President Cyril Ramaphosa’s plan to transform South Africa into a construction site through increased infrastructure investment has been widely welcomed. However, with the government being debt-heavy and cash-strapped, the big question is how these ambitious projects will be funded.

In his address at the opening of Parliament last week, Ramaphosa announced a massive infrastructure investment over the next five years.

“From our largest metros to our deepest rural areas, we intend to turn our country into a construction site, with new roads, bridges, houses, schools, hospitals, and clinics, as well as broadband fibre and power lines,” he said.

The Statement of Intent signed by members of the government of national unity GNU focuses on aligning state policy with industrial policy. This means that the country’s overall economic policy will be based on and guided by industrial policy.

Outlining the Department of Trade, Industry and Competition’s approach to industrial policy, Deputy Minister Zuko Godlimpi noted in his remarks on the DTIC budget vote that when it came to industrial financing, “we operate on the understanding that a positive relationship between national savings and gross capital formation is crucial for long-term growth”.

Notably, he said: “This assumes that the country’s savings portfolio will be available for public and private investors to finance growth in the capital stock.”

Godlimpi said that financing the country’s industrial policy objectives requires shared responsibility between public and private sector financing institutions.

“The DTIC Industrial Financing Group will continue to deploy more capital to support higher investment but will need other social partners to play an active role in providing critical resources for meaningful economic growth to be achieved,” he added.

Zooming in on retirement funds

The country’s savings portfolio typically includes retirement funds, bank savings accounts, investment accounts, government savings bonds, insurance products (endowment policies), and collective investment schemes.

The largest component in terms of monetary investment is retirement savings. The retirement funds sector holds a significant portion of the country’s savings, with assets under management totalling more than R4 trillion.

Following the two-day Cabinet lekgotla that preceded the opening of Parliament, BusinessLive reported that the government was considering changes to legislation, potentially allowing pension funds and other asset managers to support South Africa’s industrial policy initiatives.

DTIC Minister Parks Tau told BusinessLive that a proposal to amend Regulation 28 of the Pension Funds Act to support industrialisation was presented at the lekgotla.

One of the discussions proposed to the Cabinet includes introducing new asset classes into Regulation 28 to explore the potential of leveraging retirement savings for industrial financing. However, Tau said any potential changes would need to undergo a thorough review and be accompanied by effective implementation mechanisms.

Regulation 28 is a key regulation under the Act. It sets out the investment limits and guidelines for retirement funds, including retirement annuities and other related funds, to ensure that they are managed prudently and in the best interests of their members.

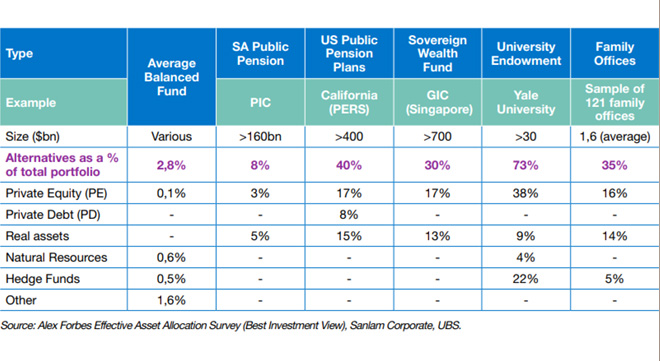

Regulation 28 includes a framework for pension funds to allocate up to 45% of their assets to infrastructure, and further separates private equity and other assets from hedge funds in the limits to promote investment into infrastructure since these investments are often housed in alternative asset classes such as private equity and private debt. However, as detailed in the latest Sanlam Benchmark Survey, despite the provisions of Regulation 28, the actual allocation of retirement funds to alternative asset class remains low, with many funds still heavily weighted towards traditional assets.

Is this a red flag?

For those familiar with the African National Congress’s 2019 and 2024 election manifestos, the DTIC’s “contemplated changes” to Regulation 28 understandably raise alarm bells. In its manifestos, the party proposes investigating the introduction of prescribed assets, which would mandate institutional investors such as retirement funds to invest a portion of their funds in infrastructure development to boost economic growth.

Although there has been no direct indication that the proposed amendment is moving towards introducing “prescribed assets”, it does appear to be edging closer in that direction.

While in favour of public-private partnerships (PPPs) in addressing South Africa’s infrastructure deficit, Aleeshia Naicker, senior investment consultant at Simeka Consultants & Actuaries, and Solly Tsie, head: investment strategy Sanlam Corporate Investments, believe introducing prescribed assets is not the way to go.

In the Sanlam Benchmark Survey, Naicker and Tsie say this approach carries significant risks, including the potential misallocation of resources and negative impact on investment returns for retirement funds.

