinary dividend per share by 29.4% and declared a special dividend of 40 cents per share as its normalised earnings rose by 20.3% in the year to the end of June.

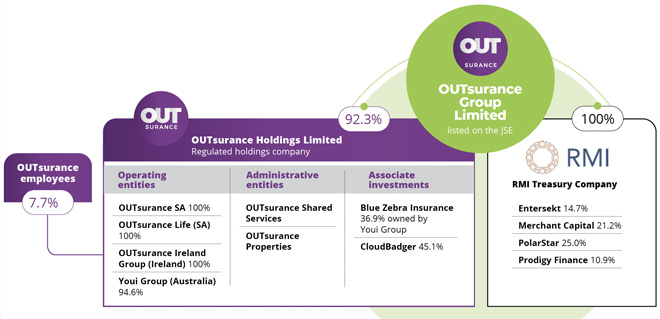

The JSE-listed OUTsurance Group has a 92.3%-stake in OUTsurance Holdings Limited, whose operating entities include OUTsurance and OUTsurance Life in South Africa, OUTsurance Ireland, and Youi Group in Australia. The multinational group specialises in property and casualty insurance.

Short-term business accounts for about 97% of group revenue.

The group’s normalised earnings rose from R2 939 billion in 2023 to R3.536bn in 2024. It declared a final dividend of 113.2c per share, taking its full-year shareholder distribution to 174.4c.

It also declared a special dividend of 40c per share thanks to the release of surplus funds held in RMI Treasury, which houses legacy venture capital investments of the group’s former parent holding company.

The 29% growth in the ordinary dividend compared to the 20% growth in earnings was a result of the retention of more capital last year to acquire the last tranche of a minority interest in Youi and to invest in the launch of OUTsurance Ireland, said chief financial officer Jan Hofmeyr. The group was also retained capital because of the hard reinsurance market.

“These factors have somewhat reversed in 2024, which allows us to revert to a more normal dividend payout ratio of 76.9% for OUTsurance Holdings Limited. That translates to a 76.1% payout ratio for OGL shareholders,” Hofmeyr said.

The strong earnings result was supported by a good operational performance and investment income results. Earnings improved despite higher natural perils claims at Youi, the large increase in the share-based payments expense, and the start-up loss incurred by OUTsurance Ireland.

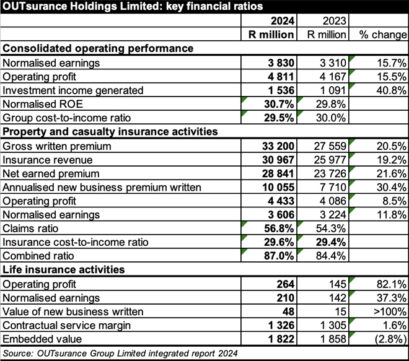

Gross written premiums (GWP) from insurance operations increased by 20.5%, from R27.559bn to R33.2bn, driven by elevated premium inflation and strong new business growth in South Africa and Australia. Insurance revenue rose by 19.2% from R25.977bn to R30.967bn.

New short-term premium business grew by 30.4% to R10.055bn, benefiting from a strong tailwind in premium inflation and consumers shopping around in Australia, said group chief executive Marthinus Visser.

“In Australia, claims repair costs for home insurance have remained particularly elevated following a period of increased natural disasters and supply constraints. Our expectations for both Australia and South Africa are that premium inflation will moderate over the next 12 months in line with a more favourable inflationary and interest rate outlook.”

Visser said OUTsurance believes the reinsurance market soften over the past 12 months, with premium increases more in line with general inflation and catastrophe retention levels unchanged from 2024. These outcomes should support a more benign premium inflation outlook.”

OUTsurance paid out claims worth R595.7 million in 2024, 11.1% up from the R536m in 2023.

Visser said the growth in new business over the past five years was the result of strong investment in new products and channels, as well as in existing core personal lines business.

The group has made a significant investment in scaling OUTsurance Brokers, and OUTsurance Brokers achieved sustainable profitability during the second half of the 2024 financial year.

The intention is to expand the sales force.

