The judge set to hear the Prudential Authority’s liquidation application for Ithala SOC Limited in March is likely focused on solving a financial puzzle – the institution’s assets, liabilities, and equity.

On 16 January, the PA announced it had approached the High Court to liquidate Ithala, stating this move was in the best interests of its approximately 257 000 depositors. In the founding affidavit accompanying the notice of motion, Nomfundo Tshazibana, the PA’s chief executive and deputy governor of the South African Reserve Bank, held that Ithala is technically and legally insolvent.

In response, Ithala issued a scathing media statement, claiming it is solvent, and its assets significantly exceed its liabilities.

Read: Ithala hits back: sharp criticism of Reserve Bank’s liquidation move

The KwaZulu-Natal Treasury quickly came to Ithala’s defence. In a statement issued on 26 January, the KZN Treasury announced it had submitted legal documents supporting Ithala’s case to “thwart” the provisional liquidation application. The KZN Treasury argues that Ithala does not face solvency or liquidity issues.

According to the KZN Treasury, as of 31 October 2024, Ithala’s total assets stood at R3.25 billion, while total liabilities amounted to R2.93bn, leaving Ithala with a positive net asset position of R316 million.

A solvency report prepared by Johann Kruger, the PA-appointed repayment administrator (RA), presents a starkly different picture. It casts doubt on the integrity of Ithala’s equity and loan book and sheds some light on what the shortfall would possibly be if Ithala were to repay all existing funds to depositors.

Currently, Ithala holds deposits totalling R2.47bn.

Here’s what happened

If you’re already familiar with the details, skip to the next section. But for those who need a refresher, Ithala is a fully owned subsidiary of Ithala Development Finance Corporation Limited (IDFC). IDFC, which is owned by the KwaZulu-Natal government, operates under a Board that reports to the Provincial Department of Economic Development, Tourism, and Environmental Affairs (EDTEA).

Ithala operated as a deposit-taking institution under exemptions from the PA, with the most recent exemption (Government Gazette 47063) allowing it to function without being classified as a bank until 15 December 2023. When the exemption expired, Ithala was no longer permitted to accept deposits or issue loans. However, it continued these activities beyond the deadline, violating the Banks Act.

On 12 December 2023, the PA appointed Kruger, a director at Bowman Gilfillan Incorporated, as the RA to oversee Ithala’s wind-down. Kruger was also named a temporary inspector on 14 December 2023 to assess whether Ithala was unlawfully operating as a bank. The PA’s investigation confirmed illegal deposit solicitation, leading to a directive on 18 December 2023 under sections 83 and 84 of the Banks Act, formally appointing Kruger as section 84 Repayment Administrator.

A slew of legal action followed.

Read: How Ithala’s banking ambitions crumbled: the rise and fall of a rural icon

On 26 July 2024, the Financial Sector Conduct Authority (FSCA) suspended Ithala’s financial services provider licence due to financial non-compliance under the FAIS Act.

On 24 October 2024, the PA ordered Ithala to stop accepting deposits and repay all existing funds within 14 business days. The directive warned that failure to comply could be considered an act of insolvency or an inability to pay debts, potentially triggering legal action for the winding-up of the entity or the sequestration of its insolvent estate.

The PA further cautioned that it might apply for Ithala’s liquidation if the directive was ignored, which it was.

Down the rabbit hole

Kruger’s solvency report, included in the PA’s notice of motion filed with the court, details Ithala’s financial state, supported by an investigating team of legal experts, accountants, and analysts. The report is based on available banking records but is not a full audit under International Financial Reporting Standards. Kruger alleges Ithala obstructed access to key records, and some financial data remains under verification.

The investigating team reviewed all bank accounts linked to the institution from 15 December 2023 to 11 June 2024.

Technical insolvency occurs when an entity’s liabilities exceed its assets. According to the investigative team’s findings, as of 31 March 2024, the institution’s total liabilities stood at R2.79bn, while total assets were R2.35bn, resulting in a shortfall of R441.63m – confirming technical insolvency.

Legal insolvency (commercial insolvency) occurs when an entity cannot meet its financial obligations as they become due. The investigation found that if the institution had to repay depositors within the next financial year, it would face a shortfall of at least R1.55bn. If depositors demanded immediate repayment, the shortfall would increase to R1.63bn.

In addition to these damning figures, the report raised serious concerns regarding Ithala’s equity and assets.

Is Ithala being propped up by the IDFC?

