Much like the relentless Terminator from the Arnold Schwarzenegger movies, non-compliant taxpayers on the South African Revenue Service’s radar have little chance of escape. So why not take a page from John Connor’s playbook and make SARS your ally – ensuring it won’t be back?

That might not have been the exact message from SARS Commissioner Edward Kieswetter on Tuesday, when he presented the preliminary revenue results for the 2024/25 fiscal year, but his detailed account of the SARS Compliance Programme’s efforts to hold delinquent taxpayers accountable certainly said as much.

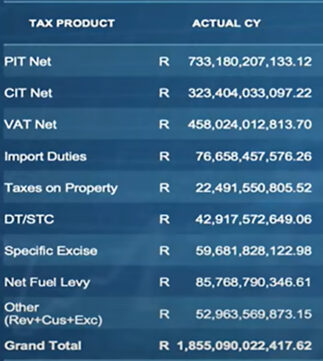

For the 2024/25 fiscal year, SARS collected a net R1.855 trillion, exceeding the government’s revised estimate by nearly R8.8 billion and surpassing last year’s R1.741 trillion by R114bn.

As usual, the largest contributor to the revenue pool was net personal income tax (PIT), which totalled R733.2bn (including interest) – an R81.8bn (12.6%) increase. Kieswetter attributed this growth to above-inflation increases in Pay-As-You-Earn (PAYE) contributions from the finance and community sectors of the economy, along with the unexpected windfall from two-pot withdrawals. These withdrawals totalled R12.9bn for the year-to-date – R7.9bn more than the projected R5bn.

SARS also used the two-pot withdrawals to recover R820 million in outstanding tax debt. To access their withdrawal, taxpayers must be registered with SARS and have no unpaid tax obligations – any outstanding debts are deducted directly from the amount before payout.

The second-largest revenue contributor was net value-added tax, which brought in R458bn (24.7% of total collections), reflecting a 2.3% growth (R10.5bn). Kieswetter attributed this increase to factors such as improved consumer sentiment, lower interest rates, controlled inflation, and early retirement fund withdrawals, all of which supported household consumption in late 2024.

The third-largest contributor was net company income tax (CIT) which reached R323.4bn – a R6.5bn (2.1%) increase. This growth was primarily driven by CIT provisional tax collections, which amounted to R323.3bn – R10.5bn (3.3%) higher than in the previous year and R4.3bn (1.4%) above the Budget 2025 estimate. Kieswetter noted that the finance sector’s strong profits were a key driver behind this performance.

The remaining revenue came from import duties, taxes on property, domestic and specific excise duties, the fuel levy, and other smaller tax streams.

But it wasn’t all take and no give.

SARS paid refunds of R447.7bn to taxpayers, the highest amount to date (versus R413.9bn in the prior year), representing growth of 8.2%.

“I am pleased that the R447.7bn returned into the hands of taxpayers is good for the economy,” said Kieswetter. “I, however, remain deeply concerned about the ever-present threat of refund fraud and abuse of the system.”

In the period under review, SARS prevented the outflow of R146.7bn of impermissible refunds.

‘32 million little things we do to produce R300bn’

Reflecting on SARS’s Compliance Programme, Kieswetter noted it generated R301.5bn in additional revenue for the 2024 fiscal year, marking a 17% year-on-year growth.

“This is the programme of work we formulate at the beginning of the year and set out to execute as we give effect to our mandate objectives,” said Kieswetter. He went on to explain that the programme’s success directly contributes to government revenue.

“The result of this work produces additional revenue which otherwise would not have been in the fiscals, because it has not been paid over voluntarily by taxpayers to SARS,” Kieswetter said, referring to the financial gains as the “compliance dividend”, or revenue derived from administrative efficiencies.

Breaking down the source of this R301.5bn, Kieswetter highlighted a variety of efforts, starting with R94bn collected by addressing more than 3.7 million instances of outstanding debt. This success, he noted, was achieved through persistent interventions such as “making the call, sending an SMS, sending a friendly letter, changing the colour of the letter from black to red, and eventually sending the sheriff or issuing a civil court judgment”.

“And that’s before we have to resort to freezing bank accounts and assets and attaching assets,” he said.

And then there is the R103bn secured from tax verifications. Using cutting-edge AI-driven risk-profiling models powered by big data, SARS was able to flag potential risks, investigate discrepancies, and act on 1.7 million verification cases.

Kieswetter also highlighted the success in tackling syndicated crime, which accounted for R30bn in additional revenue. This included the resolution of complex, cross-border criminal activities involving multiple taxpayers. SARS conducted 198 intricate investigations.

Additionally, R59bn was generated from executing 329 000 customs and compliance audits, and R14bn was collected through general compliance work, which Kieswetter said involved following up on 200 000 individual taxpayer accounts and addressing outstanding issues.

There were 26 million service interactions at SARS branches, with taxpayers and traders assisted via various channels, such as the self-service platform and phone consultations, to comply.

Themes in non-compliance

Focusing on key trends in non-compliance, Kieswetter first addressed customs enforcement.

