After nearly 20 years, ASISA’s Fund Classification Standard has undergone its first major review, which took effect on 1 October. Designed to make comparing performance and risk across local collective investment schemes easier, these changes are already making waves.

South Africa’s most popular retail investments, unit trust funds, number 1 878 portfolios, collectively managing R3.87 trillion in assets in 2024. ASISA, which represents the savings, investment, and insurance industries, said the revisions make it easier for investors to compare the performances and risk profiles of South African collective investment schemes that invest in securities (shares, bonds, listed property, and other listed and unlisted investments).

The revision follows a 2022 increase in offshore investment limits for retirement funds (an increase in the offshore investment limit for retirement funds from 30% to 45%), which prompted ASISA to update the previous version of the Standard that had been in force since January 2013.

Read: ASISA says revised classification standard will make unit trust comparisons easier

But how has the market responded in the quarter since the update?

The CIS industry statistics for the year to the end of December 2024 were released by ASISA this week. Speaking at a media conference on 4 March, Sunette Mulder, senior policy adviser at ASISA, shared how these amendments played through in what was seen in the flows for quarter four.

The amendments include the introduction of the SA Equity SA General category within equity portfolios, which requires 100% investment in South Africa.

In the global category, the Global Equity Africa category was created, following the collapse of the Regional category into the Global category.

“We’ve made Regional categories within that global sphere, and we are, over time, potentially going to end up with a Global Equity Africa. There might be a Global Equity US, if there’s five or more funds, [and possibly] Emerging Markets Asia. We will see how that unfolds,” Mulder explained.

In the multi-asset sector, the SA High Equity category was introduced, also requiring 100% investment in South Africa.

Additionally, the interest-bearing sector saw the introduction of the Inflation in Advance category.

To address the collapse of the Regional category, ASISA created the Global Interest-bearing Unclassified category.

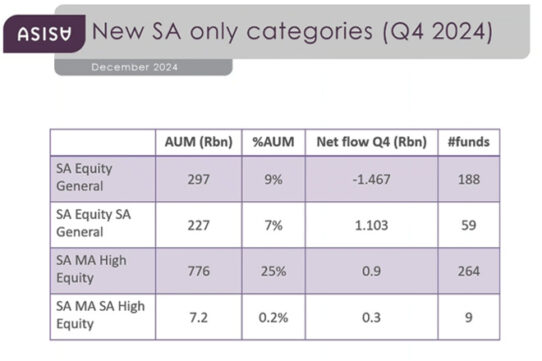

According to ASISA’s statistics for the new SA-only categories (Q4 2024) – the only statistics shared on the amended categories at the media conference – the split in assets under management between SA Equity General and SA Equity SA General is almost 50/50.

“We obviously have a lot of big South African equity-specific funds within this category that’ve moved out to their own category now. And one of the main drivers was that those Equity SA Equity General funds can go up to 45% offshore. And from a performance perspective, these funds can diverge quite a lot over time.”

Mulder said they think it’s a fairer reflection for these funds that are 100% invested in South Africa to have their own category.

“The uptake in the SA Multi Asset SA High Equity [category] is not as big yet as in the SA Equity categories, but we do foresee that it might pick up over time,” she said.