“The growth of OUTsurance SA’s commercial insurance market share, off a low base, is a cornerstone of our South African strategy over the medium term. Furthermore, the OUTsurance Broker channel is also providing us with access to the higher end of the personal lines market, providing additional runway for growth for our substantial personal lines business in South Africa,” Visser said.

South African operations

OUTsurance South Africa, which consists of two main operational segments, OUTsurance Personal and OUTsurance Business, delivered a strong operational performance “in the context of a difficult economic climate and high-inflation environment”.

GWP rose by 9.1% to R12.174bn and net earned premium was up by 9.4% to R11.963bn. Premium inflation was a large contributor to premium growth.

The claims ratio improved from 52.5% to 49.8%. Retained natural perils claims were in range with historic experience.

Investment income continued to benefit from the rising yield environment and positive equity market returns, rising by 26.1% to R628m.

OUTsurance SA achieved an operating profit of R2.678bn, which was a 17.2% improvement on the prior period.

OUTsurance Personal, the largest contributor to the group’s profitability, saw its operating profit increase by 24% from R2.276bn to R2.822bn.

GWP increased by 8.4% because of sustained higher premium inflation and robust new business performance in the direct channel. Net earned premium rose by 8.6% to R9.296bn.

The claims ratio improved from 51.6% to 49% – below the target of 50%. OUTsurance said the improvement was the result of disciplined pricing and underwriting actions during a period of elevated claims inflation and vehicle theft.

OUTsurance Business is segmented into a Direct and OUTsurance Broker channel (tied-agency).

GWP grew by 11.7% to R2.723bn. Of this, R1.576bn, or 58%, came from OUTsurance Brokers, which was 21.1% higher than in the prior year.

The claims ratio improved from 55.4% to 52.9% because of the maturing of the book and continuous enhancements in underwriting.

The cost-to-income ratio decreased from 34.8% to 32.1%, reflecting the improved economies of scale in the OUTsurance Broker channel and cost discipline in the slower-growing Direct channel.

Overall, OUTsurance Business delivered a 71.2% improvement in operating profit to R445m. OUTsurance Brokers dramatically cut its operating loss from R129m to R6m.

OUTsurance Life benefited from strong growth in the funeral segment and the discontinuation of the face-to-face channel, which dragged on performance in the prior year. Operating profit grew by 82% to R264m.

There was significant growth in the funeral business partnership with Shoprite, swinging from an operating loss of R5m to an operating profit of R64m.

Youi profits up despite claims

Despite higher natural perils claims, Youi produced a 6.2% improvement in operating profit (R1.973bn) and 12.1% growth in headline earnings R1.574bn).

Youi delivered 28% growth in GWP in rand terms, to R21.018bn.

The claims ratio increased from 55.9% to 61.6% because of an increased natural perils experience compared to the prior year. The movement in the claims ratio was negatively impacted by an adverse reserving development, particularly on home claims incurred in the 2023 financial year.

The cost-to-income ratio decreased from 31.7% to 29.6%, thanks to a focus on support cost efficiency and revenue growth.

Youi’s investment income increased by 79.2%, from R365m to R654m, because interest rates were higher on average compared to the prior year.

Irish subsidiary launches

OUTsurance Ireland received regulatory authorisation on 1 January 2024 and had its hard launch in May.

OUTsurance Ireland is offering car and home insurance direct to the market. In Ireland, bodily injury is part of standard comprehensive motor cover.

“We’re in an incremental launch phase […] We grow the business fairly conservatively, and that’s because when you have a brand-new start-up, you don’t have a lot of data to base your pricing models on. If you grow too aggressively, you run the risk of amplifying pricing errors. That said, you do need to maintain a balance to write enough business to learn those pricing lessons, but also to progress towards scale. So far, we’re very happy with the progress of the business,” Visser said.

OUTsurance Ireland’s operational loss increased from R56m to R218m as the business prepared for and entered the launch phase. It is expected to break-even in five years.

The group has capitalised the subsidiary with R1.87bn, funded with surplus capital and a withdrawal from the group’s R1.35bn revolving credit facility.