Jaco van Tonder, the head of Advisor Services in South Africa at Ninety One, summarises the key insights from the talk by Michael Kitces at the asset manager’s 2023 Investment Forum. Kitces is a US financial adviser and renowned author of numerous books on the financial advice industry. His talk focused on one of the most common challenges facing growing financial advice firms: how to deal with the inherent trade-offs (and difficult decisions) involved in growing your advice firm while keeping it the type of firm where you actually want to work.

Many advisers who are in their 50s or older today started their careers providing financial advice in exchange for selling insurance products and receiving upfront commission payments. The average adviser business 20 years ago was a simple one: a single adviser with one or two assistants, a very high work rate, and a revenue line that reset to zero every year.

Scalability in these businesses was limited, and, more importantly, revenue growth plateaued once the practice surpassed 500 to 700 client files. Advisers in these businesses quickly found out that the major factor limiting their growth was time. There are only so many hours in the week, month, and year in which to find new people with whom to do business.

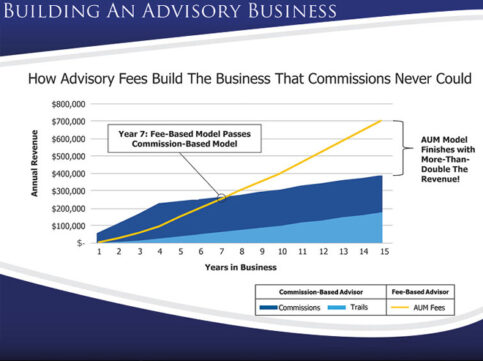

And so, at some point in the past 20 years, most advisers migrated out of the commission business model and into the ongoing-fees-on-AUM business model. It took a few years, but advisers found that smaller annual advice fees from a client quickly compounded to dwarf the large upfront commissions on insurance products.

Kitces relayed research that showed that it takes the average US adviser between five and ten years of building their AUM-fee book before the revenue from that book exceeds the revenue from commissions. And after that they never look back.

He summarised it with the following graphic:

However, unlike with the commissions model, growing an advice firm by adding more clients is not always the best strategy.

And so, we arrive at the crux of Kitces’ talk: the pitfalls facing advisers who wish to grow their annual advice fee practice.

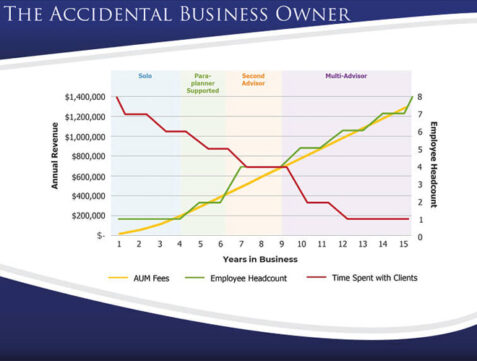

Once again, Kitces summarised the progression of an annual advice fee practice with an instructive graphic.

Figure 2 illustrates that growing your assets and advice fees over time by continually adding more clients to your book leads to an inevitable growth in the number of staff in your practice.

Although the smart use of technology can help a practice to curb the growth in its operational staff headcount, it has proved tricky to sustain strong revenue and client growth without adding paraplanners and additional advisers. Advisers typically found that, after a period of strong client and asset growth, there almost inevitably follows a period of capacity creation that leads to an increase in the staff complement of the firm.

Dunbar’s number

The main cause for the correlation between a growing client base and adviser/paraplanner headcount, is Dunbar’s number. According to Wikipedia, Dunbar’s number is “a suggested cognitive limit to the number of people with whom one can maintain stable social relationships – relationships in which an individual knows who each person is and how each person relates to every other person”.

Basically, it represents the number of people with whom a single human being can have a meaningful relationship. And according to Dunbar, the limit is about 150. This suggests that once an adviser practice reaches 150 core clients, it becomes significantly more difficult to grow the client base without adding a relationship manager – either a paraplanner or another adviser.

Higher revenue does not necessarily equal higher profits

And so, we arrive at the key question facing most successful smaller advice firms at some point in their life cycle. Is the only way to grow profitability to grow your client numbers (and by implication, grow staff headcount), to turn your successful lifestyle or boutique advice firm into a corporate institution? And what if your vision for your practice is not to build a large corporate advice firm?

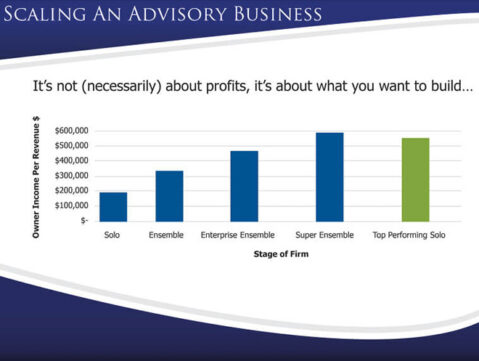

At this stage, after discovering the limit of Dunbar’s number, most readers are probably suspicious of this statement. If growing your client load inevitably leads to an increased adviser headcount, clearly the more important metric to watch is not total firm revenue, or total firm profit. What matters is profit per owner. In this regard, Kitces shared some instructive data from the US investment adviser market regarding owner profitability and firm size/life stage.

Figure 3 shows that, on average, as firms progress from solo-adviser firms through the boutique stage all the way to large corporate (which Kitces calls a super ensemble), there is an increase in the profits per owner. There is no doubt that benefits of scale do kick in for larger-headcount adviser firms, improving profitability.

But what is surprising is if one looks at the profitability of the top-performing solo-adviser practices (as opposed to the average single-adviser firms). Top-class solo-adviser practices in the US make as much profit for their owner as would the average large advisory corporates.

Maximising your profits in a smaller firm

So, what differentiates an “average” solo-adviser from a “top-performing” (and higher-earning) solo adviser?

Kitces shared several real-life adviser examples from his home market. At the risk of oversimplifying a complex situation (success in business is rarely due to one factor only), Kitces did have one observation that seems to be a common thread among all smaller successful firms. They are all super specific about the client load they take on, because they know that additional client load leads to additional staff for the practice, which changes the nature of the business. They aim for the client load that will give them the business they want (whether that is a 50-client lifestyle business or a 250-client boutique firm), and they proactively manage that number – resisting the urge from their commission-earning days of growing clients at all costs.

Conclusion

Growing your advisory firm is a top priority for all financial adviser firms. But how do you grow your business without turning it into an operation where you as the owner and CEO spend more time managing staff than you spend working with clients?

From the US experience, it turns out that you can grow a hugely profitably small advisory business, without losing the essence of the firm, if you proactively limit your client numbers and constantly improve your client quality. Rather than focusing on adding more clients, focus on improving the quality of your clients. Don’t take on new below-average clients – carefully cull some existing below-average clients and replace them with high quality-opportunities. Do this consistently for a few years, and you might be surprised at the result.

This article was first published by Ninety One and is republished with permission. It has been edited slightly.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies.