South Africans residing abroad are facing a critical shift in the procedures followed by the South African Revenue Service (Sars): it has begun flagging previously unsubmitted tax returns. This change is not arbitrary; it is based on third-party information received by Sars, which can include information received from foreign institutions through the Automatic Exchange of Information Common Reporting Standard system.

This means that Sars might be accessing information about individuals’ financial activities from foreign institutions through international agreements. Consequently, Sars is flagging tax returns that have not been filed and where it has third-party information available to it.

The concern transcends the mere flagging of returns; it lies in how Sars assesses these filings. Sars evaluates tax returns based on an individual’s tax residence status in its system. Submitting a return without formally ceasing tax residence leads Sars to evaluate it as if the individual is still a South African tax resident.

Therefore, it is imperative for South Africans abroad to take immediate action by reviewing their Sars profiles. The urgency lies in determining their compliance status. The crucial first step is to assess whether they meet the South African residence tests. If they no longer meet these criteria, prompt cessation of tax residence before submitting any flagged returns becomes crucial.

Additionally, this situation highlights the importance of continued compliance even after ceasing tax residence. We always advise that even after becoming a non-resident, continuing to submit nil returns is crucial even though it is not a legal requirement. This practice ensures a clean slate with Sars and verifies the accuracy of any third-party information received by Sars. It is a proactive step to confirm that the information in its possession is indeed accurate and correct.

Ceasing tax residence can be established through the South African residence tests or the Double Taxation Agreement (DTA) applicable to their current country of residence. This step is pivotal to ensure accurate tax assessments by Sars, aligning with the individual’s current tax status and preventing potential tax liabilities and penalties.

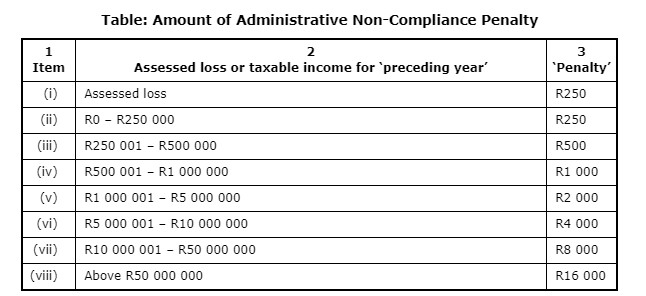

The table below provides the penalty for any failure to comply with an obligation under a tax. Sars can levy the penalty monthly for as long as the non-compliance is not rectified.

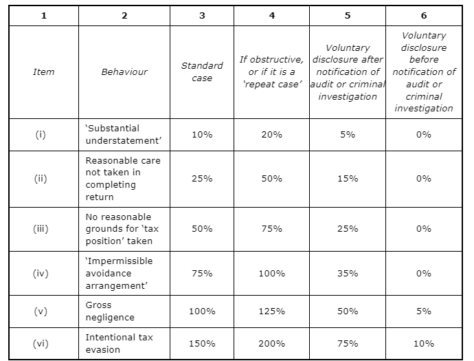

Further, if a taxpayer is indeed a tax resident, they need to submit their returns and declare foreign income while utilising the applicable foreign exemption and foreign tax credits. If the foreign income is not declared as a resident or is incorrectly declared, it can also result in understatement penalties.

The Tax Administration Act stipulates that taxpayers must accurately report all income, and failing to do so can result in penalties unless the understatement is proved to be a genuine inadvertent error.

Understatement penalties are calculated by applying the highest applicable percentage to the shortfall, which includes the differences between the correct tax liability and the amount influenced by the unreported foreign income. Penalties can be substantial and vary based on the severity and intentionality of the understatement, emphasizing the importance of thorough and accurate income reporting, especially concerning foreign income exceeding the exemption threshold.

Sars’s recent actions underscore the need for immediate attention and vigilance. Even if an individual is certain of their non-resident status, failure to formally cease tax residence before submitting flagged returns could result in the assumption of tax residence by Sars.

Hence, South Africans abroad are strongly advised to:

- Review their Sars profiles. They should log into their Sars profiles to verify their tax residence status and flagged returns.

- Assess their residence status. They should evaluate whether they meet the South African residence tests or qualify for cessation of tax residence through the DTA.

- Cease tax residence (if applicable). Taxpayers who no longer meet the residence criteria should take the necessary steps to formally cease their tax residence before submitting any flagged returns (not only tick a box in previous returns).

- File returns appropriately. They should ensure that all returns, particularly those flagged by Sars, are submitted accurately considering the individual’s tax residence status.

- Seek professional assistance. The should consider consulting tax professionals who are well versed in international tax laws to ensure compliance and mitigate any potential issues.

Failing or delaying to act might lead to unwanted tax liabilities and penalties. South Africans abroad must take proactive measures to review their tax status and ensure compliance with Sars regulations to avoid any adverse consequences.

Reinert van Rensburg is a tax attorney and Jonty Leon is managing partner at the Leap Group.

Disclaimer: The views expressed in this article are those of the writers and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute legal advice that is appropriate to every individual’s needs and circumstances.