The South African exchange-traded product (ETP) sector is likely to experience another good year in 2024 following the 28% surge in the industry’s market capitalisation to R165.4 billion in 2023, says Mike Brown, the managing director of etfSA.

He said the increase of R36.1bn in the industry’s market cap from the end of 2022 was a record for the index-tracking ETPs listed on the JSE and was the biggest realised since the first exchange-traded fund (ETF) was listed in South Africa in 2000.

Brown said the increase was a result of the strong recovery in global equity indices in the second half of 2023. “The MSCI World Index (in rands), for instance, increased by 30.8% over 2023, so the market value of many of the ETFs listed on the local exchange benefited significantly from the market gains.”

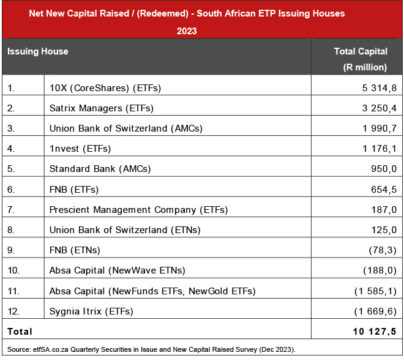

The second reason was the raising of capital by new listings. “Such listings actively raised R10.2bn during the course of the year, a fact which is not always realised by critics of the JSE, who point to the consistent delistings by corporate issuers on the market,” he said.

Brown said three trends assisted the industry’s growth in 2023:

- Actively managed ETPs became readily available to investors. By the end of the year, 44 (2022: 22) actively managed certificates (AMCs) and six (2022: 0) actively managed ETFs (AMETFs) were listed on the JSE.

- The demand for foreign-referenced ETFs and exchange-traded notes (ETNs) increased significantly as global equity markets recovered in the second half of last year, and the depreciation of the rand promoted hedging strategies.

- Higher interest rates, particularly in long-dated global and local bonds boosted the use of ETFs offering portfolios tracking the major bond indices.

“These trends are likely to continue in 2024,” he said.

The total number of ETPs increased from 183 at the end of 2022 to 211 by the end of December 2023, with AMCs responsible for most of the growth. The number of ETFs fell from 95 to 92, while the number of ETNs rose from 66 to 69.

Brown said “a strong line-up” of AMC products appears to be in pipeline.

The table below shows the total net new capital raised (or redeemed) by the ETP issuing houses in 2023.

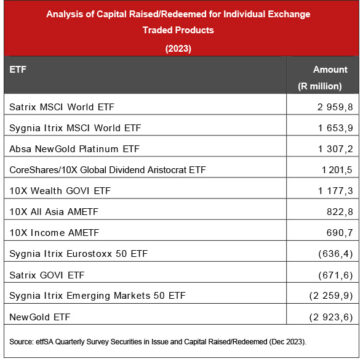

Capital raised for individual products

The MSCI World ETFs issued by Satrix and Sygnia Itrix attracted the most new capital last year.

The improvement in global equity markets, coupled with the weaker rand, encouraged investor interest in global indices and the broadly based MSCI World Index, which invests in developed country stock markets (67.3% in the United States), rather than exposure to individual countries, Brown said.

In early 2023, there was a significant increase in the issue of new securities by 1nvest and NewGold in platinum ETFs, which track the physical price of platinum bullion. Reports that the demand for platinum could surge, because of its use in fuel cells to convert hydrogen to drive internal combustion engines, proved to be premature and the price of platinum metal has subsequently waned, he said.

The NewGold Platinum ETF fared better than the 1nvest Platinum ETF, which recorded redemptions of more than R2.3bn in the fourth quarter of 2023. For the year, the NewGold Platinum ETF was able to attract new capital of R1.307bn.

Brown said two new listings by 10X, the actively managed All Asia AMETF (R822.8 million) and the Income AMETF (R690.7m), “were clear indications that such innovative products are finding investor support”.

The stand-outs regarding the delisting of existing ETF securities were the NewGold ETF, which tracks the gold bullion price, and the Sygnia Itrix Emerging Markets 50 ETF.

The Emerging Markets 50 delisting appears to be an asset allocation swap by institutional investors from emerging markets exposure to exposure in the Sygnia Itrix MSCI World ETF, Brown said.