OUTsurance Group’s interim results for the six months to the end of December 2024 reflect a robust financial performance, underscoring the company’s resilience and growth across its diverse operations. This positive outcome comes despite a significant start-up loss from its expansion into the Irish market and the phased wind-down of its employee share ownership plan (ESOP) scheme.

For most South Africans, OUTsurance is best known for its “cash OUTbonus” – 10% of premiums paid back after three consecutive claim-free years, and an additional 10% for every subsequent claim-free year. But, as the OUTsurance group’s interim results released last week show, there’s much more to the company.

To recap for those not in the know, the OUTsurance group is a multinational insurer specialising in property and casualty (P&A) insurance. Founded in 1998 by three entrepreneurs with backing from RMB Holdings, the group operates primarily in South Africa and Australia, with recent expansion into Ireland.

Its core business is underwriting personal, commercial, and life insurance, with premiums as its main revenue stream. OUTsurance Group Limited (OGL) refers to the listed entity, while OUTsurance Holdings Limited (OHL) – 92.7% held by OGL – represents the operational insurance businesses, with OGL following OHL’s historic reporting structure.

Key operating entities include:

- OUTsurance SA (100% held by OHL)

- OUTsurance Life in South Africa (100% held by OHL)

- Youi Group in Australia (94.4% held by OHL)

- OUTsurance Ireland Group (100% held by OHL)

OUTsurance Ireland Group is the newest addition to the stable, having officially launched in May 2024.

The recently released interim results highlight strong financial performance for both OGL and OHL.

For OGL, normalised earnings rose by 52.9% to R2.16 billion, with a normalised return on equity of 30.8%. Diluted normalised earnings per share increased by 53% to 138.6 cents, while the ordinary dividend per share climbed by 44.8% to 88.6 cents.

OHL also delivered solid results: normalised earnings grew by 43.5% to R2.22bn, and operating profit surged by 58.8% to R2.84bn. P&C gross written premium rose by 17.4% to R18.9bn, while P&C insurance revenue (IFRS 17) was up 16.8% to R17.4bn. Annualised new business increased by 17.9% to R5.68bn, net earned premium rose 19.5% to R16.4bn, and the normalised return on equity came in at a robust 34.9%.

Overall, the results reflect strong earnings momentum, improved profitability, and solid growth in new business and premiums across the group.

OUTsurance Ireland

This strong performance came despite pressures on group earnings from OUTsurance Ireland’s operating loss of R246 million. The group noted this was exacerbated by an IFRS 17 requirement to recognise an “onerous loss” reserve for expected future losses on in-force policies, due to the business’s current sub-scale operations.

According to OGL’s unaudited interim results and cash dividend declaration for the period under review, the OUTsurance Ireland’s operating loss, excluding onerous losses, increased from R64m to R181m, driven by increased operational costs incurred related to marketing and operational infrastructure. OUTsurance Ireland incurred R218m in normalised start-up losses during the six months under review.

The onerous loss allowance, per IFRS 17, is calculated by accruing a liability for the expected loss to be incurred by servicing in-force policies over the remaining contractual policy term. The group explained that liability, representing future losses, is required for as long as OUTsurance Ireland operates at a combined ratio above 100%. As the business scales, the onerous loss allowance will be proportionately reduced. The liability was R65m at the reporting date.

Commenting on OUTsurance Ireland, group chief executive Marthinus Visser said that since launching in May last year, new business volumes and scaling have been tracking according to plan.

“In terms of gross written premium, we recorded R80m for the six months. We are gradually ramping that up as we gain more confidence in our pricing and systems. So far, so good – we’re really happy.”

On the R246m operating loss reported in the interim results, Visser highlighted this includes a R65m onerous loss reserve, as required under IFRS 17. “It’s more a timing effect, because as we approach break-even, that reserve will unwind. We expect monthly break-even within five years of launch.”

Sun sets on ESOP scheme

Earnings were also significantly impacted by higher share-based payment expenses, driven by share price growth in the South African operation.

The interim results showed that the South African group’s share-based payments expense linked to the ESOP scheme remained a significant expense during the first half of the year.

The share-based payments expense related to the final tranche of the ESOP amounted to R776m for the six months under review, R342m higher than the same period last year, when two tranches remained. This sharp increase in the expense was driven by a 43.3% rise in the OGL share price over the last six months.

The group is in the process of phasing out its ESOP scheme as it transitions to a Customer Shareholding Plan (CSP). The final tranche of the ESOP will vest in September 2025, after which all vintages of long-term incentives will move to the new CSP.

