The South African Reserve Bank (SARB) has seized more than R67 million belonging to former Steinhoff executive Stephanus (or Stéhan) Grobler.

The bank’s deputy governor, Fundi Tshazibana, published the forfeiture notices in the Government Gazette on Friday. Both orders were issued in terms of the Exchange Control Regulations.

In one of the notices, the SARB seized more than R66m in shares and loan accounts as declared by Grobler in February 2020.

The shares were in Suez Beleggings (Pty) Ltd (R86 706), Steff Grobler Beherende (Edms) Beperk (R7 093), and Keurview Aandeleblok Beperk (R4 900).

The loan accounts were Suez Beleggings (R66 167 405) and Elmaretch Engineering Works (Pty) Ltd (R19 106).

The money will be moved to the National Revenue Fund, where all government revenues are deposited.

In a separate notice addressed to the Stéhan Grobler Trust, the bank seized R871 652.44 in a Momentum Wealth contract.

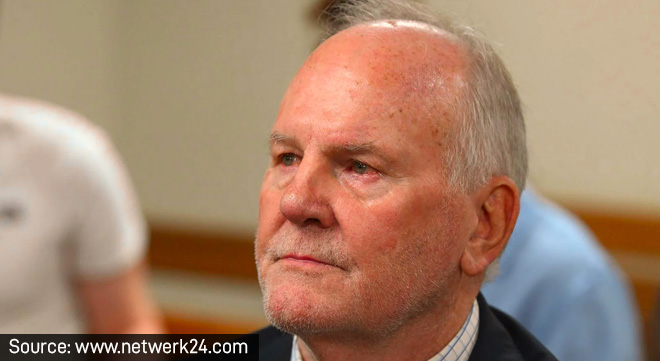

Grobler awaits trial

Grobler handed himself over to the Hawks on 22 March, a day after Steinhoff’s former chief executive, Markus Jooste died by suicide in Hermanus. He appeared in court on 25 March, where he was granted bail of R150 000.

He has been charged with racketeering, fraud, the manipulation of financial statements, and failing to report fraudulent activities.

Grobler has vowed to clear his name.

Grobler most recently appeared in the Pretoria Specialised Commercial Crimes court on 4 October, when the case was postponed to 14 February next year.

The National Prosecuting Authority (NPA) alleges that Grobler was paid generously to manipulate the financial statements of Steinhoff International Holdings Limited (SIH) and Steinhoff International Holdings NV (SINV). This accusation is outlined in a 92-page indictment against former director Grobler and former chief financial officer Ben la Grange.

Read: Steinhoff former execs accused of reaping hundreds of millions through ‘fraudulent efforts’

The NPA details how the Steinhoff Group allegedly falsified profits through two schemes: the TG Group fraud and the BNP Paribas commission transactions, which together generated over R20.7 billion in fake profits from 2014 to 2016. The TG Group fraud aimed to inflate the Steinhoff Group’s financial position by misclassifying loans as assets and recording fictitious payments as revenue without corresponding costs. Similarly, the BNP Paribas transactions were fraudulent activities processed through SIH’s accounting systems.

Grobler is accused of creating documentation to support fictitious transactions that inflated the annual financial statements of both SIH and SINV. Under Jooste’s instruction, he allegedly helped draft “contracts” with TG Group shell companies and facilitated payments from the Steinhoff Group to its operating entities to give the false impression that payments were made by the TG Group.

Earlier this month, La Grange was sentenced to 10 years’ imprisonment, with five years suspended for five years. The suspension is conditional on his avoidance of fraud during this period and his co-operation as a witness for the State in future criminal cases involving directors, officers, and employees of the Steinhoff group.

Read: Steinhoff’s fall: former CFO Ben la Grange sentenced

Assets linked to Steinhoff seized

In July, the SARB seized more than R6 billion from Ibex Investments (formerly Steinhoff). Steinhoff delisted from the JSE and the Frankfurt Stock Exchange in October 2023. Earlier in the year, Steinhoff received approval to transfer its assets, liabilities, and contracts to a new holding company called Ibex.

Read: Is Jooste’s frozen estate next on the SARB’s radar?

In April, the SARB seized assets belonging to Berdine Odendaal, the alleged lover of Jooste. The assets included R42m in bank accounts and an R18m property in Paarl’s Val de Vie estate.

Legal precedent set as Odendaal’s assets forfeited in Steinhoff fraud battle

Jooste’s personal assets, along with the family trust, Silver Oak Trust, valued at more than R1.4bn, were frozen by the SARB in October 2022.