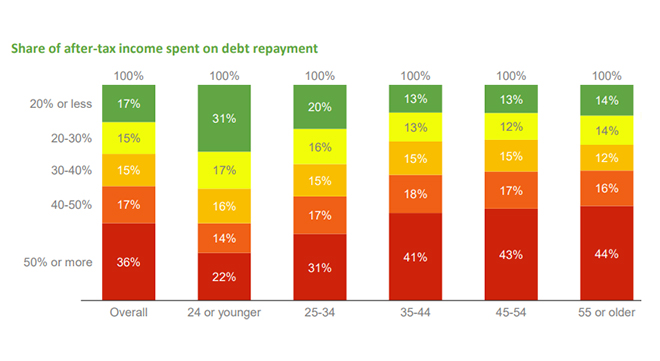

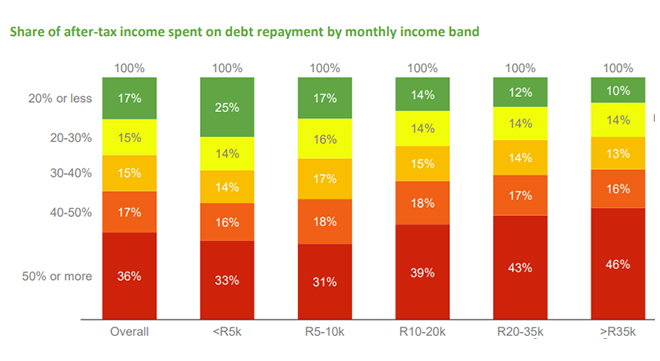

The latest Money Stress Tracker survey paints a sobering picture of financial strain across the nation. According to the third annual survey, a staggering 53% of South Africans are dedicating more than 40% of their take-home pay to debt repayments. Despite this, 42% of respondents admit to struggling with their monthly debt payments, while 32% remain convinced they don’t need help.

The survey, which draws from the insights of 26 000 registered users of www.debtbusters.co.za who are not currently in debt counselling, reveals a troubling trend: many are not taking proactive steps to address their financial stress.

The data further shows that those aged 45 or older are under the most pressure, with 60% facing unsustainable debt levels. Among monthly income bands, individuals earning more than R20 000 are struggling the most. Sixty-two percent of people earning between R20 000 and R35 000, as well as those earning more than R35 000, have unsustainable debt levels.

Research shows that the older people are, the higher their debt levels. However, most age groups are spending dangerously high levels of their income on debt repayments.

And earning a high salary does not necessarily correlate with lower debt levels. The data reveals that higher earnings often correspond with increased debt.

Benay Sager, the executive head of DebtBusters, says, generally, consumers are advised not to spend more than 30% of their take-home pay on debt repayment – at most 40%.

“The research clearly reveals that older people with higher incomes are under the greatest debt repayment pressure, yet most are resistant to seeking help. They cite not knowing who to trust as the main reason for inaction. By contrast, 54% of younger consumers show intent in dealing with money stress, although they are not always sure of the options available to them. The under-35s say they are embarrassed, while the 35-plusses tend to procrastinate,” Sager says.

The survey found that consumers’ response to money stress is long on intent but short on action, with only 35% of respondents looking for a better job/pay (up from 26% in 2022) and 39% trying to cut back on monthly spend (down from 44% in 2023).

Sager says there could be a number of reasons for this.

“It could also be some of the financial fatigue that a lot of consumers are feeling, particularly from inflation, particularly from interest rates. What we hear from consumers also, going back to the debt counselling side, in conversation is, ‘Well, I’ve cut everything to the bare bones. I don’t have anything else to cut’.”

To the question, “Why have you not yet done something to alleviate your money stress?”, 29% say they feel stuck, 21% say they are embarrassed to ask for help, 21% say they need more time to think, 19% say they do not know who to trust, and 8% say they want another loan.

According to psychologist Andrea Kellerman, over-55s are often more concerned about retirement than paying off monthly debt. Having lived with debt for a long time, they are accustomed to the stress of managing monthly payments. The anxiety of future financial security outweighs the stress of their current situation.

“Heightened stress can lead to a ‘freeze mode’ response. In addition, hormone production decreases in 45s to 55s, and this may further diminish energy and resilience. As a result, some may find it easier to ignore their stressors and avoid confronting them, resulting in future issues.”

She says by contrast, younger people may feel stuck. They may be more motivated and adaptable and have better trust levels and financial knowledge than their parents, but they face other stresses. These include limited job opportunities, higher relative startup costs, and a sense of demotivation regarding their prospects.

