Commentators have drawn attention to PSG Konsult increasing its total assets under management (AUM) by 13% to R354 billion in its 2023 financial year, whereas many wealth and asset managers were hit by outflows as investors fled to safety.

Total assets under administration rose 3% to R481bn, according to the JSE-listed financial services and insurance group’s results for the year to the end of February.

“It’s no secret that the whole industry has been going through a difficult time. The overall inflows, as reported in the Asisa [Association for Savings and Investment South Africa] stats, were considerably lower than the previous corresponding year. At PSG, I think we have been a little bit of an outlier,” News24 quoted PSG Konsult’s chief executive, Francois Gouws, as saying.

He attributed this to good performance by the group’s funds, with many in the top quartile in terms of investment returns. PSG Asset Management was named South Africa’s top asset manager of 2022 at the Raging Bull Awards.

Client assets managed by the group’s biggest business division, PSG Wealth, grew by 12% to R305.5bn, which included R13.3bn in positive net inflows.

The asset management division recorded a 16% increase in AUM to R48.6bn because of a combination of market movements and net client inflows. Assets administered by PSG Asset Management also increased, by 14% to R197.6bn, supported by R7.7bn of multi-managed net inflows.

The total value of managed assets is the main driver of earnings for any asset manager that charges a fee of a fraction of a percent of whatever is on the books, while containing costs, Moneyweb pointed out.

It said Gouws agreed that AUM is key to revenues and profitability. “Good” markets help, but investment performance and customer service are the things that really count to grow assets by attracting new clients, he said.

The group has grown AUM by 17% a year over the past 25 years since its inception in 1998.

PSG Konsult said the growth in AUM should be seen in the context of the FTSE/JSE All Share Index rising only 2% during the reporting period, down from 15% the previous financial year. It said this affected performance fees, which constituted 6.5% of headline earnings compared with 10.6% in the previous financial year.

“The problem with performance fees is that they’re not as predictable as your recurring income fees,” Gouws told BusinessLive. “The assets have grown, which tells you the [PSG Asset Management] franchise is strong … inflows were good … but obviously the market hasn’t done as well as it did the previous year.”

Room for organic growth

Although PSG Konsult is small compared to asset managers that have been around for 50 or 100 years, AUM has increased nearly fivefold over the past 10 years, from R71bn, and it nearly doubled over the past five years, Moneyweb reported.

Gouws credited PSG Konsult’s performance to the group’s advice-led business model and maintaining good personal relationships with its clients.

The JSE-listed financial services firm still has a low market share in all the areas in which it operates. Gouws estimated that PSG Wealth has less than a 5% market share, while PSG Asset Management’s and PSG Insure’s market shares are about 2% to 2.5%.

He told Moneyweb that this presented “ample opportunity” for growth, adding that the group aimed for consistent and sustainable organic growth to maintain capital resources.

Flood costs hit insurance division

PSG Insure’s gross written premium increased by 9% to R6.2bn. This amount includes gross written premiums on policies administered by the unit’s advisers that are placed with third-party insurers, bringing in commission income and administration fees.

The insurance division took a R10-million hit from the KwaZulu-Natal floods in April 2022, but the group said Western National’s reinsurance programme cushioned the effect on the underwriting results. PSG Insure delivered an underwriting margin of 13.5%.

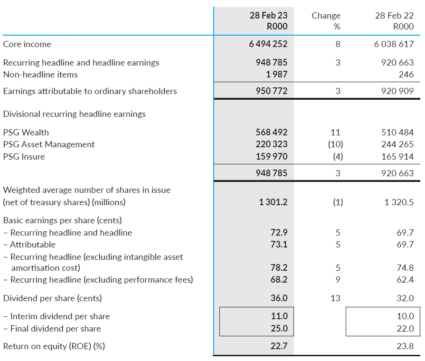

PSG Konsult’s key financial performance indicators

Maintaining the dividend

PSG Konsult said its capital cover ratio remains strong and increased to 263% from 240% in the previous financial year, comfortably exceeding the minimum regulatory requirement of 100%. Most life insurers in South Africa typically have capital cover ratios of 160% to 180%.

“We continue to generate strong cash flows, which gives us various options to optimise our capital structure and risk-adjusted returns to the benefit of shareholders. This is reflected by the repurchase and cancellation of 35.7 million shares at a cost of R415.9m during the period,” Gouws said.

The board also decided to increase the upper limit of the group’s dividend policy pay-out ratio from 50% to 60% of recurring headline earnings, excluding intangible asset amortisation. However, it has yet to reach that; PSG Konsult paid out 46% of its earnings.

PSG Konsult said cash and cash equivalents, including money market investments, jumped 18% to more than R2bn, which will allow it to continue buying back shares while maintaining a high dividend pay-out ratio.

“We’re sitting with such strong capital ratios that we need to optimise that capital,” Gouws told BusinessLive. “Our first priority is to maintain our dividend. To the extent that we have excess cash, most certainly, we will continue to buy back stock. We think generally it’s better to do buybacks than special dividends – that’s not really a consideration for us at this present moment.”

The group declared a final dividend of 25c a share, taking the full-year dividend to 36c, 13% higher than the previous financial year’s distribution. This was despite earnings attributable to ordinary shareholders rising only 3% to R950.77m, while recurring headline earnings per share rose 5% to 72.9c.