In a historic year for South Africa’s hedge fund industry, regulated hedge funds have achieved record-breaking asset growth and double-digit net inflows.

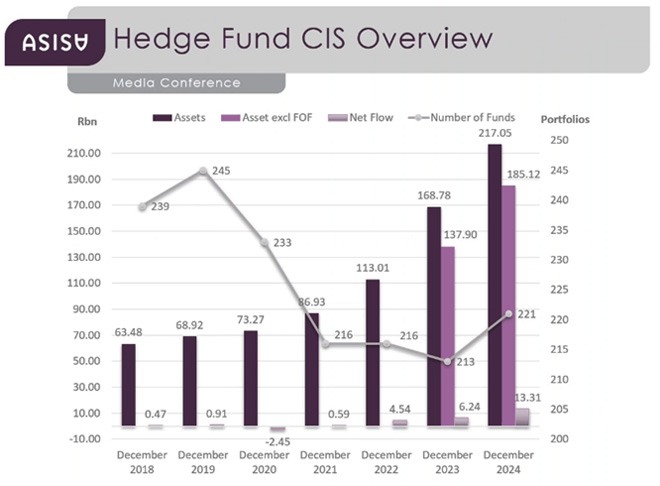

The latest annual hedge fund statistics from the Association for Savings and Investment South Africa (ASISA), released earlier this month, show that hedge funds attracted strong net inflows of R13.31 billion in the 12 months to 31 December 2024. This is more than double the R6.24bn recorded in 2023 and significantly exceeds the R4.54bn in 2022.

This milestone coincides with the 10th anniversary of South Africa becoming the first country to implement comprehensive hedge fund regulation.

Back in 2015, the South African Reserve Bank and the Financial Services Board, now the FSCA, introduced regulations under the Collective Investment Schemes Control Act (CISCA) that aimed to align hedge funds with other investment products. The regulations also increased operational and compliance costs, leading to consolidation within the industry.

At the same time, South Africa’s economy was in turmoil. Rising inflation, a weakening currency, and economic slowdowns created an unstable market environment. Although hedge funds typically thrive in volatility, the challenges of 2015 led to disappointing performance. Many funds struggled to meet investors’ expectations, and investor confidence waned, causing a decline in new hedge fund investments.

The combined pressure of economic instability and stricter regulations forced some smaller hedge funds to close or merge. By the end of 2016, the number of regulated hedge funds had dropped to about 80. In 2018, assets under management (AUM) stood at R64bn.

Reporting on the latest hedge fund statistics, Hayden Reinders, convenor of the ASISA Hedge Funds Standing Committee, said the industry has AUM of more than R217bn or R185bn, excluding double counting.

These assets were invested in 221 hedge funds managed by 12 management companies.

“And we look forward to seeing that number keep going,” said Reinders.

Retail vs Qualified Investor Hedge Funds

Hedge funds, like unit trust portfolios, fall under CISCA and are deemed regulated collective investment schemes.

South Africa’s hedge fund regulations classify funds into two categories: Retail Hedge Funds (RHFs) and Qualified Investor Hedge Funds (QIHFs).

RHFs are subject to stricter investment and risk limitations and are open to all investors who can afford the minimum lump-sum investment of R50 000. In contrast, QIHFs require a minimum investment of R1 million and cater to investors with a solid understanding of hedge fund strategies and risks.

