Santam, South Africa’s leading short-term insurer, delivered a standout performance last year despite a stagnant economy and significant claims from weather-related perils.

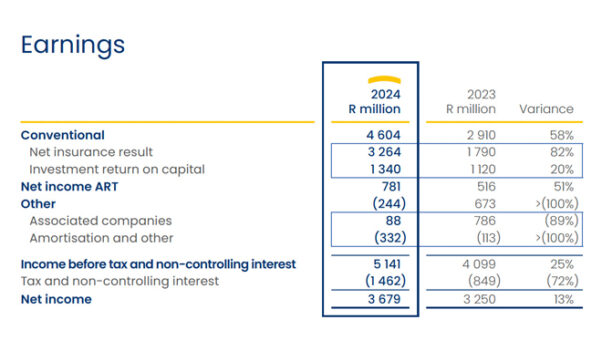

Headline earnings per share (EPS) hit R34.77, up by 51%, fuelled by a 58% rise in conventional insurance earnings to R4.604 billion and a 51% increase in Alternative Risk Transfer (ART) earnings to R781 million.

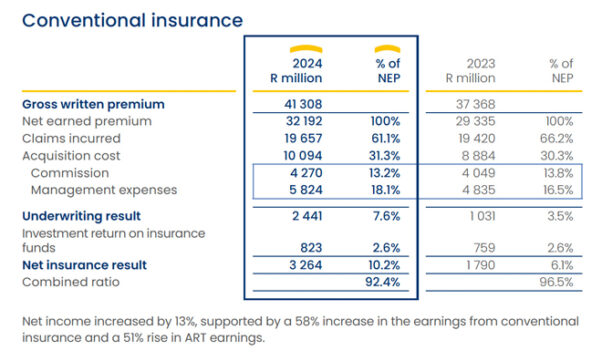

The underwriting margin – a key profitability metric (underwriting profit divided by net earned premiums) – leapt from 3.5% in 2023 to 7.6%, landing within the company’s target range of 5% to 10%.

Net income after tax and non-controlling interest grew by 13% to R3.679bn.

The final dividend rose by 8.8% to R9.85 per share, lifting the total dividend to R15.20 per share, up by 8.6% from 2023.

Gross written premium (GWP) – total premiums written before reinsurance deductions – climbed by 10.5% to R41.3bn, with South Africa contributing R33.9bn (up 8%) and international markets adding R7.4bn (up 28%).

Net earned premium (NEP) – premiums after reinsurance costs – increased 10% to R32.192bn, outpacing 2023’s growth of 6%.

Pivoting towards non-traditional markets

Santam said it delivered the strong performance despite the difficult operating environment, marked by GDP growth of only 1.1%, high unemployment, and consumers’ disposable income coming under pressure because of high debt and elevated inflation and interest rates.

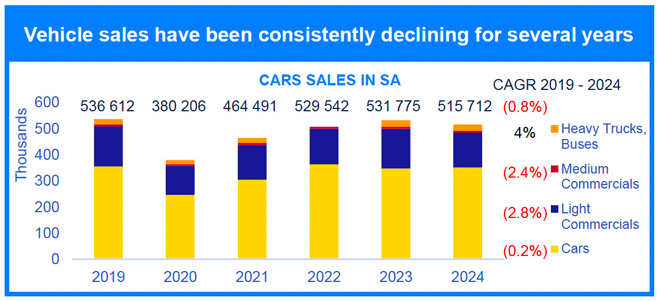

These factors are suppressing real growth in the consumer base and making it difficult for consumers to afford insurance premiums. Furthermore, the financial pressures on consumers have put a damper on vehicle sales – a key driver of growth in Santam’s largest line of business.

The performance of the traditional insurance markets in which Santam has a high level of penetration is closely correlated to the performance of the economy.

In response, Santam said its refreshed “FutureFit 2030” strategy will put more focus on its direct distribution channels, where its market share is relatively low, and non-traditional market segments, “which are much less penetrated and provide good prospects for accelerated growth, while driving enhanced financial inclusion”.

Claims: battling weather and costs

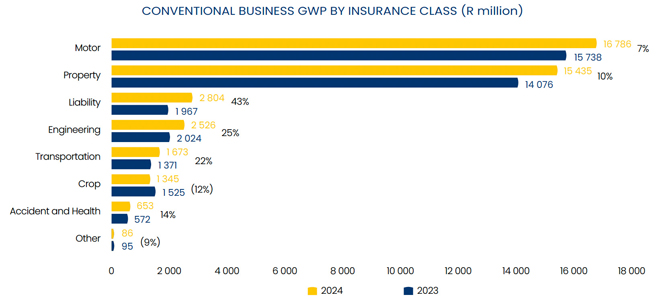

Santam’s two largest insurance classes, motor (41% of GWP) and property (37% of GWP), were affected by the challenging claims environment.

Motor repair costs increased by more than headline CPI. Santam said it is working with key stakeholders to contain costs across the motor value chain over the long term.

