The demand for personal loans is likely to remain strong, with 33% of respondents to TransUnion’s Q2 2024 Consumer Pulse Study saying they intend to apply for a new personal loan in the next 12 months – more than any other credit product.

According to TransUnion’s Consumer Pulse Study, 91% of consumers believe access to credit is essential. Among Gen Z consumers, the top three anticipated new credit products in the next 12 months are personal loans (35%), credit cards (26%), and student loans (25%) – all viewed as entry-level options.

TransUnion’s South Africa Industry Insights Report found that, in the second quarter of this year, Millennials (46%) and Gen Z (16%) accounted for 62% of new credit originations, with 60% of Gen Z originations issued to those between the ages of 26 and 29 years, and one-third those between 22 and 25.

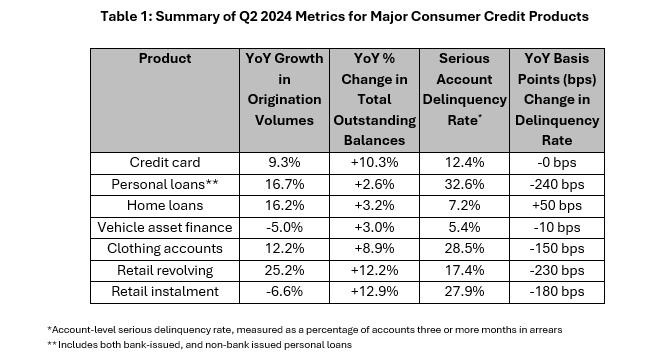

The report also found that the number of overall credit originations (a measure of new accounts opened) increased by 15.2% as South Africans increasingly used new and existing credit products to meet their consumption needs via credit cards, personal loans, and retail revolving loans.

The number of credit-active consumers grew by 4.7% year-on-year to 18.5 million people, of whom 28.1% hold credit cards.

Originations for consumption-led products – for example, facilities to pay for day-to-day expenses – accounted for 83% of all new credit opened, growing by 16.8% YoY in the second quarter.

The country’s credit market stood at an outstanding balance of R2.37 trillion, up 3.7% YoY, with total balances within consumption-led products up by 5.1% YoY.

According to Lee Naik, the chief executive of TransUnion Africa, the growth in new credit products and the use of existing credit is typically driven by economic requirements as consumers take on credit to boost their income during challenging economic times.

“However, there is hope on the horizon, as inflation decreased during the quarter, with annual food price inflation at its lowest since late 2020. Consumers are likely to see further respite in the coming months. Along with the reduction in interest rates, this combination will likely provide relief to stretched household budgets.”

Rise in lower-amount personal loans contributes to growth

Personal loan originations increased by 16.7% YoY during the second quarter, accounting for 77% of all new credit originations. Over the same period, the average new loan amount declined by 14.2%, suggesting that lenders were willing to offer modest amounts as they balanced portfolio health and rising demand from consumers.

A deeper exploration of originations over the past 12 months shows that the vast majority of new personal loans were granted for amounts less than R5 000, comprising 75% of new loans granted during the second quarter – an increase from 73% of loans during the same quarter of 2023.

During the second quarter, 3.2 million consumers opened new personal loans for R5 000 or less, compared to 1.9 million consumers during the same quarter in 2023.

Lenders are examining risk profiles more closely.

During the second quarter of last year, 77% of consumers who opened personal loans under R5 000 held a below prime risk profile, and this proportion decreased to 74% during the same quarter in 2024.

In the second quarter of 2023, 90% of loans of R5 000 or less were granted by non-bank lenders, compared to 86% during the second quarter of 2024. Over this time, 10% of these loans were granted by bank lenders in the second quarter of 2023, compared to 14% in 2024.

According to TransUnion. these trends indicate that seekers of lower-amount loans are driving growth in account volumes for bank and non-bank personal loan lenders.

Throughout this period, account-level delinquency rates improved by 240 basis points YoY to 32.6%, demonstrating that lenders’ more cautious risk management has helped to reduce delinquency.

Gen Z drives credit card growth

Credit card originations increased by 9.3% YoY, with Gen Z credit cardholders having grown by 22.7% YoY. Millennials and Gen X consumers contributed 72% of credit card originations during the second quarter, with below prime growth at 12% YoY, compared to prime and above growth at 10% YoY.

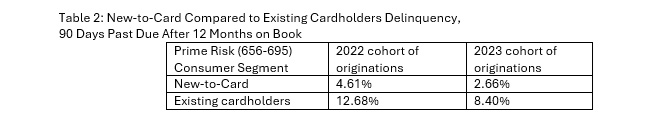

The findings of a recent study of TransUnion’s South African credit card population showed that although credit card growth was primarily driven by existing cardholders during the first quarter of 2023 (referring to consumers who have one or more cards and are opening additional cards), the number of first-time credit cardholders is rising rapidly. In the most recent quarter, 38% of originations were issued to first-time cardholders – the highest proportion since the first quarter of 2020.

The study further showed that consumers holding their first credit card are well disciplined in managing their credit card payments, with those who opened their first credit card in recent vintages showing healthy performance trends, particularly compared to those opening additional credit cards.

“Opportunity exists to enable greater access to financial inclusion by getting the first credit card into a consumer’s wallet,” said Naik. “Our research shows that first-time cardholders are disciplined in managing their payments, as they focus on building their credit profile while accessing the opportunities made possible by having access to credit cards.”

Mortgage originations continue to rise

Mortgage growth continued the momentum, particularly in the more affordable housing sector. Despite the sustained high interest rate in the second quarter of 2024, mortgage originations continued to grow – by 16.2% YoY, and the average new loan amount increased by 1.7% to R940 675.

During the first half of 2023, 32% of mortgages were granted to subprime and near-prime consumers, and this ratio increased to 36% of mortgages being granted to below-prime risk tiers during the first half of 2024. Mortgages granted to super-prime borrowers declined from 41% in the first half of 2023 to 37% during the first half of 2024.

“The growth in mortgages in the affordable housing bracket and the increase in mortgages granted to below-prime borrowers seem to highlight banks’ intent to support South Africans in their quest to own property,” Naik said. “We also note that while there’s been growth in originations, the rate of growth has also increased substantially, which may in turn indicate increased homeowner confidence, supported by banks’ confidence in the country’s property market and in their risk strategies to accommodate more lenders.”

Naik added that South Africans are managing their credit portfolios, despite the challenging economic environment during the second quarter of the year.

“Lenders would serve their customers well by offering comprehensive financial literacy programmes throughout the customer journey, and not just at origination. Collaborating with allied partners who can help consumers understand more about how risk is measured and how risk scoring is used in decision making around credit would further support consumers in managing their finances more efficiently.”