Tribunal upholds financial planner’s actions in annuity rate dispute

The planner acted in the client’s best interest, highlighting the importance of clear communication and thorough record-keeping in financial advice.

With over R5.2 billion in unpaid retirement fund contributions and municipalities among the worst offenders, the FSCA is poised to gain expanded powers under the COFI Bill.

The planner acted in the client’s best interest, highlighting the importance of clear communication and thorough record-keeping in financial advice.

With SARS tightening crypto enforcement, taxpayers should review their past filings, ensure accurate reporting of crypto profits, and consider the Voluntary Disclosure Programme to avoid severe penalties and interest.

Key proposed amendments include imposing fines for non-compliance, enhancing the Information Regulator’s authority to issue directives, and introducing search-and-seizure powers.

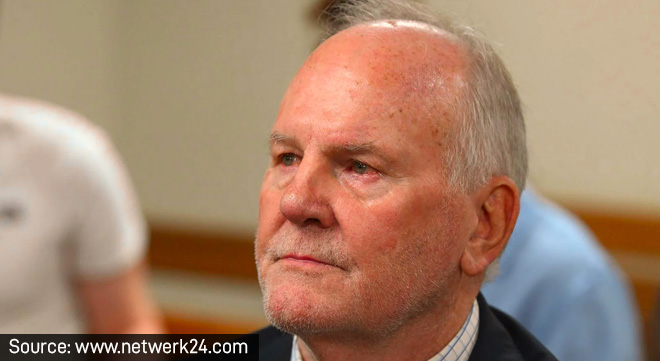

Stephanus Grobler, who is facing multiple charges including racketeering and fraud, is due to appear in court in February next year.

Financial stress frequently appears in the workplace as anxiety, which can develop into depression, increased absenteeism, and substance abuse.

Associate Professor Tasleem Ras’s analysis of a patient’s case highlights critical pitfalls in cancer care.

FSCA warns about Miway Express Credit Solutions, as well as entities and individuals who are impersonating legitimate FSPs.

The group reported a 15.9% increase in assets under management to R435bn.

Medical inflation outpaces CPI because of unique pressures such as the rising costs of technology, chronic diseases, and private healthcare pricing.

The former owner of Gundo Wealth Solutions has been fined R3 million and debarred for a decade for brokering investments into VBS Mutual Bank.

MBSE’s RE training equips students with the knowledge and skills they need to approach the RE 5 exam confidently.

The Authority has made good on its undertaking to act against unlicensed trading signal providers, imposing a R1m fine and a 10-year debarment.

The Allianz Commercial Cyber Security Resilience report shows that the costs associated with certain data privacy breach claims can match or surpass those of ransomware incidents.

The Authority says its investigation raises concerns about aggressive sales tactics, unrealistic returns, and significant losses by clients.

Court finds that Pieter Bothma accepted bribes to facilitate unauthorised investments, laundering millions for Fidentia’s directors.

Launched in 2019, the inquiry sought to investigate allegations of racial profiling by medical schemes. As 2024 draws to a close, the CMS is still battling objections and technical reviews to finalise the report.

Contribution increases in 2025 are exceeding CPI, with some medical schemes aiming to rebuild reserves and ensure long-term sustainability.