South Africa’s collective investment schemes market recorded a record net outflow of R35.25 billion in 2024, according to data released this week by the Association for Savings and Investment South Africa (ASISA). This came despite a rebound in business, consumer, and investment sentiment in the second half of the year, as economic growth remained sluggish.

The local CIS industry is a significant part of the economy, with assets under management amounting to nearly half of South Africa’s gross domestic product (GDP). According to the South African Reserve Bank (SARB), the country’s GDP (annualised and at market prices) was valued at R7.35 trillion at the end of the third quarter of 2024.

Sunette Mulder (pictured), senior policy adviser at ASISA, noted that while 2024 was a positive year for South African investment markets, investor confidence remained weak.

“Local investors did not seem convinced and were consequently reluctant to commit their money to CIS portfolios,” she said.

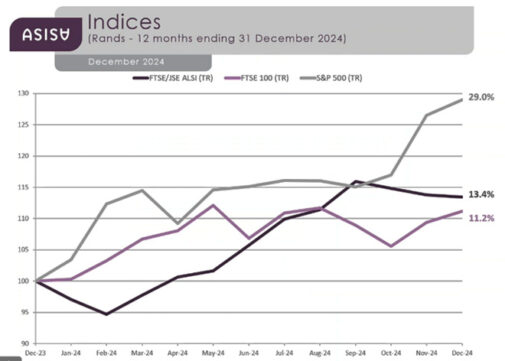

Despite this caution, the industry’s assets under management have grown substantially over the past four years. ASISA data shows a 42% increase, or R1.14 trillion, from R2.73 trillion at the end of December 2020 to R3.87 trillion by the end of 2024. The 10.8% rise from R3.49 trillion in 2023 was largely driven by strong stock market performance, with the JSE All Share Index delivering a 13.4% return over the 12 months to 31 December 2024.

South Africa equity general portfolios bore the brunt of the net outflows, with investors pulling out R11.95 billion. However, Mulder pointed out that investors reinvested R121.07bn in income declarations (dividends and interest), resulting in total net inflows of R85.82bn for the year.

Interest-bearing portfolios were the biggest beneficiaries, attracting R42.31bn across South African interest-bearing short term, variable term, and money market categories.

By the end of 2024, South African investors had a choice of 1 878 local CIS portfolios, reflecting the broad range of investment options available in the market.

“Which I think does speak to the choices that investors have to make, and how important it is for investors to get the correct advice when they do invest, to choose the right portfolios for the investment purposes,” said Mulder.

CIS by numbers

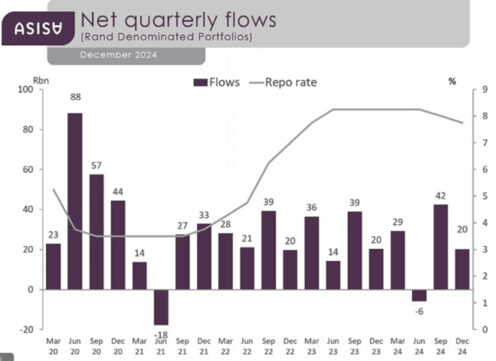

Mulder noted that over the past five years, asset movements have fluctuated, with quarterly flows rising and falling. On average, net flows have been about R29bn a quarter. However, the past year has been particularly challenging for consumers.

“We do see there are flows, but the bulk of those flows were reinvestments,” she says.

Mulder explains that if reinvestments are excluded, it becomes clear that local investors are not saving enough.

“There’s clearly a view from consumers that they are experiencing tough times, and it’s not coming through in our investment flows.”

Despite this, she sees a positive takeaway for the CIS industry.

“That shows the current investors are gaining positive value from investing in CIS products, and they are sticking the course, and they are reinvesting in the market.”

Over the past few years, there has been a back-and-forth shift between South African multi-asset and interest-bearing funds.

“We saw a comeback on the multi-asset funds in December 2022 and 2023, but over the last year, it pulled back again to our interest-bearing funds,” said Mulder.

She noted that the performance of these funds raises the question of whether investors are chasing returns.

“But it’s important to understand that a diversified portfolio is important for investors to reach their aims.”