On 1 September 2024, SARS introduced a major change affecting small parcel e-commerce imports. Previously, imports valued at R500 or less were subject to a flat 20% customs duty, with no VAT applied. However, from this date, SARS added VAT of 15% to these low-value consignments in addition to the 20% customs duty.

Kieswetter explained that this move was necessary to level the playing field between traditional retailers and clearing agents handling thousands of small parcels – the Sheins and Temus of this world.

“High-street retailers were paying full duties, while clearing agents importing on behalf of individuals were exempt from VAT and benefited from a reduced duty rate,” he said.

The initial focus was on clothing, textiles, and footwear, but from 1 February, the policy was expanded to a broader range of goods. According to Kieswetter, this adjustment led to a six-fold increase in revenue collection.

“Small for now – it’s under R200m – but as we step this up, and with a full year ahead, we estimate a revenue prejudice of about R3bn.”

Kieswetter then turned to high-risk excisable industries, such as fuel, alcohol, and tobacco, which, he noted, are rife with non-compliance. SARS has successfully prosecuted cases in these sectors, with potential revenue losses of about R5bn.

“But let me tell you, we are merely scratching the surface. There is so much more work to do in customs – under-declaration, mispriced trade, trade-based money laundering, to name a few,” he said.

SARS currently has 105 cases on the National Prosecuting Authority (NPA) roll, with 33 already in trial and 72 awaiting a trial date. Additionally, 27 importers and clearing agents – primarily in the clothing, textile, footwear, tobacco, and alcohol sectors – had their licences either suspended or revoked because of non-compliance.

Efforts to remove illegal imports from circulation have also intensified.

“The number of seizures has increased by 33%, while the value of seized goods has reached almost R6bn,” Kieswetter said.

SARS is also ramping up efforts to combat large-scale tax and customs fraud involving sophisticated syndicates. Kieswetter underscored the importance of collaboration with local and international law enforcement agencies, as well as enabling legislation for information-sharing and joint enforcement action.

“The illicit tobacco and gold trade is a prime example. Through our investigative and prosecution work, we’ve dismantled complex schemes. Just in this industry, we’ve raised R10bn in assessments and recovered R4.2bn in cash over the past five years,” he said.

The SARS Syndicated Tax and Customs Crime Division’s efforts have resulted in total revenue recoveries of R66.7bn – comprising R24bn in collections, R1.3bn in refund savings, and R40.5bn in revenue leakage prevention.

“In this year, we have continued to collaborate with local and international enforcement authorities, making significant inroads in both the gold and illicit trade industries, issuing assessments of a further R10bn,” Kieswetter said.

SARS is watching

Kieswetter also addressed SARS’s controversial push to implement the daily monitoring of licensed tobacco manufacturers. Despite legal setbacks, he made it clear that SARS remains committed to deploying this technology in the coming year.

SARS’s plan to install CCTV cameras in tobacco manufacturing warehouses as a measure against illicit trade has faced fierce resistance, with courts repeatedly ruling against the tax authority’s surveillance efforts.

The dispute dates back to 2022, when SARS introduced a rule under the Customs and Excise Act requiring tobacco manufacturers to install CCTV cameras in their facilities. The move, aimed at curbing tax evasion and the illicit cigarette trade, sparked immediate opposition from the industry.

The Fair-Trade Independent Tobacco Association (FITA), representing about 80% of licensed cigarette manufacturers in southern Africa, along with 11 individual tobacco companies, took SARS to court to block the measure.

In May 2024, the High Court in Pretoria granted an interim interdict preventing SARS from enforcing the CCTV rule, ruling that implementation should be suspended pending a full review of its legality.

According to News24, FITA and other manufacturers argued the measure infringed on their rights and constituted an overreach of SARS’s authority. SARS, however, maintained the cameras were crucial to combatting the illicit tobacco trade, which costs the state billions in lost tax revenue each year.

Undeterred, SARS sought leave to appeal the ruling. However, in September 2024, the same court dismissed its application, stating the revenue authority had not demonstrated reasonable prospects of success, as reported by EWN.

Despite winning the interdict, tobacco manufacturers suffered a setback in December 2024 when the Gauteng High Court struck two urgent applications by FITA and others off the roll. The court ruled the applications lacked urgency and did not warrant immediate intervention, according to IOL.

This ruling created some confusion about whether SARS could proceed with its CCTV plans, but the original May 2024 interdict remained in effect, keeping the surveillance programme on hold.

SARS then turned to the Supreme Court of Appeal (SCA) in an effort to overturn the interdict. However, in March 2025, the SCA dismissed its application, upholding the High Court’s ruling, News24 reported.

For the moment, SARS has exhausted its appeal options, with the Constitutional Court the only remaining avenue.

Yet, Kieswetter remains defiant. During Tuesday’s briefing, he reiterated SARS’s determination to implement the technology in its fight against illicit trade.

“We use smart technologies and closed-circuit TV installed at tobacco manufacturers, despite the significant resistance by some industry players. SARS continues to engage with industry to discuss the implementation process, and we are also appealing the current judgment against the use of CCTV implementation. This approach will extend to other areas of abuse and criminality,” he said.

Told you. Relentless.