Jan Hofmeyr, chief financial officer, noted that the CSP is significantly less geared than the ESOP scheme, “which will result in a more stable expense base going forward”.

Hofmeyr explained that the ESOP is a cash-settled scheme, where option values are marked to market at each reporting interval, creating volatility in share-based payment expenses and, consequently, a volatile impact on cost-to-income ratios within the OHL Group.

The ESOP was designed to incentivise employees, particularly divisional executives and senior managers in new and emerging business units. OUTsurance employees benefited by acquiring shares at a predetermined price, allowing them to profit from the growth in the OUTsurance Holdings share price between the issue and vesting dates.

Regarding whether the CSP would provide the same level of motivation for participating staff, or whether smoother accounting would lead to lower internal motivation, Visser responded: “If we look at the motivation of the ESOP over the years in the unlisted environment, it provided a much more gradual realisation of value. And motivation levels have always remained.”

He noted that both the management team and their supportive shareholders are focused on the long term.

“That’s why we were willing to engage in these long J-curves, because we know the payoff is there.”

Visser pointed out that OUTsurance, which recently turned 27, started with R90m in capital and is now worth more than R100bn. “That’s 1 000 times money, sort of 29% compound growth. We’ve seen bad cycles before, and we’ve seen better cycles.”

He assured that senior management is still deeply engaged, and the new scheme will enable more management to become shareholders.

“That is the ultimate alignment. That also enables long-term thinking, managing the business as if it’s your own.”

He underscored the importance of driving down cost ratios, noting: “If you think about expenses as if it’s your own money that you spend, I think that is a structural advantage, and that’s also why we have ESOP schemes in Australia at Youi, and in Ireland as well, in that start-up, unlisted environment, because it’s a key part of our incentivisation.”

Visser does not see the new scheme diluting senior management’s incentive to perform.

“The plan is still to move the minorities at the OUTsurance Holdings level up to the OUTsurance Group level, and you’ll see the participation of management and alignment of management is strong.”

OUTsurance SA

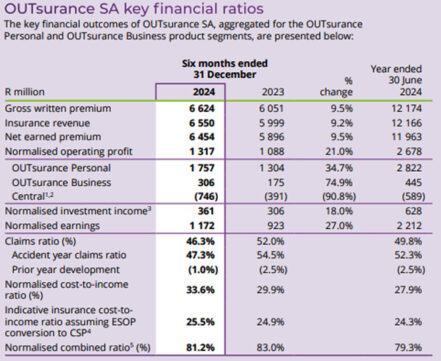

OUTsurance SA, the Group’s South African P&C insurance business, comprises two key segments: OUTsurance Personal and OUTsurance Business. According to Visser, OUTsurance SA delivered a strong operational performance, supported by favourable weather conditions.

“If you look at the whole market, you’ll see that most other insurers also reported on the favourable conditions in terms of the claims ratio, that we experienced favourable weather, but most pleasingly, for our OUTsurance, we were also able to improve the cost ratio through various gains in efficiencies, both in the back office as well as the operational areas,” said Visser.

The insurer recorded 9.5% growth in gross written and net earned premiums, with Visser noting that persistent premium inflation, driven largely by rising repair costs, continues to be a key driver of premium growth.

The claims ratio improved from 52% to 46.3%, with both the Personal and Business segments showing stronger outcomes. Claims from natural perils, measured as a percentage of net earned premiums, declined from 5.8% to 3.4%.

Although the normalised cost-to-income ratio rose from 29.9% to 33.6%, both OUTsurance Personal and OUTsurance Business achieved lower segment-level cost-to-income ratios, aided by cost discipline and scaling efficiencies at OUTsurance Business Brokers.

“We’ve reached break even, and we’re making a small margin there, and we just want to gradually manage that up to our target, until we get to our target margin of 15% and as such, we’re working through an incremental growth of that agency force,” Visser said.

He added that the OUTsurance Business margin improved as a result of a lower cost ratio from scale benefits and a better claims ratio, “and that was because that cost ratio is coming down as we scale, but also the claims ratio benefiting from the favourable experience”.

