Global equities, as measured by the MSCI All Country World Index in US dollars, have soared by more than 15% from lows in October last year. This raises the question whether a new bull market is in the offing, or whether it is/was just a rally in a major bear market.

The move should be seen in context.

A business cycle normally consists of four distinct stages:

- Recovery from contraction or slower growth;

- Acceleration of growth that leads to overheating;

- Slower growth; and

- Contraction or recession.

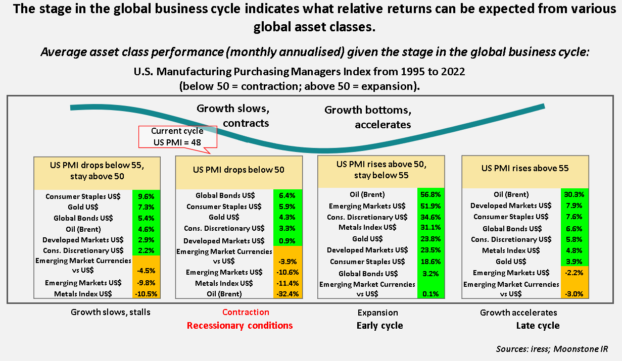

The stage in the business cycle indicates the relative returns that can be expected from various broad global assets, as performance differs significantly during each stage of the cycle. Each business cycle is unique, as a myriad of factors and events – including geopolitics, pandemics, acts of terrorism and financial crises – could change the shape of the broad economic cycle.

The United States is the world’s largest economy, so the USA Manufacturing Purchasing Managers Index is a good indication of the stage in which the US economy – and therefore the global economy – finds itself.

A reading below 50 (neutral) indicates contraction that could deepen into recession. Following contraction, a level above 50 but below 55 indicates an early cycle of expansion. A level above 55 indicates an acceleration in growth that could potentially lead to overheating – the late cycle in the broad business cycle. Following the late cycle, a drop below 55 but remaining above 50 indicates the stage when growth slows and stagnates.

A business cycle may be extended, however, as multiple stages may be the order of the day, as the stages of slower growth or stagnation do not have to be followed by contraction or recession, as growth may accelerate.

Comparing returns in each cycle over 27 years

My analysis of the average performance of broad asset classes (monthly annualised returns), given the stage in the global business cycle over the past 27 years (1995 to 2022), gives me a glimpse of the returns that can be expected in the current stage of the economic cycle. Furthermore, it provides an indication of the probable returns in the next stage of the cycle.

More importantly, it helps me to compare returns achieved hitherto in the current stage of the cycle to average returns achieved during a similar stage over the past 27 years.

The numbers don’t lie.

It is evident that since the current stage in the global business cycle started in November 2022, when the USA Manufacturing PMI fell below 50, investment markets have already priced in the next stage of the cycle where the PMI rises above 50.

It is evident the market is anticipating that the US Federal Reserve has nearly finished tightening monetary policy, as inflation is abating. According to recent surveys, the business mood is also improving on perceptions that the risks of a recession are fading.

Global equity markets are facing major headwinds, though.

Will the US avoid a recession?

At this stage, it is too early to say that the US will avert a recession. My advanced momentum indicator of US market valuations leads the momentum of the US Industrial Production Index by about two to three quarters. The valuation momentum metric turned negative in the second quarter of 2022 and indicates a mild contraction in industrial production in the coming months.

The improved business and investor mood, specifically in the US and the Eurozone will, no doubt, add fuel to the central banks’ fire to keep monetary policies tighter for longer in their resolve to keep fighting inflation. The Fed is not near to pivoting towards cheaper money.

Stocks are nowhere near the exuberant levels seen after recovering from the Covid-19 crash in 2020 but are still about 20% above the state of the underlying economy as measured by consumer sentiment. Consumer sentiment is likely to turn sour in the months ahead as lay-offs and, therefore, unemployment will increase with the Federal Reserve’s path of subdued growth and the softening of labour market conditions.

Stocks have to compete with US government bonds. The rout in global bond markets saw US yields on maturities soaring to about 4% on two-, five- and 10-year US government bonds. Finally, investments in US government bonds are relatively “risk-free”. In comparison, many of risk assets’ future returns are already priced in, and mediocre returns may await investors. There are exceptions, however. In contrast to the other major economies, China is already at the early stage of the cycle where growth is accelerating.

It is not uncommon for the valuations of risk assets such as stocks to remain elevated and to become more expensive, though. The acid test will be when the next so-called Black Swan strikes. Yes, “rare events with serious consequences”, according to Nassim Taleb, author of The Black Swan: The Impact of the Highly Improbable. The flight to quality and security will again favour government bonds in developed economies.

It seems that global stocks and other risk assets are about to wobble. The risk is on the downside and could be very uncomfortable. The bear market rally in global stocks could fade soon.

Ryk de Klerk is an independent investment analyst.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies.

Very useful article! Would it be possible to do this analysis for South Africal asset classes?

Dear Prieur

Thank you for your comment. I am considering your request, but I need to overcome technical difficulties created by the reclassification of the JSE sector indices in 2019.