Equity, in banking terms, refers to the ownership value after subtracting liabilities from assets. It includes shareholder investments (in this case, IDFC) and retained earnings. It is a key measure of financial health and an institution’s ability to absorb losses.

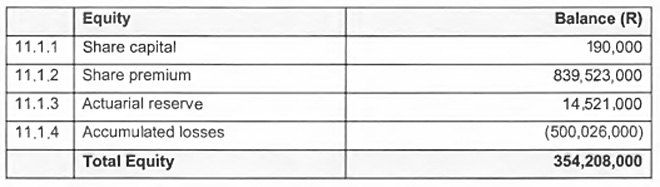

Ithala’s audited financial statements for the year ending 31 March 2024 show its equity includes share capital, share premium, actuarial reserve, and accumulated losses.

The report breaks down the figures:

- “Share capital” consists of 190 064 970 ordinary shares of 0.1 cent each, totalling R190 000.

- The “share premium” is the equity introduced by Ithala’s sole shareholder, IDFC, annually, amounting to R839 523 000. This ensures the bank’s equity remains positive (technically solvent) and is primarily used to cover the annual net loss.

- The “actuarial reserve” of R14 521 000 covers post-retirement medical benefits for 92 employees who started before 1 August 2000.

- “Accumulated losses” of R500 026 000 reflect the total losses Ithala has incurred since its registration in 2001.

The report notes that the institution bears a significant accumulated loss of R500 026 000 which is offset against the share premium balance.

“This reveals that the technical solvency of the institution, as reflected in its annual financial statements, is only achieved by the continued annual share premium contribution provided by its sole shareholder, the IDFC. Without the continued annual share premium contributions, the institution can be considered technically insolvent,” the report reads.

Only the ‘loanly’

Under assets, the report draws attention to several troubling aspects of Ithala’s loan book.

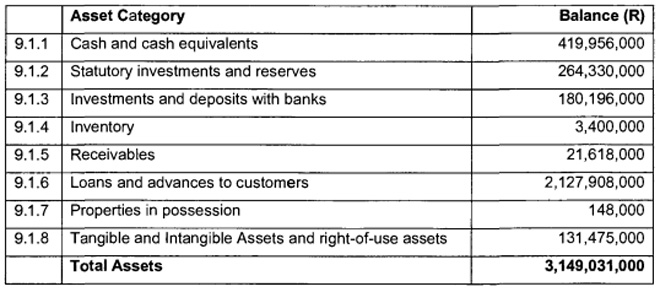

The report notes that, as per Ithala’s audited financial statements for the year ending 31 March 2024, the total assets amounted to R3 149 031 000, with R2 279 908 000 classified as “loans and advances to customers”.

The investigative team flags concerns regarding the realisable security values applied to Ithala’s loan book. The report further lists these risks that could adversely affect the net carrying value of the loan book:

- Taxi loans, comprising approximately 8% of Ithala’s April 2024 loan book, pose risks due to the lack of insurance coverage on them, as reported in various credit risk management meeting minutes.

- Staff loans, comprising approximately 10% of Ithala’s April 2024 total loan book, include instances where declined credit decisions were allegedly overruled by the Office of the CEO and where loans were processed without following proper procedures.

- The investigative team suspects that some of the pension-backed loans, which constitute approximately 22% of Ithala’s April 2024 loan book, may have been granted in violation of the Pension Funds Act. The compliance issues identified by the investigative team include the lack of proof of ownership of property; proper utilisation of funds; loan-to-value ratios, and notifications to retirement funds for re-advances.

- Additionally, while cash advances comprise 1% of Ithala’s April 2024 loan book, the investigative team’s completed review of the February 2024 records indicates that 267 of the cash advance clients were younger than 18 years of age.

Attached to the report was an IDFC presentation document styled “1DFC and Ithala SOC Joint Session: 13 September 2023”. The IDFC Projection, premised on values drawn from Ithala’s 31 March 2023 annual financial statements, estimates a 50% recovery on the sale of the Ithala loans and advances book in respect of loans repayable over more than five years.

The report also includes a copy of a document that was “apparently prepared” by Ithala’s chief executive officer, Mohamed Gafoor, in October 2023.

These documents were found by the investigative team during their review of data imaged from the CFO’s company device.

The file, titled “Winding-Up Plan – Plan to wind-down deposit-taking activities which will result in the wind-up of Ithala SOC Limited”, outlines Ithala’s plan to wind down its deposit-taking activities if it fails to meet the performance obligations in the Exemption Notice, leading to the withdrawal of its exemption status.

These projections were also premised on values drawn from Ithala’s 31 March 2023 annual financial statements.