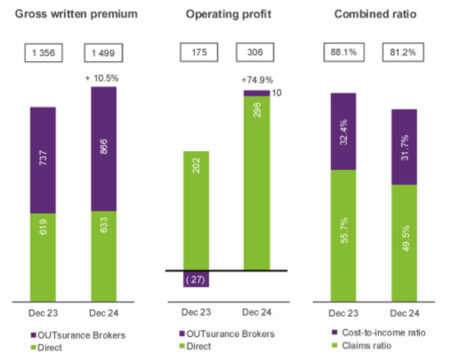

OUTsurance Business reported 10.5% gross written premium growth, while the broker channel grew by 17.5%. Operating profit surged 74.9%, with Visser noting: “And that is with the brokers coming through that J-curve and turning from a loss to a profit, enabling that strong profitability growth.”

According to the group, the trajectory of real growth in the OUTsurance Personal book improved over the reporting period, assisted by the new business contribution from the OUTsurance Broker channel. Gross written premium grew by 9.2%. Excluding the FirstRand Homeowners book, in run-off, gross written premium increased by 10.3%.

The increase in OUTsurance SA’s overall cost-to-income ratio was mainly because of excess share-based payment expenses incurred by the Central segment, linked to the mark-to-market revaluation of the final tranche of ESOP instruments. These expenses contributed 8.1% and 5% to the cost-to-income ratios in the respective periods.

Normalised investment income rose by 18%, and despite the drag from share-based payment expenses, OUTsurance SA’s normalised operating profit climbed by 21% to R1.317bn compared with the prior period.

Hofmeyr highlights two key channels driving this result: the OUTsurance broker channel and the direct channel, which is the call centre channel. He notes the OUTsurance broker channel now far surpassed the direct channel in terms of gross written premium contribution.

“Overall, we have seen growth written premium growth of 10.5%, a fairly muted growth in the direct segment, which has seen more inflationary growth than real growth,” Hofmeyr explained.

He added that OUTsurance brokers have grown gross written premium by 17.5%.

“We have applied extreme focus to ensure that the profitability profile of the OUTsurance broker channel trends towards our target margins, and therefore headcount growth has also been managed in line with the target of improving profitability in this channel,” Hofmeyr said.

OUTsurance Life

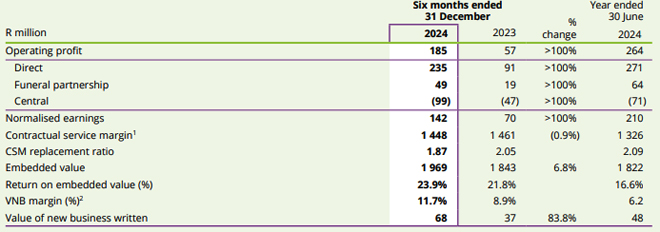

Commenting on OUTsurance Life, Visser underscored the group’s strong focus on better aligning the product and distribution channel.

“Since the discontinuation of the face-to-face channel, a lot of simplification in terms of the product and process has taken place. And we’re really excited about that,” he said.

He also noted that IFRS 17 is proving to provide a more stable profitability profile.

“And in terms of growth, we saw the value of new business written increase significantly by 83% on the back of the direct segment,” Visser added.

Operating profit more than doubled to R185m, despite the significant increase in the share-based payments expense, which is accounted for in the Central segment. On the final ESOP tranche, OUTsurance Life incurred a share-based payments expense of R83m compared with R37m in the comparative period.

The value of new business written increased by 83.8% to R68m, with an improvement in the VNB margin to 11.7%.

Hofmeyr noted that the increase in operating profit was driven by two strong performances: the life direct segment, which includes the group’s underwritten life and direct funeral operations, and the partnership with Shoprite.

“The direct book benefited particularly from expense discipline that’s been applied in this business and various innovations with regards to growing the operational success of this business,” Hofmeyr explained.

He also noted that the funeral partnership with Shoprite has grown significantly over the years.

“And that is playing through in the much stronger operating result delivered, where we’ve seen an increase from R19m to R49m in operating profit,” he added.

From an operational metrics perspective, Hofmeyr highlighted the group’s strong performance in terms of the CSM replacement ratio, embedded value performance, and return on embedded value.

Since June 2024, OUTsurance Life’s CSM increased by 9.2% to R1.488bn. According to the group, this increase benefited from strong growth in the Funeral segment and pricing actions aimed at improving new business margins.

The embedded value grew by 6.8% to R1.969bn, “reflecting the growth in the in-force book’s profitability”.

“And also, pleasingly, the VNB margins, which have been achieved. When we exclude the noise of the share-based payments expense, the VNB margins printed at 18.9%, and that is on account of a favourable mix towards more short-term funeral business in the group, which is more profitable, as well as pricing actions that have been taken in the direct business to ensure that our operating margins are achieved,” Hofmeyr said.