Price moves for some agricultural commodities have been dramatic since Russia invaded Ukraine at the end of February.

The chart below shows how prices have jumped, with wheat gaining most.

We believe that prices are likely stay around these high levels for the foreseeable future.

Demand is set to remain high, while supply will remain constrained this year and next. The tightness in supply and demand may even worsen in 2023 and beyond. This is because unpredictable weather patterns are adding to supply uncertainty, alongside the possibility of continued disruption to production in Ukraine.

Meanwhile, crops will likely be produced with lower levels of fertiliser, following significant price rises and supply disruption in fertiliser markets as a result of the war.

Ukraine and Russia are important commodity exporters

The reason for the price rises is clear when we consider how important Ukraine and Russia are as exporters of food and other commodities. Sunflower oil and grains (corn, wheat and barley) have been most impacted on the agricultural side.

Potash (40% of global exports when Belarus is included) has seen the most disruption on the fertiliser side.

The long-term supply disruption for Ukraine is still unclear. However, many of the most crucial agricultural regions have seen fierce fighting, farmland blighted by landmines on a large scale and the destruction of agricultural equipment.

The disruption to commodity exports from Ukraine and Russia will have price repercussions on other commodities. Palm oil prices look set to rise because palm oil is increasingly used as a substitute for sunflower oil, for example.

Rising prices across a range of commodities also reduce the incentive for farmers elsewhere to shift into wheat, which would address some of the supply constraints, because they can get decent prices for other crops.

Disrupted fertiliser supply could reduce crop yields

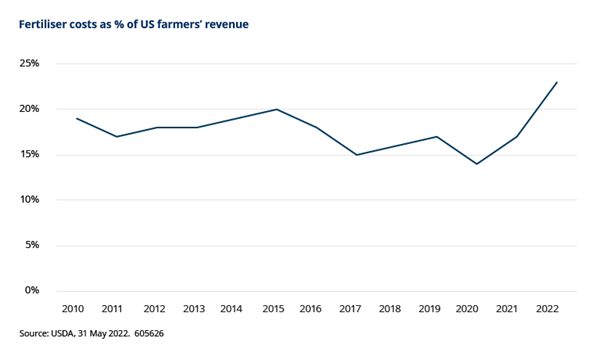

Another limitation on other regions’ ability to fill projected shortfalls is the disruption to inputs, such as fertiliser. The cost of fertiliser for US farmers has increased from 14% of revenue in 2020 to about 23% in 2022.

This is already resulting in changes in planting behaviour. For example, US farmers are planning to plant record levels of soybeans (which require relatively less fertiliser) and less spring wheat and corn, according to the US Department of Agriculture’s most recent survey.

Recently, there have been signs of fertiliser demand destruction. Farmers have held off buying fertilisers where possible, hoping that prices will fall over the course of the year. This has proved to be a fairly self-fulfilling prophecy, with US prices 35% below their March peak.

For wheat, the application of fertiliser starts fairly early in the season, with the peak application in late June to mid-August. The extent to which whether demand is being destroyed, rather than deferred, should therefore be seen in the next few weeks.

Several countries are limiting food exports

Given the disruption to crop and fertiliser exports, it is no surprise that various countries are taking steps to protect their food supply. Currently, about 17% of the world market in calories is under food restrictions.

Reliance on food imports varies, but it is as high as 100% in some countries in the Middle East and North Africa.

As the market tightens, supply becomes more dependent on marginal producers – that is, those that produce a relatively small amount. This increases the risk of food price volatility from extreme weather events. West Africa is particularly at risk, with 70% of cropland exposed to drought.

Tight food supply could imperil the transition to biofuels

Apart from curbs on exports, another response to tight agricultural commodity markets might be shifts in flows and usage. About 20% of the world’s wheat is used for animal feed, so we may see substitutes being introduced to try to preserve wheat for human consumption.

Biofuels are another area that may be affected, given they use about 10% of the world’s wheat. First-generation biofuel companies (those that use edible foods rather than using waste) may feel some policy pressure if governments pause or unwind subsidies. Supply constraints and reputational damage are other risks.

We have recently seen a debate among the G7 countries to postpone the transition to biofuels in order to try to alleviate food shortages. The mandates call for biofuels to be blended with ordinary petrol and diesel to reduce emissions.

If a postponement is enacted, it will be very difficult for countries such as Germany to meet their carbon commitments around transport. The fact that this is being considered shows the extent of the inflation dilemma that policymakers are in.

Food security is a long-term concern

The Ukraine crisis has brought food security into focus. Additionally, the longer-term narrative around food supply is changing.

Population growth means that global food and water production is expected to need to increase by 70% by 2050 versus 2010 levels. Climate and wider environmental factors mean that resource intensity needs to reduce by about two-thirds at the same time.

In the near term, it is likely that food security will be the priority of governments. Higher fertiliser prices, tight agricultural equipment markets and disrupted value chains for things such as pesticides, mean that global yields across the agricultural commodity complex could fall both this year and next.

Looking further ahead, the system needs to be made more sustainable, or it will be subject to increasingly detrimental negative feedback loops, such as extreme weather and ecosystem degradation. Even under a scenario of 2 degrees of global warming, wheat and corn yields are projected to fall by 14% and 12% respectively.

All of this paints a picture of elevated agricultural prices in the foreseeable future.

Felix Odey is portfolio manager: global resource equities at Schroders.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies.