In a move that finally breaks a four-year hiatus, the South African Reserve Bank’s (SARB) Monetary Policy Committee (MPC) last week cut the repo rate by 25 basis points to 8% per annum, bringing the prime lending rate down to 11.5%. But the question on everyone’s mind is: what kind of rate-cutting cycle lies ahead? Will it be a slow, steady decline, or are we in for a front-loaded push?

However, this question cannot be answered in a vacuum. A report by Momentum Investments Group highlighted that the US Fed kicked off monetary easing last week (18 September) with a larger-than-expected 50 basis points cut to the Federal funds rate, now in a range of 4.75% to 5%. This follows eight consecutive meetings of holding rates at a 23-year high since its last hike in July 2023.

Sanisha Packirisamy, chief economist at Momentum Investment Group, says this decision to cut interest rates comes as the US Fed has become more comfortable about the decelerating inflation profile.

“They also signalled that they are not overly concerned about the resilience of the economy,” says Packirisamy.

In the week prior to the Fed’s move, the European Central Bank (ECB) cut rates by 25 bps to 3.5%, marking its second cut since June 2024, with 50 basis points in total so far.

Meanwhile, the Bank of England (BOE) held its bank rate steady at 5% during its 19 September meeting, following a 25 basis points cut in August from a 16-year high. The Bank of Japan (BOJ) also maintained its overnight call rate target at 0.25% on 20 September, having raised rates twice in 2024, bucking the global easing trend.

The future trajectory of interest rates

In the latest episode of No Ordinary Wednesday, Investec Treasury economist Tertia Jacobs highlights the ongoing debate among markets and economists about the future trajectory of interest rates – whether the trend will follow a slow, steady decline or a front-loaded approach.

“Everyone has been listening to what the FOMC (Federal Open Market Committee) members have been saying, as well as non-Fed members, and everyone has an opinion,” Jacobs explains.

The key issue, she notes, is determining which of the Fed’s dual mandates – inflation or full employment – will take precedence in shaping policy decisions moving forward.

Jacobs points out that inflation is easing, with the August rate at 2.5%, but the focus is shifting towards economic growth and employment.

“The growth side, I think, is going to become more important, where we have seen a moderation in employment, which is now at 4.1%,” she says.

Monthly job creation has slowed, dropping from an average of 230 000 to about 75 000. Despite this, she adds, “No one is yet saying that there is a meaningful decline in economic growth, and that is what’s going to shape the debate.”

Jacobs says that the Fed’s upcoming median dot plot will provide valuable insights.

“Very importantly, what the Fed’s median dot plot will tell us [is] do some of the Fed members see a more aggressive kind of rate cut? Because in June, the median dot plot was for one rate cut. So we will be able to get some guidance about the Fed’s thinking,” she says.

According to Packirisamy, the dot plot suggests further US rate cuts, potentially to a range of 4.25% to 4.5% by the end of 2024.

Albert Botha, head of Fixed Income at Ashburton Investments, says further cuts by the Fed are expected in 2024 and 2025, potentially lowering rates to at least 3.5%.

“This represents between 1.75% and 2.5% worth of cuts over the next 12 to18 months. The SARB is likely to mirror this rate path, with cuts expected at the end of the month and continuing through next year. Projections suggest the repo rate will bottom out between 6.25% and 6.75%,” says Botha.

Getting a grip on inflation

Discussing the challenges facing SARB Governor Lesetja Kganyago and his team as they navigate interest rate decisions in the medium to long term, Jacobs notes that recent developments on the inflation front have been promising.

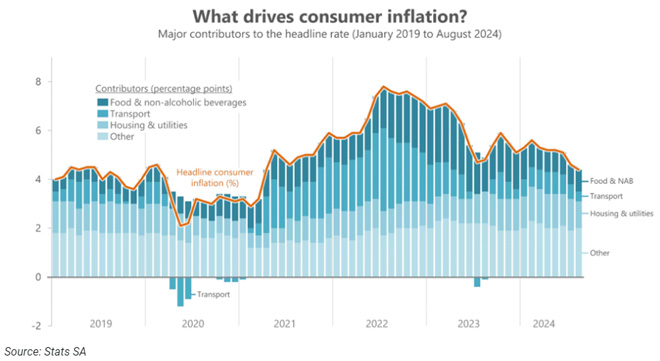

“We have seen in headlines, CPI inflation now receding from above 5% to 4.6%,” she says. “Very importantly, what have been the drivers? And I think the Reserve Bank will assess that.”

Jacobs highlights several key factors contributing to this decline.

“The sharp decline in the fuel price from June, with the oil price tumbling to $71 per barrel or so, combined with a stronger rand, has allowed for huge declines in the petrol price. The rand in itself is quite constructive, because it lowers imported inflation,” she says.

She also points out that food inflation has been lower than expected, rising by only 3.9% recently.

These combined factors have contributed to inflation reaching the midpoint of the SARB’s target range earlier than anticipated.

Jacobs notes, “The governor has been very focused that inflation must return to the midpoint of the target band, but on a sustainable basis. And it looks like, when we look at the inflation forecast for the next 12 months or so, we are there.”

She adds that whether the Fed opts for a more aggressive or front-loaded strategy will have a direct impact on the SARB’s stance.

