Working South Africans are feeling significantly less stressed about their finances, and more than two-thirds are optimistic their financial situation will improve in the next six months, according to the latest Old Mutual Savings & Investment Monitor (OMSIM).

Old Mutual released the 2024 Monitor last week. The OMSIM is based on research conducted among employed South Africans between the ages of 18 and 65 with personal monthly incomes of R8 000 or more. About 57% of those surveyed earn less than R25 000 a month. The field work for the survey was conducted in April and May, with 1 508 respondents asked a series of questions.

The percentage of respondents who reported feeling “high” or “overwhelming” levels of stress about their finances declined to 37% this year, compared to 45% in 2023 and 50% in 2022. This year’s finding is in line with the percentage of respondents who were highly financially stressed before the pandemic struck: 36% in 2018 and 38% in 2019. Not unsurprisingly, the percentage of respondents who said they were highly stressed about their finances hit 58% in the Covid year of 2020.

The overwhelming majority of respondents were optimistic that their financial situation will improve in the next six months. According to the survey, 68% held this view, although this is three percentage points lower than in 2023 and four percentage points lower than in 2021. The number of respondents who said they were optimistic that things would improve “in the next six months” has risen steadily from 41% in 2019 to 61% in 2021.

Respondents’ reasons for believing their finances will improve include the expectation that they will earn more income from a second job or starting a business or side hustle, better budgeting and debt management, and being able to save more.

This optimism is also evident in the finding that 36% of respondents feel confident about the outlook for the country’s economy – nine percentage points higher than last year.

There was an upward trend in respondents’ level of satisfaction with their financial situation, from 6.1 last year to 6.5 (on a scale of 1 to 10). The reported level of financial satisfaction has not been at this level since 2015. It hit a low of 5.3 in 2020.

One of the positive trends according to this year’s survey is that South Africans are trying to preserve their savings. The percentage of respondents who said they dipped into their savings to make ends meet fell from 54% last year to 45%. There was also a decline in respondents who cashed in an investment earlier than planned, from 18% to 15%, and in respondents who paused contributing to an investment, from 14% to 9%.

The proportion of household income allocated to savings increased to 23% in this year’s survey, from 20% in the previous two years and 19% in 2021.

The survey also found a promising trend in access to financial advice, with 43% of respondents saying they used a financial adviser in 2024, up from 39% in 2023.

Why South Africans are saving

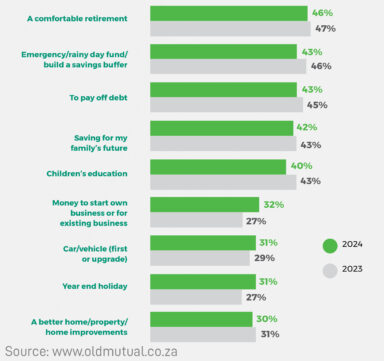

Saving for retirement continues to be the top savings goal among employed South Africans, followed closely by saving for a rainy-day fund, and saving to pay off debt.

But only 51% express high confidence in the adequacy of their retirement savings, with the highest level of confidence (75%) among those earning between R60 000 and R119 999. Those earning between R8 000 and R14 999 are the least confident (43% believe they will have enough), while 51% and of those earning between R15 000 and R29 999 and 59% those earning R30 000 to R59 999 are confident they will have enough.

A critical aspect of this year’s report is the introduction and awareness of the two-pot retirement system effective from 1 September. The Monitor found that 43% of South Africans do not fully understand the reforms. Although 63% of South Africans are aware of the new laws, understanding remains low, with only 24% claiming to comprehend the system very well.

More South Africans are poly-jobbing

As in previous years, respondents’ top financial priority for 2024 is income or job security. The second priority is cutting expenses, followed by paying off debt. Servicing debt remains household’s the second-biggest expense (21% of household income) after consumption and living expenses (41%).

The next three priorities are building up emergency savings, ensuring their investments are secure, and getting the best investment returns.

To increase household income, South Africans are holding down several jobs. This year’s survey classified 57% of respondents as poly-jobbers, up from 50% in 2023), with more young workers (18 to 29 years old) becoming part of this growing trend. The number of young poly-jobbers has risen from 60% in 2022 to 73% in 2024.

Forty-two percent of respondents earn at least some income through social media, and for 17% this is a significant part of their income (54% and 24% among respondents aged 18 to 29).

The OMSIM also found a growing entrepreneurial spirit among South Africans, with 47% of respondents owning a business, up from 44% the previous year, while 32% are prioritising saving to start or finance a business, up from 27% in 2023.

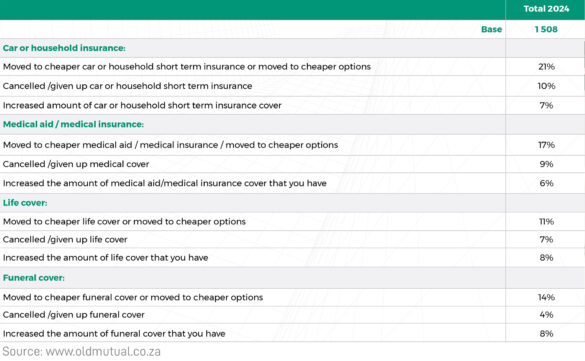

When it comes to cutting expenses, the trend is to move to cheaper risk and protection options, with consumers trimming and reorganising cover rather than giving it up entirely.

Main reason for taking out a personal loan

This year’s Monitor found some improvement in consumers’ management of debt. The number of respondents who said they have fallen behind on bills, credit and store card payments, and home loan payments declined compared to last year.

Overall, the incidence of personal loans taken out from institutions, microlenders, and family or friends held steady at 57%. This implies that consumers are servicing what they have, with fewer taking on fresh obligations.

The main reason respondents took out a person loan was to pay for an “unexpected expense” (48%). These expenses included home maintenance or repairs (38%), vehicle maintenance or repairs (34%), a medical expense (30%), fees and education-related costs (28%), funeral costs (23%), buying furniture or an appliance (16%), and buying a cellphone, tablet, or technology item (10%).

The other reasons for personal loans were:

- To buy or pay for an item or service: 32% of respondents.

- To pay off other debt: 28%.

- To pay for everyday expenses or to make ends meet: 26%.

- To buy stock or equipment for a business: 21%.

- To pay for a special celebration: 10%.

- To lend the money to someone else: 8%.