The financial model detailed in the document projects a funding surplus or shortfall if Ithala sells off its assets to transfer its deposit book to another institution.

Asset values are calculated using discount factors based on credit quality and liquidity.

Two scenarios are considered:

- Orderly sale: Management has time to find buyers and negotiate the best prices.

- Fire sale/liquidation: Assets are sold quickly at steep discounts.

The first scenario assumes a total effective discount of 35% discount on the loans and advances balance (and 54.1% on non-financial assets).

The second assumes a total effective discount of 37.4% on the loans and advances balance (and 66.5% on non-financial assets).

“Therefore, notwithstanding the RAs limited access to the pertinent information, we submit it reasonable for our present purposes, to apply the lower of the shareholder and executive’s documented forced sale impairment projections of Ithala’s loans and advances book, being 37.4%, in calculating the likely realisable value of this asset to be R1 332 070 000,” the report reads.

It’s a long, winding road

The Winding-Up Plan states: “Ithala anticipates the wind-down of the deposit-taking activities may ultimately result in the wind-up of Ithala’s business.”

According to the document the first scenario results in a R306.7m balance sheet shortfall. After calling a R300 million guarantee, writing off the R56.5m IDFC loan, and covering retrenchment and wind-up costs, Ithala is still short R63.2m, “which will have to be funded from other sources”.

The second scenario is projected to lead to a R878m balance sheet shortfall. After similar deductions (as set out in the first scenario), Ithala remains R266m short.

The document states that the Winding-Up Plan was adopted as a framework for winding down Ithala’s deposit-taking activities if its Exemption Notice is withdrawn.

“The KZN MEC for Finance, in terms of section 66(1) of the PFMA read together with Treasury Regulation 13.1.1, granted the MEC for EDTEA approval to issue a guarantee to the Minister of Finance, to the value of R300m annually over three years to enable Ithala to comply with the capital adequacy requirements and to protect depositors’ funds held by Ithala. The guaranteed amount was held in the KZN Provincial Revenue Fund and could be drawn upon as and when required.”

That guarantee was set to expire on 31 December 2024.

The document also states that it should be noted that “no authorisation has been received from IDFC regarding the write-off of the loan account; this is an assumption based on the fact that they are the shareholder”.

The investigative team’s review of additional correspondence retrieved from the CFO’s device indicates that the Wind-Up Plan was drafted in response to a similar assessment carried out by the IDFC.

In a letter dated 28 October 2023, titled “Ithala SOC Limited: Governance Context and Concerns”, Pearl Bengu, the IDFC’s group chief executive, informed Ithala’s CEO, Dr Thulani Vilakazi, that the IDFC team had assessed the potential consequences of a poorly managed wind-down of Ithala SOC’s deposit-taking activities. Based on their risk management processes, the team estimated a worst-case reversionary liability of approximately R979 million.

This assessment was shared with the Ithala SOC Board as a discussion document for a joint IDFC-Ithala SOC Board meeting. However, according to Bengu, Ithala SOC’s management rejected the scenario, arguing that it was “patently incorrect” and that their own assessment placed the reversionary liability at just R300m.

Bengu attributed the discrepancy to a misunderstanding, stating that the Ithala SOC team was actually referring to a wind-up plan. She clarified the distinction, explaining: “For clarity, winding up is a process under the Companies Act, a determination that cannot and will not be made by the PA. It will occur as a consequence of an order of a competent court. The PA documentation refers to a ‘winding-down’ of the Ithala SOC deposit-taking activities, a power clearly within the ability of the PA to exercise, after following its processes.”

Calming depositors’ fears

The liquidation application means that depositors’ accounts had to be closed to allow for the pending court processes.

Shortly following the PA’s notice of motion to apply for Ithala’s liquidation, the National Treasury issued a statement assuring retail depositors that their funds will be protected by a government guarantee, “subject to the completion of necessary technical work”. This includes providing a government guarantee to one or more banking institutions to facilitate the timely migration of depositors’ accounts and ensure access to funds.

Treasury did not share what the value of the government guarantee is at present.

It did say it was working closely with the PA to ensure an orderly process that protects depositors’ interests.

“While depositors will need to urgently make alternative banking arrangements, they can be assured that we will endeavour to secure their funds as far as is possible,” the statement read.

Treasury added that further details about accessing guaranteed funds would be provided after the court’s decision on Ithala’s liquidation application.

The PA planned to submit the application to the High Court in Pietermaritzburg on 30 January, but the matter has been postponed. A new date has not been determined yet.