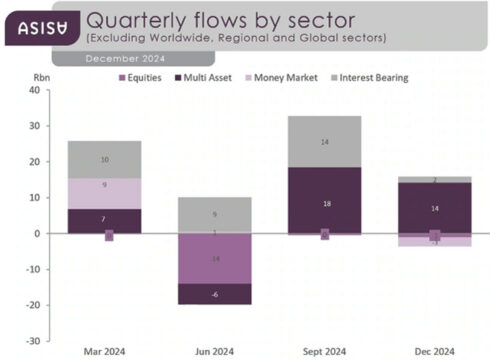

Looking at quarterly flows over the past year, South African multi-asset funds performed strongly in the third and fourth quarters, while South African interest-bearing funds saw the most inflows in the second and third quarters.

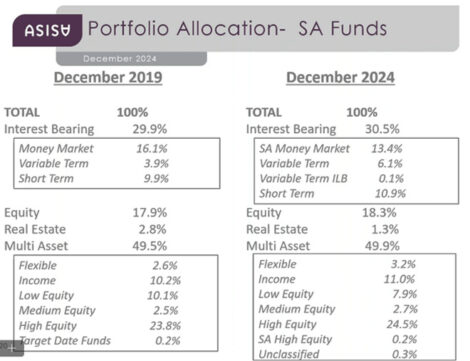

At the end of the year, South Africa’s CIS asset allocation showed a stable structure.

Mulder reported that interest-bearing funds accounted for about 31% of assets, while equity funds increased slightly to 18.3%, driven mainly by market performance.

She noted that real estate funds continued to decline, whereas multi-asset funds remained steady between December 2019 and 2024.

The categories that received the largest inflows during the year were South African interest-bearing short-term funds, which attracted R25.4bn, followed by global equity general funds, with R17.6bn.

South African multi-asset income funds saw inflows of R14.8bn, while SA multi-asset high-equity funds received R13.9bn. The SA interest-bearing variable-term category also performed well, bringing in R10.4bn.

“So, you’ll see very much that focus on our interest-bearing, and even on the multi-asset front, the income funds, the big winners of 2024,” Mulder said.

Investors withdrew the most money from SA equity general funds, which saw outflows of R11.9bn. SA multi-asset low-equity funds recorded R6.2bn in outflows, while SA equity large cap funds lost R4.2bn. SA real estate general funds saw R2bn in withdrawals, and global multi-asset low-equity funds experienced outflows of R1.8bn.

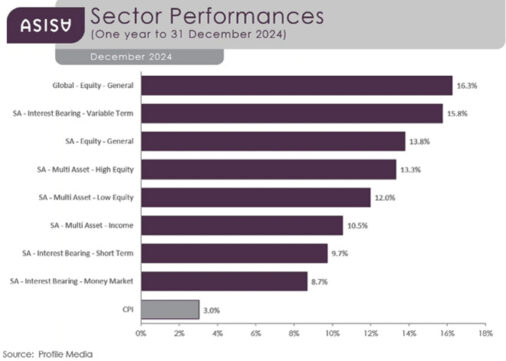

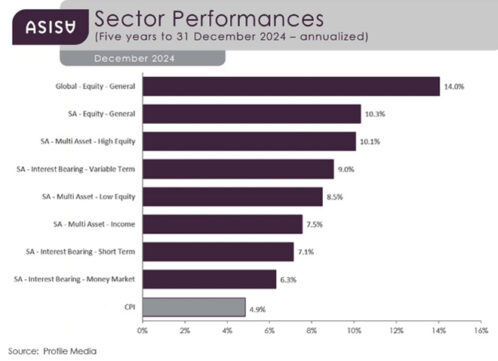

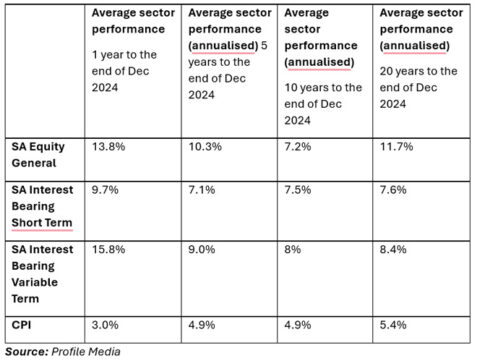

To put these flows into perspective, the average performance of the major categories over the past year shows global equity general funds performing very strongly at 16.3%. Mulder said, interestingly, the variable-term funds came through as the second-strongest category. Despite the outflows from SA equity general funds, the South African equity market still performed well.