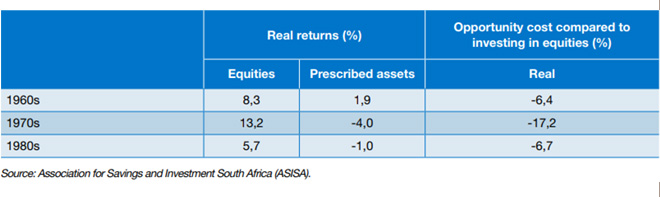

“Historically, prescribed assets were used between 1958 and 1989 in South Africa but were eventually abolished due to their inefficiency and the burden they placed on investment performance, as shown in the table below.

“During this period, prescribed assets underperformed equities by 6.4% per annum, 17.2% per annum, and 6.7% per annum during the 1960s, 1970s, and 1980s respectively, representing the opportunity cost experienced by institutional investors during those periods.”

In its results statement released last month, Sygnia’s directors also voiced skepticism about the potential introduction of prescribed assets and stricter offshore investment limits for retirement funds.

Sygnia is the second-largest provider of exchange-traded funds in South Africa and the largest provider of international ETFs on the JSE.

“In reality, retirement funds already own 25% of government debt, and it is difficult to see how a higher prescription would solve long-term solvency issues. Similarly, applying more stringent offshore investment limits would deprive savers of the benefits of diversification and force them to invest in an ever-shrinking JSE, where the top 10 stocks already represent 45% of its market capitalisation. Many of these companies do not have significant operations in South Africa and contribute little to the economy (for example, Naspers and Prosus are proxies for one Chinese technology company),” the directors said.

Public-private partnerships in addressing infrastructure deficit

So how can South Africa address its infrastructure deficit sustainably?

According to Naicker and Tsie, PPPs present a viable solution. To support their argument, the duo highlighted research done by the South African Institute for Civil Engineers (SAICE) into the deteriorating state of the country’s infrastructure.

SAICE’s recommendations included increasing infrastructure maintenance, enhancing institutional capacity through PPPs, and raising additional funding in innovative ways.

“PPPs have a proven track record in South Africa, with successes in projects like the Lesotho Highlands Water Project, Gautrain Rapid Rail Link, and the Renewable Energy Independent Power Producer Procurement Programme (REIPPP), among others.”

Naicker and Tsie say the government’s role in the PPPs can include:

- Direct investment into infrastructure projects, including crowding in private sector investment.

- Creating an enabling environment for private sector investment into infrastructure, including reforming regulations and policies.

- Contributing to building expertise and capacity to effectively manage infrastructure projects from concept to operation.

“The private sector can play a complementary role, including providing capital, bringing expertise and innovation, and attracting investments from institutional investors such as pension funds.”

The role of retirement funds and the private sector

At Alexforbes’s annual Hot Topics event in Cape Town earlier this month, Nimisha Bhawan, the head of Investment Advisory, discussed a growing global and local trend: focusing local and retirement savings on infrastructure investments.

“It’s very topical with all of our retirement clients right now. They are very aware of the limited opportunity in the [JSE] listed space. They are also aware of the long-term nature of these infrastructure investments, their ability to generate inflation-matching or inflation-beating returns.”

Bhawan said retirement funds were getting together to try to leverage these opportunities, however, she cautioned that it is an extremely complex space. For example, Bhawan said it took an asset manager in the unlisted space three days to do due diligence for a specific strategy versus two to three hours in the traditional space.

“It’s not as simple as going and looking at where the stock price is trading, doing your little Excel model of what the fair value should be. You need to conduct in-depth research into the quality of the management team, their track record, and most importantly, their pipeline because you’re going to be locked into this fund for 10 to 12 years. And that lock-in in the end means lack of liquidity.”

She says the latter has proved to be a contentious topic and a barrier to entry.

“And of course, fees. You can’t talk about the unlisted space without mentioning that the fees are higher than then in the traditional space. So, lots of plusses, but lots of dragons to navigate around.”

Bhawan pointed out that with the government’s high debt levels, the current administration is constrained in terms of how much it can increase expenditure to try to improve economic activity and create jobs. She said considering the country’s high employment rate (32.9% in the first quarter of 2024), the private sector would have to come in and deploy capital to help create a favourable economic environment.

“What I worry about is that, post this five-year period, if the government and the private sector do not rally together, grow this economy and create jobs, we run the risk of creating a ripe environment for populistic political parties to gain popularity, as we saw in France. Because a lot of people would be rejecting the status quo, they’d be saying that the status quo has not worked for me, I’m still unemployed.”

She says this also speaks to impactful investing.

“That’s the other thing that should be a key consideration for investors, investing in projects that have economic and socio-economic development objectives as well, such as quality education and affordable housing.”