The contentious nature of the phrase “bona fide inadvertent error” received some attention in the 2025 Budget Review. The courts have recently interpreted the phrase somewhat differently to what the South African Revenue Service (SARS) has in mind.

The bona fide inadvertent error provision was inserted into the Tax Administration Act (TAA) to provide taxpayers with an exclusion from an understatement penalty (USP) when they make an error without the deliberate intention to defraud the fiscus.

National Treasury states in the Budget Review: “The concept and scope of a ‘bona fide inadvertent error’ has proven to be contentious. This concept is not explicitly used in similar understatement penalty frameworks, because these do not mix purely factual tests such as ‘substantial understatement’ with taxpayer behaviours in a single provision. To clarify the scope of ‘bona fide inadvertent error’, it is proposed that ‘bona fide inadvertent error’ be explicitly linked with ‘substantial understatement’.”

Nico Theron, a dispute specialist and founder of Unicus Tax Specialists, says the intention behind the proposed change is unclear. However, he suspects the argument by taxpayers that they cannot be penalised for a bona fide inadvertent error will fall away, and it will become a question of the facts.

“My understanding is that they [SARS] are concerned about the way the legislative framework is interpreted – that taxpayers can escape the USP entirely by saying that they have relied on advice, and the error was not intentional.” The courts seem to be leaning more towards this argument. If this is the case, it may render the USP system redundant because taxpayers can simply claim they did not intend to deceive, Theron says.

“The taxpayer then falls outside the system without being tested on the reasonability of the action that he has taken.” Theron believes this is the reason behind the proposed tweak.

Substantial understatement

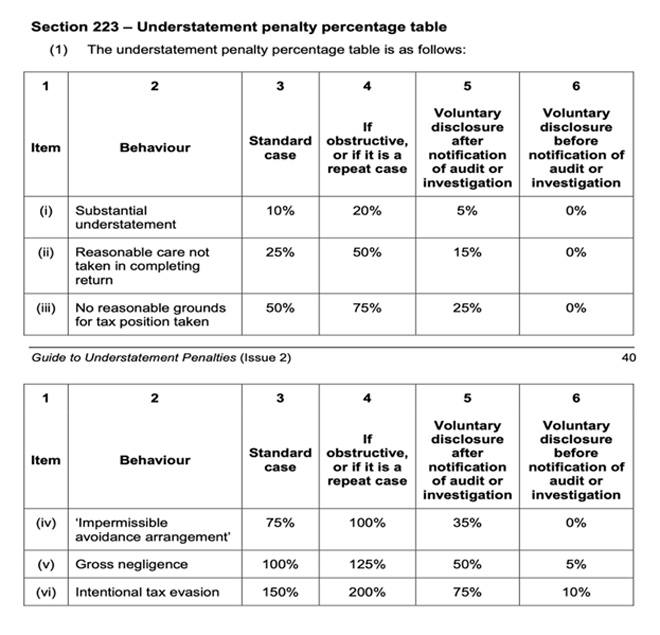

The only penalty that can be remitted in terms of the TAA falls under the category of “substantial understatement”. The others technically cannot be remitted because the Act does not provide SARS with the discretion to remit.

Heinrich Louw, a tax director at Cliffe Dekker Hofmeyr, writes in the law firm’s special Budget edition that a substantial understatement is factually determined with reference to the amount involved.

If the prejudice to SARS exceeds 5% of the amount of tax that should have been charged, or it exceeds R1 million, it will constitute a substantial understatement. The applicability of the other categories is determined with reference to the behaviour of the taxpayer.

There are two exclusions to escape a penalty. If the taxpayer has obtained advice and an opinion from a registered tax practitioner and it is a bona fide inadvertent error.

“SARS has generally taken a very narrow view on what constitutes a bona fide inadvertent error,” Louw adds.

Recent court decisions

This lack of consensus on interpretation recently played out in the well-publicised Thistle Trust and Coronation cases. In the case of the Thistle Trust v Commissioner for SARS, the taxpayer relied on a tax opinion in respect of a particular tax position.

SARS disagreed with the position and assessed the taxpayer and raised an understatement penalty based on “reasonable care not taken in completing return” and “no reasonable grounds for tax position taken”.

The court agreed with SARS that the tax position was incorrect. In respect of the understatement penalty, the taxpayer argued that because it relied on a tax opinion (which appears to have been incorrect), the understatement resulted from a bona fide inadvertent error, and no understatement penalty should be imposed.

In an appeal to the Supreme Court Appeal (SCA), the court assumed that SARS had conceded this point. On appeal to the Constitutional Court, the issue of whether there was a bona fide inadvertent error was not decided, but the court did mention that because the taxpayer relied on a tax opinion, SARS would fail to discharge the burden of proving that the taxpayer did not take reasonable care or that it had no reasonable grounds for the tax position taken.

Read: ‘Instructive remarks’ from the Constitutional Court on understatement penalties

Louw further explains that the facts were somewhat similar in the Coronation Investment Management SA (Pty) Limited v Commissioner for SARS case.

The taxpayer also relied on an opinion in respect of the tax position it took. The SCA held that the tax position was wrong, but it also held that the taxpayer’s bona fides could not be questioned: the relevant tax returns were submitted in the bona fide belief that the tax position taken was correct. The Constitutional Court agreed with the taxpayer (on the opinion it obtained), and the issue of the penalties fell away.

Read: Important lessons from the Constitutional Court in the Coronation case

Theron says the problem is that the Coronation case relied on the decision in the Thistle case, but that case relied on what the court believed was a concession from SARS on USPs. “Technically, there is no higher court decision on what bona fide inadvertent error really means,” says Theron.

The proposed amendment gives effect to what SARS’s view has always been about how the phrase should be interpreted. In a way it makes it “cleaner”, and it makes it more likely for SARS’s argument to stick. However, it is not ideal for taxpayers, he adds.

Amanda Visser is a freelance journalist who specialises in tax and has written about trade law, competition law, and regulatory issues.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article is a general guide and should not be used as a substitute for professional tax advice.