“So, the investors who decided to move away from that, depending on where they moved their money, might have missed out on some of the growth that was in the equity market,” Mulder said.

She added that the important thing for investors is to compare the returns to CPI – 3%.

Over five years, global equity remained strong, with a 14% return. Following that, South African categories performed well, with SA equity general delivering a strong 10.3% – this compared to CPI at 4.9%.

“On average, these categories are delivering for current investors,” Mulder noted.

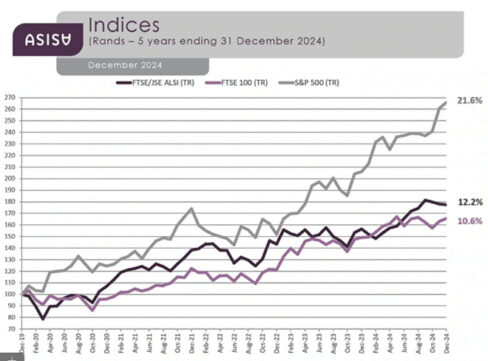

Looking at a 10-year basis, global equity stood at 12.2%, while all the South African categories, including interest-bearing and money market, were clustered within a narrow band. These categories still outperformed the CPI for investors over the decade.

Over 20 years, global equity general and SA equity general both performed strongly, with their returns closely aligned.

When comparing the total returns of the markets in South Africa, the United Kingdom, and the United States, there was a significant spike in the US market, which achieved an annual return of 29%. In contrast, the South African market delivered a total return of 13.4%, while the UK market posted a return of 11.2%.

Over five years, the US market outpaced the South African and UK markets on an annual basis.

On a global scale, there were 143 035 CIS portfolios with total assets under management of $75.0 trillion as of September 2024, according to the International Investment Funds Association (IIFA).

International investors allocate about 48% of CIS assets to equity portfolios, while South African investors prefer diversification, with SA multi-asset portfolios holding the largest share of local CIS assets (49.9%) at the end of 2024. SA interest-bearing portfolios accounted for 30.5%, while only 18.3% of assets were invested in SA equity portfolios.

“But I think the important and interesting bit for us to look at is how the international CIS market differs from our South African market, very much a focus offshore on the specific funds dealing with equities bonds, where our market has always been much more aimed at balanced funds giving investors diversification,” says Mulder.

Investor trends

Acknowledging that recent years had been difficult for the South African economy and consumers, Mulder cautions investors against projecting too much of the past into the future, particularly with the interest rate cycle changing downwards. The SARB reduced the prime lending rate by 0.25% in September 2024 and again in November 2024.

“Investors have been shunning growth assets for several years now, most likely because high interest rates put the returns delivered by fixed-interest portfolios almost on par with the average performance of general equity portfolios. However, equity portfolios tend to outperform other asset classes over the long term, and it is time in the market, rather than timing the markets, that delivers investment growth.”

Mulder believes that in a couple of years, 2024 may stand out as a turning point for South Africa and an important year for growth assets.

“While the global political environment is deeply concerning, we have seen green shoots appearing in the South African environment for the first time in 2024. A stable inflation rate and lower interest rates meant more disposable income for South Africans. In addition, the new two-pot retirement system provided many households with a cash injection. We have also enjoyed a stable electricity supply, a peaceful transition to a Government of National Unity, and a concerted effort to reverse South Africa’s greylisting.”

Offshore focus

Locally registered foreign portfolios held assets under management of R975bn at the end of December 2024, a 14.1% increase from the R855bn held at the end of December 2023.

These portfolios recorded net outflows of R5.46bn for the year.

There were 727 foreign currency-denominated portfolios on sale in South Africa at the end of 2024.