“There’s definitely scope for the Reserve Bank to front-load rate cuts,” Jacobs says. “I think we must just contextualise it, because if they front-load rate cuts, it may not necessarily mean more, but they could go earlier.”

According to Jacobs, the SARB’s decision will hinge on its risk assessment.

“They usually look through volatility, drivers of inflation, if it’s like fuel or food, that leads to inflation falling well below the target, which is likely to happen over the next four or five months, or on the upside as well,” she adds.

While it remains uncertain if the SARB will choose to front-load cuts, Jacobs says that “it’s not inconceivable”.

How low can it go?

According to the Momentum Investments Group, given the improved inflation trajectory, another 25 basis point cut can be expected in November (the last interest rate setting meeting for 2024).

“We expect that the interest rate cutting cycle will continue in the new year and we pencil in two more 25 basis point cuts in 2025, ending the year at 7.25%, slightly higher than the Reuters consensus of 7% and the FRA market (7%),” says Packirisamy.

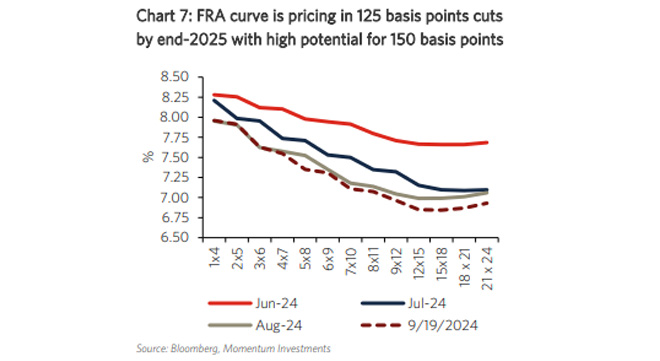

The group’s report notes that, over the past three months, the market has adjusted its outlook for interest rates notably lower (see chart 7) in line with domestic inflation trends and global interest rate trends.

“Similar to our view, the FRA curve (on 19 September) had priced in a cumulative 50 basis point cut by the end of 2024,” says Packirisamy.

She adds that the market is, however, expecting a slightly more aggressive cycle from here onwards with an additional 100 basis points fully factored in by the end of 2025 and “there is a very high probability (above 90%) priced in for an additional 125 basis points of cuts”.

“The SARB’s quarterly projection model (QPM) is guiding toward a repo rate of 7.86% by the end of this year, which means no more interest rate cuts this year (contrary to Momentum’s and the FRA’s expectation).

“The model suggests a terminal rate of 7.17% in 2025, which would require 75 basis points of cuts in the year. The total interest rate cuts by the end of 2025 would be 100 basis points, in line with our projection,” Packirisamy says.

Casey Sprake, Investment Analyst – Fixed Income at Anchor, anticipates a measured approach from the MPC. In a recent article, he notes that the MPC considered three options on 19 September: leaving rates unchanged, a 25-basis point cut, or a more aggressive 50-basis point cut.

“Ultimately, the committee reached a consensus on a 25-basis point reduction, concluding that a slightly less restrictive stance aligned with the goal of achieving sustainably lower inflation over the medium term. This decision reinforced our long-held view that the MPC would avoid a sharp 50 basis point cut, as the SARB typically favours gradual reductions to maintain market stability and predictability.”

Sprake believes this cautious stance reflects the SARB’s commitment to managing expectations and avoiding market shocks.

“The central bank can adjust based on evolving economic conditions by opting for a data-dependent, incremental strategy. This method minimises the risks associated with large, rapid cuts, such as heightened market volatility or misaligned signals.”

He highlights that the latest SARB MPC statement forecasts rates stabilising slightly above 7% next year, confirming their base case of 100 to 125 basis points of cuts.

“It is worth noting that the SARB’s Quarterly Projection Model (QPM) previously saw the repo rate ending at 7.25% but now signals a further 25-bp cut in 2025/2026, taking the repo rate to a steady state of 7%.”

What the rate cut means for consumers

As the debate between a gradual decline and an upfront push persists, everyone can acknowledge that the recent rate cut, along with anticipated future cuts, brings much-needed relief.

According to Jacobs, the rate cut will alleviate some of the cash flow pressures on households.

“The disposable income of households will improve. We’ve already seen the petrol price cuts – that will help – the withdrawal from the two pots retirement system has become effective on 1 September, and we have seen pension funds having to deal with huge demand. So that will be another income stream. And the third aspect will be the rate cuts. So for cash-strapped consumers, that’s definitely going to assist.”

Prior to the rate-cutting cycle that started in 2021, debt servicing cost of the average household was less than 7% of disposable income, and it rose very rapidly to more than 9%.

“So there’s definitely scope for immediate relief coming through with rate cuts, even though it’s going to be fairly small for starters,” Jacobs says.

Botha says rate changes will impact various sectors of the economy.

“For most people, this will provide welcome relief on home loans, credit cards and other debt. New homeowners can expect monthly payments to drop between R750 to R775 per R1-million loan size with the first 1% worth of cuts, while those with about 10 years left on their loans will see a reduction of R620 to R650 per R1-million outstanding.”

He adds that for market participants, lower rates typically benefit riskier asset classes such as property and equity, “particularly if South Africa’s socio-economic circumstances continue to improve”.

“While fixed income funds may yield less in absolute terms, real returns remain attractive as local inflation continues to fall towards 4% or lower,” says Botha.