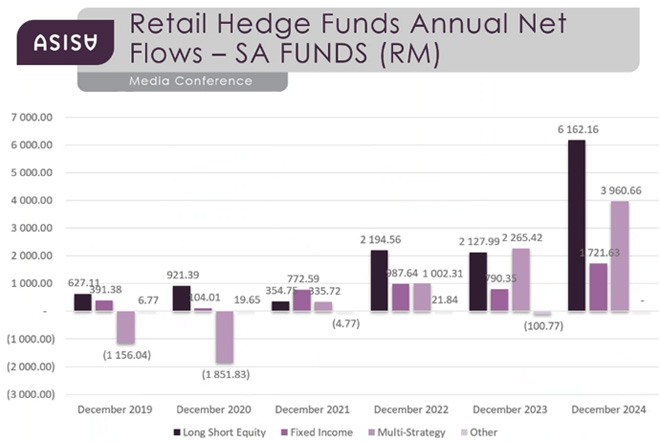

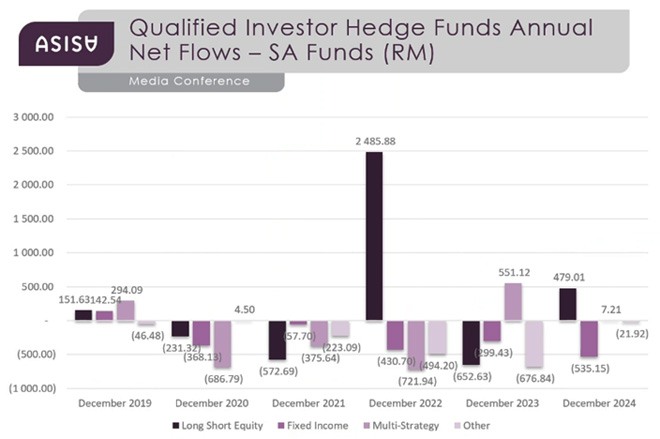

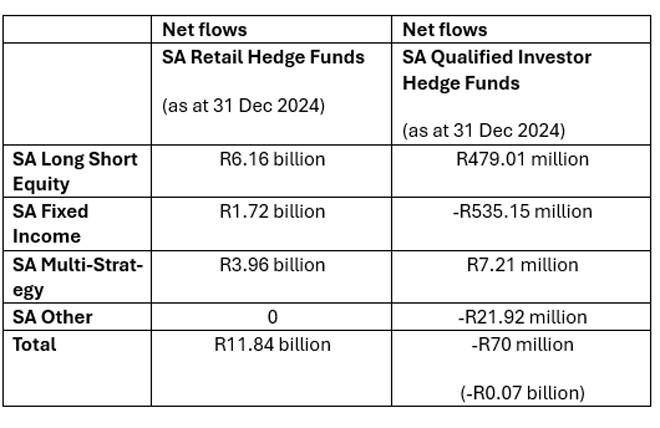

In 2024, RHFs attracted net inflows of R11.84bn. QIHFs, on the other hand, recorded net outflows of R70m.

According to Reinders, the RHF category was designed to be more accessible to individual investors, and its growth reflects this intent. In December 2020, AUM were split at 37% for RHFs and 63% for QIHFs. By December 2024, the balance had shifted to 42% for RHFs and 58% for QIHFs.

He noted that when the hedge fund regulations were introduced, most funds defaulted to the qualified investor category. However, over time, funds began consolidating, and some realised they could operate as retail funds. This shift has contributed to the steady growth of RHFs in recent years.

“Retail funds are slowly starting to win back traction,” said Reinders

He added that retail investors again contributed most of the net inflows in 2024.

“This is a strong vote of confidence from retail investors who recognise the important role of regulated hedge funds in mitigating market volatility within an investment portfolio.”

Investors go Long Short

Besides RHF and QIHF, hedge funds in South Africa are classified into four categories based on investment strategy: Long Short Equity, Multi-Strategy, Fixed Income, and Other.

Long Short Equity funds are portfolios that predominantly generate their returns by pairing long positions on equities with short selling to benefit from both rises and falls in market prices.

Multi-Strategy funds do not rely on a single asset class to generate investment opportunities but blend various strategies and asset classes, with no single asset class dominating over time.

Fixed Income portfolios invest in instruments and derivatives sensitive to movements in the interest rate market.

Other portfolios apply strategies that do not fit into the aforementioned classification groupings.

By December 2024, the distribution among RHFs was led by Long Short Equity at 50%, followed by Fixed Income at 27%, Multi-Strategy at 22.8%, and Other at 0.2%.

For QIHFs, the allocation differed, with Multi-Strategy making up 35.5%, Other at 32.5%, Long Short Equity at 29%, and Fixed Income at 3%.

Net inflows and outflows

Reinders said that based on net inflows, SA Long Short Equity funds were the most popular choice among both retail investors and qualified investors in 2024.

In RHFs, SA Long Short Equity funds attracted net inflows of R6.16bn. SA Multi-Strategy funds followed, drawing R3.96bn in retail inflows and R7.21m from qualified investors. SA Fixed Income funds recorded net inflows of R1.72bn, while flows into the SA Other category remained flat.

Data shows that in the QIHF space, SA Long Short Equity funds saw net inflows of R479.01m, while SA Multi-Strategy Hedge Funds gained R7.12m. However, SA Fixed Income funds experienced net outflows of R535.15m, and SA Other funds recorded outflows of R21.92m.

When compared side by side, it is clear which one is the winner.

Reinders noted that RHFs have consistently seen net inflows over the past three years, with particularly strong inflows in the past year.

Looking at trends over the past five years, Reinders pointed out a clear shift away from QIFHs.

He suggested that Long Short Equity funds, which initially found their footing in the QIHF space, have increasingly shifted towards RHF platforms. This, he said, explains the gradual decline in QIHF allocations.

Although Long Short Equity funds continue to dominate, they are “not as dominant as they were in the past”, because Fixed Income and Multi-Strategy funds have gained traction over the past two years.

The outlook for 2025

Reinders hopes the positive trend for retail hedge funds continues in 2025. He also noted that flows into QIHF will likely remain muted until National Treasury finalises its review of the tax treatment of collective investment schemes, including hedge funds.

Read: ASISA rejects proposed ‘dualistic nature’ of CIS portfolios

“The review will also provide much-needed tax clarity for our industry, hopefully enabling the Financial Sector Conduct Authority to dust off its review of Board Notice 90. In its current form, BN 90 prevents long-only unit trust portfolios from investing in hedge funds even though they are also regulated as collective investment schemes.”

He added that increased attention on hedge funds, their track record as collective investment schemes, and their stellar consistent performance will hopefully also encourage retirement funds to take up the full 10% asset allocation to hedge funds.

“Although the amendments to Regulation 28 of the Pension Funds Act, allowing local pension funds to invest 10% of assets into hedge funds, came into effect at the beginning of 2023, most retirement funds are nowhere near the 10% maximum, which means there is plenty of room for growth.”