As the provisional tax deadline approaches, it is crucial for business owners, investors, and self-employed individuals to understand their tax obligations. Provisional tax mandates that taxpayers with non-salary income make advance tax payments throughout the year, thereby avoiding a lump-sum tax bill at the end of the financial year.

Provisional tax is not a separate tax but a mechanism that allows taxpayers to pay their tax liability in advance. This system helps both taxpayers and the South African Revenue Service by improving cash-flow management and reducing the risk of underpayment.

Who is a provisional taxpayer?

Any person who receives income (or to whom income accrues) other than remuneration is a provisional taxpayer, provided that certain requirements are met.

Most salary-earners are therefore not provisional taxpayers if they have no other sources of taxable income. It is important to note that receiving exempt income, as follows, does not make you a provisional taxpayer. If you receive interest of less than R23 800 and you are under 65; or if you receive interest of less than R34 500 and you are 65 or older; or you receive an exempt amount from a tax-free savings account.

A provisional taxpayer is defined as:

- A natural person who derives income other than remuneration, allowances, or advances. This also includes individuals who receive remuneration from an employer not registered for employees’ tax (for example, an embassy is not obliged to register as an employer for employees’ tax purposes).

- A company.

- Certain trusts.

- A person who has been notified by the Commissioner of SARS that they are a provisional taxpayer.

Common examples of provisional taxpayers are:

- Freelancers, consultants, and business owners.

- Investors earning rental income, interest, or dividends above the exemption threshold.

- Companies and certain trusts.

Who is not a provisional taxpayer?

A person is not a provisional taxpayer if they do not conduct any business and their taxable income:

- does not exceed the tax threshold for the tax year; or

- will be R30 000, or less for the tax year from interest, dividends, foreign dividends, rental from the letting of fixed properties, and remuneration from an unregistered employer.

The following are also not provisional taxpayers:

- Deceased estates.

- Approved public benefit organisations.

- Approved recreational clubs.

- Body corporates and share-block companies.

- Small-business funding entities.

- Associations approved by the Commissioner under section 30B(2) of the Income Tax Act.

Key deadlines and payment structure

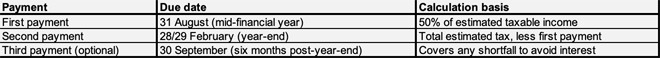

Provisional tax is payable in two mandatory instalments, with an optional third payment to avoid interest charges. The deadlines are as follows:

Missing these deadlines can result in penalties. SARS imposes a 10% late-payment penalty, along with interest, on outstanding amounts, which can be a costly mistake for businesses and individuals alike.

Provisional tax is based on an estimate of taxable income for the financial year. Taxpayers must calculate their estimated tax liability and make payments accordingly.

Here’s how to do this:

- Estimate your total taxable income for the year, including salary, business profits, rental income, investment returns, and any other applicable income.

- Deduct the allowable expenses and tax exemptions.

- Apply the relevant tax rate to calculate the total tax due.

- Subtract any PAYE already deducted (if applicable) to determine the provisional tax payable.

SARS can request a recalculated estimate if it believes the declared income is too low or inaccurate. Taxpayers should ensure their estimates are justifiable to avoid penalties.

A significant challenge for taxpayers is underestimating their taxable income, leading to inadequate provisional tax payments. SARS may impose additional penalties if the second provisional tax payment is less than 80% of the final assessed tax liability (for income over R1 million) or 90% of actual taxable income or the basic amount [the lower of these amounts apply] for income under R1m. In cases where a taxpayer underestimates their income, SARS enforces a 20% penalty on the resulting shortfall.

To avoid these penalties, it always best to proactively plan by having an 18-month tax forecast prepared to ensure sufficient cash flow for meeting tax liabilities. Taxpayers can make a top-up payment in September to correct any shortfalls and avoid unnecessary penalties.

Taxpayers should ensure that their payments reach SARS by the due date to avoid penalties:

- Late payments attract a 10% penalty.

- SARS charges interest (currently 11.5% a year) on unpaid amounts. (The current interest rate on outstanding taxes can be found on SARS’s website.)

- Payments via SARS eFiling should be arranged in advance to avoid delays.

Provisional tax is an essential part of tax compliance for business owners and investors in South Africa. Understanding the deadlines, calculation methods, and potential penalties can help taxpayers manage their obligations as cost-effectively as possible.

Proper planning and regular reviews of estimated income throughout the year can save taxpayers from unexpected tax liabilities. Working with a tax professional ensures compliance and optimal tax efficiency.

Danielle Luwes is tax director at Hobbs Sinclair Advisory.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article is a general guide and should not be used as a substitute for professional tax advice. Always consult a tax professional for specific advice related to your circumstances.