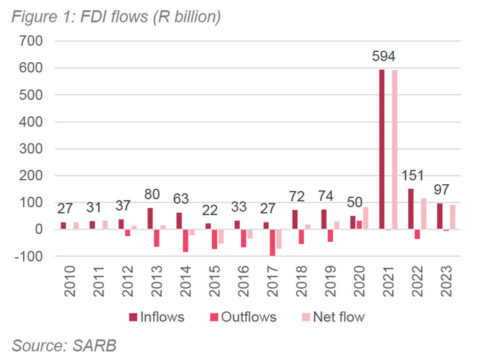

South Africa has seen a positive net inflow of foreign direct investment (FDI) every year since 2018, according to PwC’s Economic Outlook report for April.

Considering the country’s economic challenges and the obstacles faced by private business, many would expect that outflows would overshadow inflows. But data from the South African Reserve Bank (SARB) shows that the country’s net FDI flows averaged R58 billion a year after the global financial crisis excluding 2021, the report says.

The year 2021 was an outlier because of the disruptive effects of Covid-19. In 2021, many of 2020’s stalled deals were concluded, while many lockdown-hit companies had to make new strategic deals to keep their doors open.

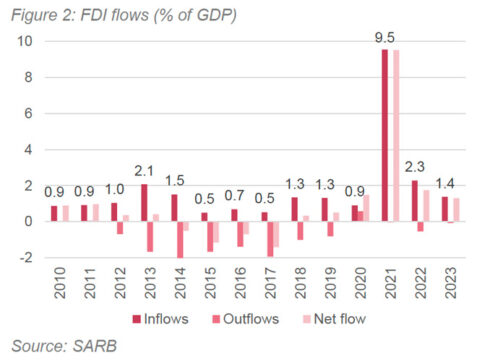

Last year, South Africa recorded FDI inflows of R96.5bn (1.4% of GDP) and outflows of R5.2bn (0.1% of GDP), for a net inflow of R91.3bn (1.3% of GDP).

SARB data shows that the cumulative value of foreign liabilities – including debt instruments, equity, and investment fund shares – was nearly R3 trillion in 2022. Foreign liabilities represent the value of inward foreign investment stock and refer to the liabilities or obligations of the domestic company to its international investor.

Manufacturing is the industry with the largest (38.5%) foreign liabilities (inward investment stock). South Africa is home to production facilities owned by some of the world’s largest producers of vehicles, food products, and building materials.

Mining and quarrying have the second-largest inward FDI stock (24.2%), which is not surprising when considering the country’s 170-year history in this industry. South Africa is the world’s largest exporter of platinum group metals.

Financial services have the third-largest stock of inward FDI (20%). South Africa is home to some of the largest banks and insurance firms on the continent and relies on its globally competitive financial services industry as a positive attribute to attract FDI in other industries.

PwC’s report says South Africa has many positive attributes for foreign investors, including world-class financial services and communication industries, a deep capital market, quality tertiary institutions producing graduates with internationally comparable qualifications, abundant natural resources (including renewables), a strategic geographical location for entry into the rest of sub-Saharan Africa, a transparent legal system, and a certain degree of political and policy stability.

The Venture Capital & Private Equity Country Attractiveness Index produced by the IESE Business School ranked South Africa 66th out of 125 countries in 2023, placing it in the company of Malta, Croatia, and Slovakia.

How foreigners perceive the country

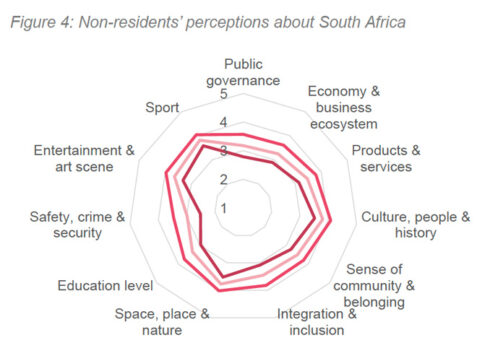

PwC says the perception among non-residents of South Africa’s public governance and business ecosystem are “moderately positive”, according to research by nation branding experts Bloom Consulting.

In mid-2022, Consulting published an analysis of South Africa’s international reputation, based on the perceptions of non-residents. This is the most recent comprehensive review of perception among non-residents about South Africa based on diverse factors, including the economy and business sector.

Bloom Consulting surveyed the views of people familiar with the country and those who are unfamiliar with it. On all the metrics considered, those familiar with South Africa had a better opinion about the country compared with those who were not familiar with the country.

The results were “moderately positive” among those who are unfamiliar (with an average score of 3.1 out of 5 across categories) and can be considered close to “positive” among those who are familiar (3.8).

From an FDI perspective, two key considerations that strongly inform investment decisions are the quality of public governance and the nature of the economy and business ecosystem, PwC says.

South Africans generally have a negative perspective of the quality of public governance, and the trend on most of its data tracked by the World Bank’s Worldwide Governance Indicators (WGIs) has certainly been negative of late.

However, South Africa’s scores on the WGI metrics are not dismal as many South Africans would think. The country’s average percentile rank across the six indicators is 47. This indicates that South Africa is near the middle of all countries considered, with 0 representing the lowest rank and 100 the highest rank, according to PwC.

In other words, the World Bank’s quantification of South Africa’s public governance quality is similar to that found by Bloom Consulting: a “moderately positive” view. The perception assessment places the country near the middle of the data range (between 1 and 5), with an average score of 3.2 between those familiar and unfamiliar. This is close to the level of 3 considered “moderately positive”.

Because the country has seen an extended period of deterioration in some key institutional metrics, South Africans too often view the country as severely underperforming in comparison to what they think many countries in the rest of the world are getting right. However, the WGIs show a middle-of-the-pack performance rather than something more dismal. And foreign investors also have a “moderately positive” view, which is consistent with the country’s performance on the WGIs, PwC’s report says.