Investors in retirement annuity (RA) funds should withdraw money from their savings component only if they are facing genuine financial hardship, because they will pay the price for these withdrawals in retirement, says Coronation Fund Managers.

Historically, RA investors been unable to dip into their savings before retirement. Currently, unless particular circumstances apply, the earliest they can access their RA is when they turn 55. They have the option to withdraw one-third of the investment in cash, and the remaining two-thirds must be used to purchase an annuity income. If they do not want to make a lump-sum withdrawal, they can purchase an annuity with the full amount.

When the two-pot retirement system comes into effect on 1 September, an RA investor’s account will be split into three components:

- A vested component, representing the value of their RA fund, less the seed capital, when the new system is implemented.

- A retirement component.

- A savings component.

The most significant change under the new system is that RA investors will be allowed to make one pre-retirement withdrawal each tax year from their savings component. RA investors can withdraw the entire balance available in the savings component, but they don’t have to exercise this option.

The savings component will initially be seeded by R30 000 or 10% of their fund value on 31 August, whichever is lower, which will be transferred from the vested component. One-third of their contributions from 1 September will be allocated to the savings component.

Two-third of their contributions from 1 September will be allocated to the retirement component, which cannot be accessed until retirement.

Higher tax rates

Pieter Koekemoer, the head of personal investments at Coronation, says it is essential that RA investors understand the implications of pre-retirement withdrawals from the savings component.

“Early access is costly and can seriously reduce your standard of living in retirement. You are effectively borrowing money from your future self over a fixed term, and you will essentially lose the tax benefits you received from the government when you contributed towards your RA.” Koekemoer says.

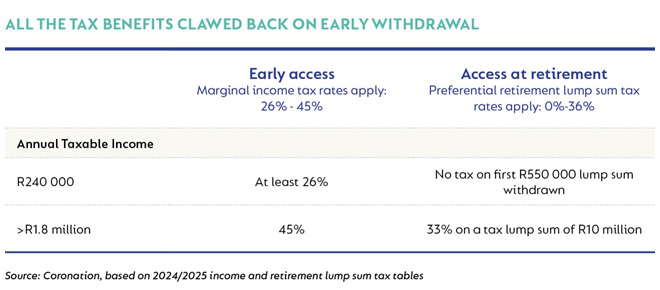

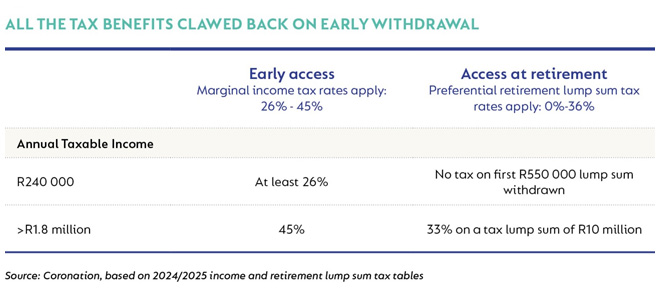

“If you wait until retirement – any time after 55 for RA investors – before withdrawing your money, the preferential retirement lump-sum tax tables will apply. However, if you withdraw early, the more punitive marginal tax rates will be deducted from your withdrawal. This can significantly impact your retirement.”

Koekemoer says someone whose annual taxable income is R240 000 will have their savings component withdrawal taxed at a rate of at least 26%, or more than a quarter of the money they access. This contrasts with the zero tax on the first R550 000 lump sum withdrawn at retirement age.

He says the principle also holds at the higher end of the income scale. If a lump sum of R10 million is withdrawn at retirement, the effective tax rate will be 33%, compared to the pre-retirement withdrawal rate of 45%, assuming the RA investor earns more than R1.8m in that tax year. This is a 12-percentage point difference in tax payable.

Impact on retirement benefits

RA investors who make pre-retirement withdrawals are effectively borrowing from their future self over a fixed term at their expected rate of return on their RA investment, Koekemoer says.

To illustrate his point, Koekemoer provides an example of someone who is 35 years old and intends to retire at age 65. Any R1 accessed before retirement may cost this person R30 in lost retirement benefits at the time of retirement. In other words, by resisting the urge to access their savings early, the investor’s money could have multiplied by a factor of 30 over the three decades until retirement.

“While the numbers become less dramatic when you shorten the period between early access and retirement, they remain retirement-defining,” Koekemoer says.

“Even for an individual making an early withdrawal 10 years before their intended retirement date, it would still cost them R3 in lost retirement benefits for every R1 taken out early.”

A single decade of missed compounding means you have effectively halved the purchasing power of the money taken out as part of your pre-retirement withdrawal, Koekemoer says.

“The bottom line is that to avoid a significantly reduced standard of living in retirement, you must resist the temptation to make regular early withdrawals to fund discretionary spending today. By not accessing your retirement savings early, you allow the powerful effect of compound growth to work to your full advantage.”

Disclaimer: The information in this article does not constitute investment, financial planning, or tax advice that is appropriate for every individual’s needs and circumstances.