The Association for Savings and Investment South Africa (ASISA) has noted a rise in the number of risk and savings policies held by policyholders affiliated with the association’s life insurers.

According to the long-term insurance statistics released this week, in-force policies increased by 1.4% from 43.2 million in 2022 to 43.8 million at the end of 2023.

On the risk policy front, consumers purchased 9.97 million new individual recurring-premium risk policies in 2023. Of these, 5.59 million (56%) were funeral policies. This was 8.5% more than in 2022, when 9.19 million risk policies were sold, of which 4.39 million were funeral policies.

The statistics for savings policies indicate that 536 784 individual recurring-premium savings policies (including endowments and retirement annuities) were taken out, marking a 1.3% increase from the 529 930 policies bought in 2022.

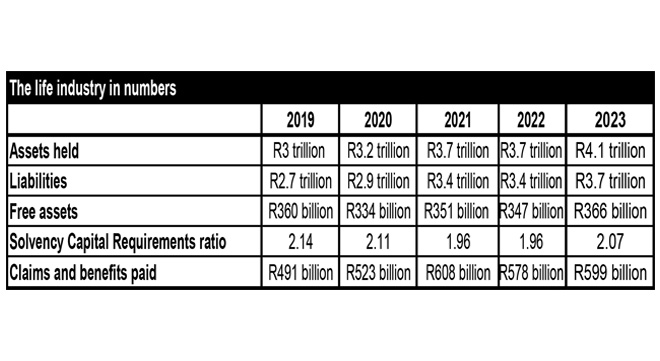

Policyholders and beneficiaries received R599 billion in 2023 following tragic events such as death and disability or significant life-stage changes such as retirement.

Payments to policyholders and beneficiaries included retirement annuity and endowment policy benefits, as well as claims against life, disability, critical illness, and income protection policies.

Lapsed and surrendered policies

The statistics also indicate a slight reduction in the number of policies that lapsed last year compared with 2022: 8.25 million versus 8.33 million.

Gareth Friedlander, a member of the ASISA Life and Risk Board Committee, says although even a slight reduction in the lapse rate is good news, policy lapses are concerning.

The 2022 ASISA Life and Disability Insurance Gap Study, conducted every three years, showed that the average income-earner had a combined life and disability cover shortfall of at least R2.4 million at the end of 2021. According to the study, South Africa’s 14.3 million income-earners had only enough life and disability insurance to cover 45% of the total insurance needs of their households.

“With every risk policy lapsed, South Africa’s sizeable insurance gap widens even further, leaving more families financially vulnerable should their breadwinner die or become disabled,” says Friedlander.

The number of surrenders also decreased last year. In 2022, 585 265 policyholders stopped paying their premiums and withdrew their fund value before maturity. This fell by almost 4% to 563 326 in 2023.

Friedlander comments that the increase in new savings policies and the decrease in surrenders was an unexpected positive development, considering the financial hardships that faced most consumers in 2023.

However, he adds that the high cost of living, driven by high interest rates and fuel prices combined with the stagnant economy, will likely drive some policyholders to give up their policies and cash in their savings.

He cautions that this should always be a last resort and encourages policyholders struggling to make ends meet to discuss their options with their financial advisers before letting go of their policies.

“A financial adviser can help you by taking a holistic view of your financial situation and helping you find sustainable solutions that are not driven by emotions.”

Vital statistics

At the end of December 2023, the life insurance industry managed assets of R4.08 trillion, while liabilities amounted to R3.72 trillion. This left the industry with excess assets of R366bn – more than double (2.07) the Prudential Authority’s Solvency Capital Requirement of R176.7bn.

Friedlander notes that the industry managed to shore up capital in 2023 to levels last seen in the years before the Covid-19 pandemic. He adds that the strong capital buffers ensure that life insurers can pay claims and policy benefits, even in times of extreme market turmoil and unusually high claims.

“South African life insurers have shown remarkable resilience in a period marked by unprecedented claims due to the Covid pandemic, with only a slight dip in solvency levels in 2021 and 2022,” he adds.

He also points out that this is the first time the long-term insurance industry has reported assets above R4 trillion.

The 10.2% growth in assets from R3.7 trillion at the end of 2022 to R4.1 trillion at the end of 2023 was largely because of market performance.

The FTSE/JSE All Share Index delivered a return of 9.3% over the 12 months to the end of December 2023.

‘Picture-perfect competitive industry’

Friedlander describes the long-term insurance operating environment as slow-growing, with individual life insurers achieving growth by dipping into the market share of competitors by offering better value and product innovation. He says this has created a highly competitive market, which is good news for consumers.

“We have the picture-perfect competitive industry with an enormous amount of innovation and a lot of digitisation.

“We have also seen an increasing number of industry participants with smaller players joining and banks coming in, which is representative of a competitive and innovative industry.”