In a year marked by severe weather events and macro-economic strain, PSG Insure has emerged as the fastest-growing division of PSG Financial Services, according to the group’s latest annual results.

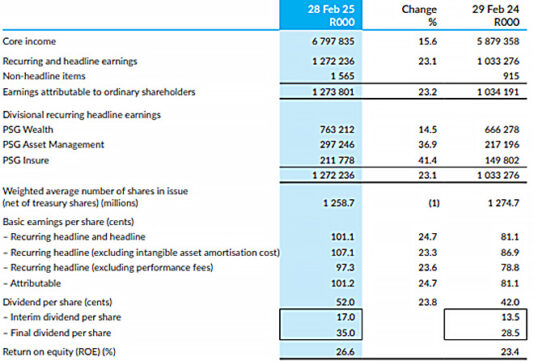

For the year to the end of February 2025, PSG Insure increased its recurring headline earnings by an impressive 41%, rising from R149.8 million to R211.8m.

Recurring headline earnings are a key indicator of core operational performance, excluding one-off items such as asset sales or restructuring costs. They offer a clearer picture of a company’s ongoing profitability.

Although PSG Insure remains the smallest contributor by absolute earnings, its standout growth rate outpaced the group’s other two core divisions: PSG Wealth and PSG Asset Management.

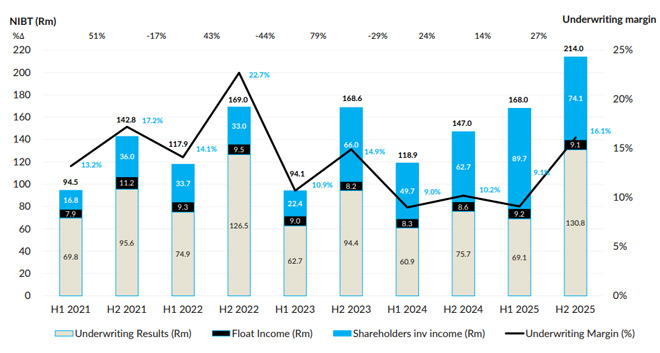

PSG Insure’s performance came on the back of a 9.2% increase in gross written premiums, totalling R7.6 billion, and a significant improvement in its net underwriting margin, which rose to 12.7% from 9.7% a year earlier.

“The comprehensive reinsurance programme we have in place reduced the adverse impact of catastrophe events during the year, including the Western Cape storms and large fire claims,” PSG noted, adding that it would continue to focus its efforts on growing its commercial lines business.

Western National Insurance Company serves as the primary underwriting entity for PSG Insure’s short-term insurance operations. It is a licensed non-life insurer operating under the umbrella of PSG Financial Services, formerly known as PSG Konsult. In 2012, PSG Konsult acquired a 60% stake in Western National Insurance, with the remaining 40% held by Santam, South Africa’s largest short-term insurer.

PSG Insure functions as the distribution and advisory arm, offering insurance solutions to clients. Western National, as the underwriting entity, provides the insurance products that PSG Insure distributes.

There were 336 insurance advisers in the group at year-end (a net decrease of nine advisers during the year because of the consolidation of some of its smaller adviser offices).

The collaboration between PSG Insure and Western National has enabled the development of “innovative insurance solutions”, particularly in the commercial lines segment.

Giving insight into its strategy, PSG stated the division continues to invest in its claims and administration functions to build scale and unlock operational efficiencies.

“To maintain and improve our underwriting results at Western, we are continuously building capacity in the underwriting and actuarial functions, as well as completing our investment in geo-coding.”

Western National’s net insurance result and shareholders income are shown below:

PSG Wealth leads group earnings

Although PSG Insure delivered the highest growth in recurring headline earnings, PSG Wealth remained the largest contributor to the group’s bottom line. The division increased its recurring headline earnings by 15%, from R666.3m in February 2024 to R763.2m in February 2025.

