US President Donald Trump’s tariff war took a turn for the worse after he announced massive tariffs against virtually every country in the world with immediate effect on 2 April.

Stock markets crashed, and on Tuesday last week the broader US stock market (S&P 500 index) traded 20% lower than on the day after Trump was inaugurated in January this year. The drawdown quantum was similar to the one that started in September 2018 when the tariff war between the US and China came into effect and lasted three months.

The valuation levels of capital markets reflect the capital-weighted scenarios of decision-makers collectively, and Trump’s toing and froing on tariffs forces a change in scenarios and perceived outcomes. Changes are immediately reflected in asset prices, and it’s no wonder investors are feeling punch-drunk. Nobody (except Trump and his inner circle) knows how the tariff story will play out. The question is whether we have seen the worst hand Trump could deal, and if so, what implications could it have on my investment strategy and therefore risk budget.

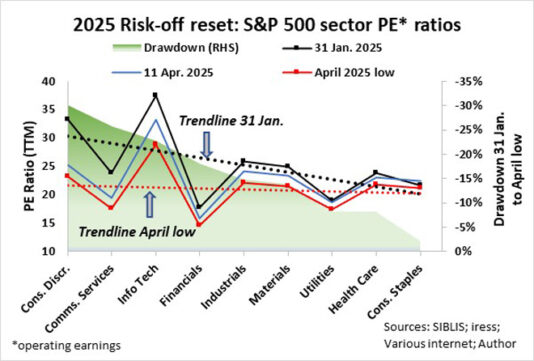

At the end of January this year, the slope of the S&P 500 sector PE trendline was heavily skewed towards the growth sector, but my calculations indicate that at last week’s worst market levels, the slope of the PE trendline flattened. A very unusual occurrence indeed! However, since Trump eased up on tariffs on Wednesday, the slope of the PE trendline has started to increase again in favour of the growth sectors.

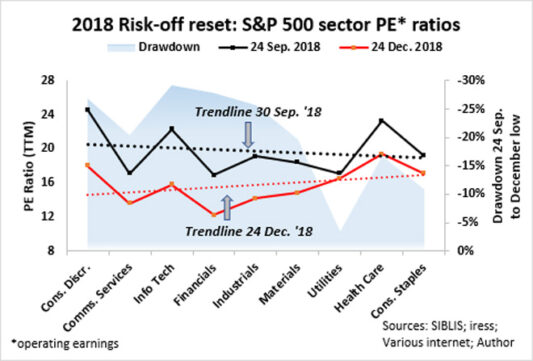

When the previous tariff war started in earnest in September 2018, the slope of the S&P 500 sector PE trendline was slightly skewed towards the growth sector, most probably because the growth sectors were less prominent. At the bottom of the markets on 24 December that year, the PE trendline’s slope was more skewed to the defensive sectors.

As things stand, it is evident that after suffering major drawdowns since January, the growth sectors of the US market are in value territory again, and their re-rating potential exceeds that of the defensive sectors.

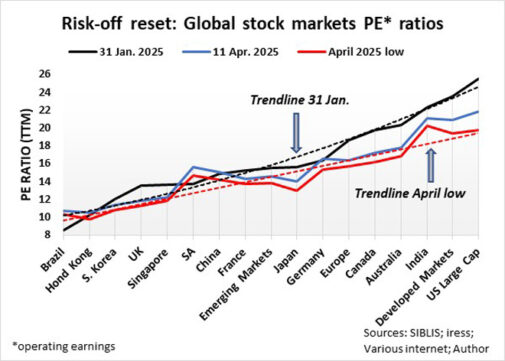

At the end of January this year, the slope of the PE trendline of global stock markets was heavily skewed towards stock markets in developed countries and warranted a polynomial fit of the trendline. At last week’s worst market levels, the slope of the PE trendline flattened considerably. Since Trump eased up on tariffs on Wednesday, the trendline rose, while the slope of the PE trendline has started to increase in favour of developed markets.

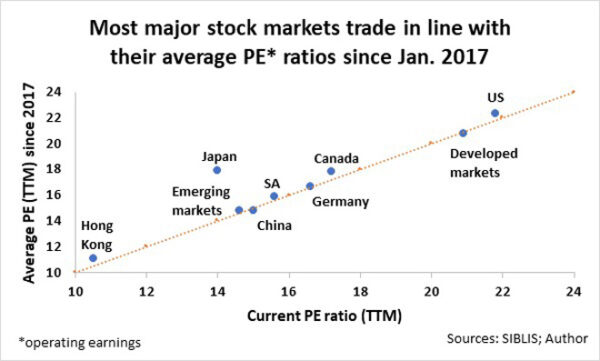

My analysis indicates that by the close on Friday, most major stock markets were priced in line with their average PE ratios since January 2017. In other words, global stock markets in general offer value but they are not overly cheap. The valuations of some stock markets, such as Brazil, South Korea, Singapore, Japan, Australia, and India, are still below their average since 2017, though.

I turned bullish on global stocks in general, but I am mindful of a possible retest of last week’s lows. As in the past, program trading – trading by computer – had a major impact on stock prices last week. The S&P 500 index was pushed down to test a major trendline and bounced back immediately afterwards. A break below 5 000 could see another leg down of about 5%, which would push the S&P 500’s PE to the average since 2017 minus one standard deviation – bargain territory.

I am overweight US small caps, the Magnificent Seven, and bank stocks, and underweight gold and consumer staples.

I am also bullish on other risk assets, such as emerging market currencies (the rand in particular) and high-yield emerging market bonds.

Catching a falling knife? No. Buying value? Yes, it is risk-on for me.

Ryk de Klerk is an independent investment analyst.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute investment or financial planning advice that is appropriate for every individual’s needs and circumstances.