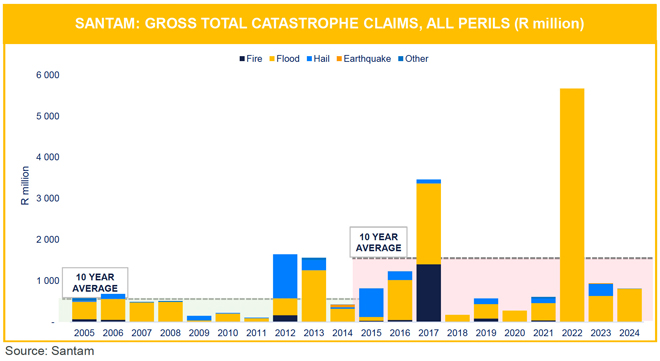

Losses from extreme weather conditions were most pronounced in the property book. “The frequency and severity of claims from inclement weather conditions have increased substantially over the past decade, including in South Africa, which has traditionally been seen as a benign catastrophe environment.”

The insurer experienced a similar number of “significant weather-related events” in 2024 (catastrophe claims from a single event in excess of R100m) compared to 2023. Losses from these events were more severe in 2024, at R652m compared to R583m in 2023. The events were widespread across the Western Cape, Eastern Cape, and KwaZulu-Natal.

The average cost of claims arising from natural catastrophe (NatCat) perils over the past 10 years has doubled compared to the preceding decade. The heightened NatCat claims appear to be the “new normal” in line with global NatCat trends.

The average annual cost of NatCat claims increased from less than R1bn between 2005 and 2015 to about R2bn in the past 10 years.

Yet, gross claims paid dropped to R28.6bn from R29.9bn, and cumulative catastrophe claims held steady at R748m.

A 55% decline in other significant losses (mostly fire-related) to R238m further eased the pressure.

Underwriting actions and underwriting results

Santam said it has implemented several underwriting actions in the past two years in response to the elevated claims environment. These included premium increases and higher excess amounts for selected risks across the motor and property classes, enhanced safety requirements to mitigate against high-value vehicle theft, the accelerated roll-out of geocoding to enhance property risk selection and rating, and the expanded surveying of property risks.

“Through these actions, we have successfully addressed power surge losses, improved the profitability of the motor book and turned around the property portfolio from a loss contributor over an extended period to a positive contributor to the underwriting performance in 2024.”

An underwriting margin of 7.6% was achieved for 2024, compared to 3.5% in 2023. The underwriting margin increased from 6.5% in the first half of 2024 to 8.6% in the second half of the year, partly due to fewer weather events.

The underwriting margin was well within Santam’s target range of 5% to 10% target range, despite weather-related and other large losses of R986m in 2024 (2023: R1.3bn).

The net insurance margin was 10.2%, compared to 6.1% in 2023.

Business segments: broad-based growth

Santam’s conventional insurance arms – Broker Solutions, Client Solutions, Partner Solutions, Specialist Solutions, MiWay, and Santam Re – drove much of the success.

GWP grew across most units, except Specialist Solutions, which dipped slightly because of aggressive international competition offering “unsustainable rates”.

Partner Solutions surged with the MTN in-force book transfer, while MiWay’s 8% GWP growth came from new inbound and tied agency strategies.

Santam Re posted double-digit gains despite cutting underperforming business.

Key insurance classes performed strongly:

- Motor: up 7%, aided by premium tweaks and underwriting.

- Property: up 10%, with profitability restored via higher excesses.

- Engineering: up 25%, thanks to Santam Re restructuring.

- Liability: up 43%, driven by demand.

- Transportation: up 22%, boosted by marine growth.

Larger contribution from ART

The ART businesses, which consist of Centriq and Santam Structured Insurance, grew their contribution to Santam’s profit by 51%, from R516m in 2023 to R781m in 2024. This was the combination of a 57% growth in operating earnings to R694m and an increase in the investment return earned on capital to R87m (2023: R73m).

Operating earnings were supported by good growth across all main income lines (fee income, investment margin, and underwriting margins).

Fee income grew in line with an increase in business under administration. One-off initial fees were, in addition, earned from new deals written during the year, contributing to an overall growth of 28% in fee income from R379m in 2023 to R487m in 2024.

The favourable investment market performance was the main driver behind the 24% growth in the investment margin to R399m.

Outlook for 2025

Santam is upbeat about its growth prospects in 2025.

Economic conditions are expected to improve slightly in 2025, with a forecast GDP growth rate of 1.5%. Together with easing pressure on personal disposable income, and a strategic focus on higher growth areas in the direct, partnership and international business areas, Santam is positive about topline growth prospects in 2025.

“Volatile weather conditions are expected to persist, which may result in volatility in underwriting margins. The underwriting actions we implemented to date will, however, position us well to manage these. We remain confident in the group’s prospects and the potential to deliver enhanced growth and profitability.”