It’s not surprising that South African investors are concerned about the Communist Party of China’s clampdown on vast swathes of the economy. Thanks to Naspers’s and Prosus’s investments in Tencent, about one-fifth of the JSE’s market capitalisation is in Chinese tech, and it is estimated that an additional one-third of the local market’s capitalisation has exposure to China through commodities sales

How can we understand what appears to be an abrupt about-turn from the growth-orientated, reforming and globalising China – and what are the implications for investors?

In a research report published at the beginning of this month, Michael Every, Rabobank’s head of financial markets: Asia-Pacific, says many Western analysts are attempting to explain away the slew of government interventions as “technocratic policy adjustments” or “periodic regulatory compliance measures”, and miss that China is “unashamedly a deeply political economy with an openly proclaimed Marxist-Leninist-Maoist-Xi Jinping guiding ideology”.

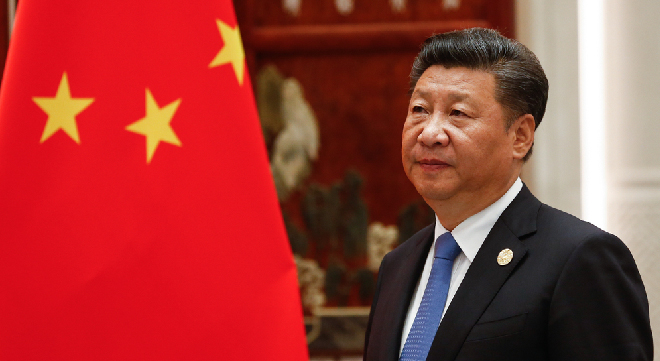

In the report, titled “Pro-Fund or Profound Revolution?”, Every writes that one cannot correctly analyse developments in a Marxist-Leninist-Maoist economy unless one knows what Marx, Lenin and Mao argued. To that end, Every provides a brief overview of Marx’s philosophy and Lenin’s and Mao’s economic theory and practice. He then moves on to contemporary developments under President Xi Jinping, whose “Thought on Socialism with Chinese Characteristics for a New Era”, or more commonly “Xi Jinping Thought” (XJT), “is now the official curriculum at schools and universities across China – meaning that an understanding of its core messages and targets is of the utmost importance to markets”.

According to Every, XJT holds that it was Marxism-Leninism and “Mao Zedong thought”, not Deng Xiaoping or the post-2000 economic reformers, that enabled China to compete with the capitalist nations and lift millions of people out of poverty.

Every makes four key arguments:

- While many in the West approach China as having a de facto neo-liberal capitalist system, this view is not only overly simplistic but arguably wrong. Although many of the things China says may sound “Western” or easily recognisable – for example, “green”, “sustainable”, “people-centred” – this does not mean that the underlying political economy is Western.

- While the West considers the economic thinkers of the past to be exactly that, China is not just paying lip-service to Marxism, but it is taking cues from the roots of Marxist thought traditions, while adding modern-day interpretations in order to choose its own path. With the Western capitalist system in trouble, China’s leadership feels emboldened to push ahead in this regard.

- Whereas in the West change is gradual or non-existent, and usually part of a democratic model in which consensus is required, in China far more dramatic changes can happen suddenly if needed for the perceived greater good. Such changes are happening, and are currently speeding up, not slowing down.

- While we can perhaps see the ideal destination to Common Prosperity, the journey itself is likely to be extremely bumpy, and involve many more major zero-sum trade-offs. However, the political imperative appears to be there to continue to move down this path.

Every says the implications of the current policy direction for the Chinese economy and for investors in China include:

- Additional downward pressure on Chinese growth by reducing business confidence and scaring off foreign investors, while also failing to square the circle between the needs for a trade surplus, higher household spending and sustained high investment. “Alternatively, it may lead to sustained high growth of a more balanced kind – for example, more social housing and less private housing; more high-tech/green manufacturing jobs and fewer gig economy/services jobs. Western exporters to China focused on the higher-income/luxury sectors may be unhappy in either case.”

- Chinese equities may continue to struggle to keep up with those of the US, particularly in sectors on which the government focuses its sights. Risks to the housing sector also loom large if comments about too-high prices are followed up on.

Read the full report for Every’s take on all the economic, investment and geopolitical implications of XJT.