PSG Wealth, which offers a range of investment solutions for individuals, families, and businesses, also saw client assets under management grow to R410bn, driven by R20.6bn in net inflows.

The group attributes PSG Wealth’s success to its “hybrid model combining in-person and digital engagement, a broad product offering, and strong adviser-client relationships in a competitive wealth management landscape”.

Its adviser force expanded to 635 advisers, up from 608 the previous year.

“We advocate diversification, and our solutions offer a balance between rand hedge and interest-rate-sensitive investments with a long-term focus,” PSG noted.

PSG Asset Management AUM climbs to R60.7bn

PSG Asset Management delivered the second-highest growth among the group’s core business units, with recurring headline earnings rising by 37% – from R217.2m in the previous year to R297.2m for the period to the end of February 2025.

The division benefited from increased performance and management fees. Its assets under management (AUM) rose by 17.2% to R60.7bn, supported by R4.5bn in client inflows and R4.4bn in market appreciation. It also administered R264.3bn in assets, buoyed by R13bn in multi-managed net inflows.

PSG said the division “continues to focus on delivering long-term, risk-adjusted returns”, while growing its presence among retail investors.

“We prioritise investment performance while managing operational processes and talent management,” the group stated. “Increasing brand awareness, particularly in the retail investor market, and regular client communication through events and publications remain key focus areas for the division.”

Key financial performance reflects resilience

At group level, PSG Financial Services reported a 24.7% rise in recurring headline earnings per share and delivered a return on equity of 26.6% for the year.

Although operating conditions remained difficult, more favourable equity markets supported the group’s performance. “Our key financial metrics under these conditions highlight the competitive advantage of our advice-led business model,” said chief executive Francois Gouws (pictured).

Total AUM increased by 15.7% to R470.7bn. This includes R410bn managed by PSG Wealth and R60.7bn under PSG Asset Management.

Performance fees contributed 3.7% to headline earnings, up from 2.8% the previous year.

PSG’s key financial performance indicators for the year are shown below:

Gouws said the group remains focused on future growth: “The firm remains confident about its long-term growth prospects, and we therefore continue to invest in both technology and people. Compared to the prior year, our technology and infrastructure spend increased by 18.6% (these costs continue to be fully expensed), while our fixed remuneration cost grew by 6.1%.”

PSG’s capital position remains strong, with a capital cover ratio of 257% as of 29 February 2024 – well above the 100% minimum regulatory requirement.

In August 2024, Global Credit Rating Company reaffirmed PSG’s long- and short-term credit ratings at A+(ZA) and A1(ZA), with a positive outlook.

Strong cash flows continued to support capital optimisation efforts. During the year, PSG repurchased and cancelled 19.1 million shares at a cost of R330.3m.

The group noted that its shareholder investable asset exposure to equity remained at 9%, adding: “We continue to monitor investment markets and will gradually increase our value at risk exposure to align with our long-term target.”

Reflecting its solid financial standing, PSG declared a final gross dividend of 35 cents per share, bringing the total dividend for the year to 52 cents per share – up from 42 cents in 2024. The group’s dividend pay-out ratio remains between 40% and 60% of full-year recurring headline earnings, excluding intangible asset amortisation.

Looking ahead, Gouws acknowledged the ongoing macro-economic challenges facing the country: “PSG is a proudly South African firm that believes in harnessing the power of South Africans’ knowledge base to drive economic progress, and in their ability to ignite its untapped potential. Nevertheless, continued low levels of economic growth, South Africa’s debt and fiscal position and heightened geopolitical tensions remain seemingly intractable problems.”

However, he added that South Africa’s economic and societal challenges will not be resolved quickly.

“Therefore, we will continue to monitor local and global events, and the associated impact on the group’s clients and other stakeholders and will adjust our approach if required. Irrespective of the short-term challenges, we remain confident in our long-term strategy and will continue to invest in our businesses, thereby securing prospects for growth.”

Read the full annual results here