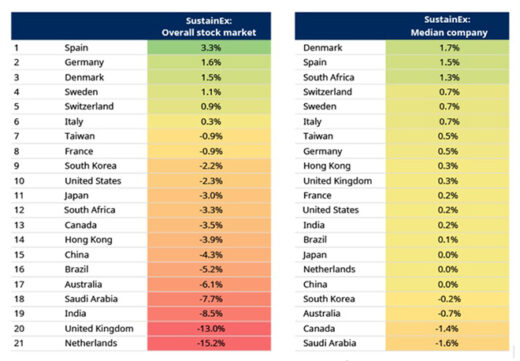

When it comes to sustainability, South Africa has been ranked in the middle of the global stock market league table, with the Spanish stock market leading the way.

This is according to SustainEx, a tool used by Schroders’ portfolio managers and analysts to assess the sustainability risks of stock markets.

SustainEx is Schroders’ proprietary model of the dollar cost/value of a company or market’s effect on society, scaled to its sales for comparability. It provides an indication of the financial materiality of companies’ externalities and can be used to assess the risk to corporate profits if those externalities were reflected on the companies that generate them.

Kondi Nkosi, the country head: South Africa at Schroders, says the analysis ranks some of the world’s biggest stock markets by their sustainability credentials, providing an additional lens on how to assess their risks and opportunities.

“In the past, the negative effects of companies’ activities have been borne by society. But, from carbon pricing to sugar taxes, governments are increasingly reflecting them back on the companies responsible. Companies and consumers are also paying more attention to the behaviour of the companies they choose to do business with,” he says.

According to Nkosi, assessing these sustainability risks helps to build up a fuller picture of the risks and opportunities facing individual companies by quantifying the dollar-value of their negative and positive effects on society.

But sustainability credentials are only one part of the puzzle and should not be relied on in isolation.

“Many other factors influence the success or failure of a company and an investment. When it comes to generating returns for our investors, valuations are key. It is the job of active investors to identify where the market is and is not, pricing in these risks and opportunities correctly. This applies to sustainability as it does to many other relevant considerations,” he says.

The Spanish stock market’s social credentials

Providing an illustration of how SustainEx works, Nkosi explains that a figure of 3.3% for the table-topping Spanish market means that, in aggregate, companies listed there have an unrecognised positive effect on society worth 3.3% of their sales.

“Putting this in perspective, the consensus forecast is for Spanish corporate profit margins to be 11.3% over the next 12 months. But, if these positive externalities were to crystallise in financial terms, that would rise to 14.6%. In money terms, for every €100 of revenues, earnings would be €14.60, not €11.30, a 29% rise. Not something to ignore,” he says.

But this does not mean that all companies will be impacted in this way or in this direction. Nkosi clarifies that this is Schroders’ estimate of the potential aggregate impact when all Spanish companies are combined.

These figures should not be thought of as a forecast but as an indication as to the potential risks and opportunities facing different companies and markets. They are also not a reflection of any country itself, only the companies listed on its stock market.

So, what’s behind the Spanish market’s strong showing?

“Its large utilities and telecoms companies provide valuable services for society, including clean water, sewerage, and sanitation,” says Nkosi.

SA ranks in the middle

Digging deeper into South Africa’s middling performance (in terms of total Sustainex score), he says there’s a stark difference between the stock market’s environmental and social rankings.

“It ranks highly in terms of social characteristics but poorly on environmental, driven by the high proportion of materials and mining stocks in the market. It is a top performer when it comes to its median ranking.”

At the other end of the chart is the UK stock market, because of its exposure to tobacco and alcoholic drinks companies. These have direct health and indirect societal costs.

“What the markets’ poor scores in aggregate don’t tell you is that our analysis suggests around half of the UK’s listed companies have a positive, unrecognised, effect on society. There would be upside financial benefits if this was recognised and crystalized on their profit and loss statement.”

He again emphasises that while the analysis brings additional insights, the league table is too blunt to be used in isolation to drive investment decisions.

What should investors do?

Nkosi says a portfolio that excludes the markets of the worst offenders would look far more beneficial to society than simply buying the broad global market. But excluding certain companies or sectors doesn’t stop harmful activities taking place.

“For every seller of shares there is a buyer. And maybe that buyer doesn’t care as much about engaging with companies to encourage a transition away from more harmful activities,” he says.

However, he says the power and importance of active ownership should not be discounted.

“This can drive better outcomes for society and better returns for shareholders.”