Actionable points that Sager suggests include developing trust-building initiatives and educating older consumers on the options available to address financial stress, providing more knowledge of options and support to younger consumers who feel stuck or embarrassed, and exploring opportunities to educate and support lower-income groups who lack clear options to improve financial situation.

Women, younger South Africans feel most financial stress

Of the 75% respondents who said they felt financially stressed, 93% said this was negatively affecting their home life, 76% their work life, and 74% their health.

According to the survey, the two main concerns when it comes to finances are running out of money before the end of the month and struggling to pay off debt.

Younger people and those with less income are the most anxious, with particularly women carrying the burden of financial stress. Compared to men, women are 10% more stressed about finances, with almost four out of five women saying they suffer from financial stress. They are 20% more stressed about health and 30% more stressed about home life.

Kellerman says women are more inclined to admit and express their stress. There’s also a societal expectation for women to provide emotional support and nurture their families, rather than only providing financial stability.

She explains men tend to compartmentalise stress by focusing on one issue at a time, while women are more likely to keep all their stressors open and constantly analyse them. This tendency to juggle multiple stressors simultaneously leads to increased feelings of stress among women.

“Additionally, consider that today more women are taking on the dual responsibility of being mothers and breadwinners. This adds on another layer of pressure, and the double burden contributes to heightened financial stress.”

The survey was conducted in June. Factors that contributed to consumers feeling slightly less stressed at the time were a significant period without loadshedding and interest rates that remained unchanged for more than a year.

Between 2023 and 2024 concerns about interest rate increases declined by 22%. Those concerned about loadshedding declined from 17% to 7% over the same period.

“Increasing interest rates and not knowing if you’re going to wake up to stage 3 or stage 6 loadshedding is stressful. Consumers like certainty. Although interest rates are high, consistency is less stressful than dealing with continuous rate hikes,” says Sager.

The ins and outs of debt counselling

Applying for debt counselling in South Africa involves partnering with a registered debt counsellor to manage and repay your debts. The process begins with a thorough financial assessment where your income, expenses, and debts are evaluated. Debt counsellors then negotiate with creditors to restructure payments, aiming to lower monthly obligations and extend repayment terms. They also provide crucial budgeting guidance to help meet debt obligations while covering living expenses. Legal protection shields you from creditor lawsuits during the review period, and the counsellor manages payment distribution to creditors.

The advantages include reduced monthly payments, legal safeguards, potential interest rate reductions, improved financial management skills, and the consolidation of payments into one monthly instalment. However, debt review may impact your credit score negatively and restrict access to new credit. The process can be long and involves associated fees, adding to financial burdens. Some individuals may also experience stigma or stress throughout the process.

So, although debt counselling serves as a valuable resource for individuals facing overwhelming debt, careful consideration of its implications is essential before committing to the process.

Sager says there are about 250 000 people in debt counselling in the country.

“There should probably be 10 times more people taking advantage of it. It’s not the only option, but as a debt repayment option, there should be many more people.”

Debt review remains constitutionally available regardless of age, but practical considerations may discourage people of a certain age from viewing it as an option.

“Often, what happens is that if people are close to retirement age, they will wait for that if they are going to get a pot of money. They’ll probably wait for that to materialise before anything happens,” says Sager.

He says there is some pushback with regards to restructuring on particular types of debt, particularly for home loans.

“That’s quite difficult when it comes to particular ages if it’s within a few years of retirement, so one has to be careful. It may not be the first option from a restructuring perspective, but for other things, there’s the ability to use current income to pay expensive debt and deal with it in such a way that there’s less expensive debt left before retirement.”

A common misconception is that individuals under debt counselling cannot change jobs until they complete the process. Not true, says Sager.

He explains that debt counselling is a legal process provided by the National Credit Act (NCA) to help consumers manage debt repayments. He says changing jobs is not impeded by debt counselling. However, financial services companies may inquire if you are in debt counselling and use this information to assess your financial management skills.

There is no legal restriction against employment due to debt counselling, but employers can ask about your current status. They cannot ask if you have ever been in debt counselling. Amendments to the NCA in 2015 erased records of those who successfully completed debt counselling to protect employment and lending prospects.

The duration of debt counselling depends on the amount of debt and the monthly repayments an individual can afford, according to Sager. He says there is no fixed timeframe; it varies from person to person.

“But I think it’s important to understand what you’re paying towards. Is it going to be enough to cover the interest repayments in such a way that you can get ahead of the curve? And I think that’s what needs to be properly disclosed to individuals when they are considering debt counselling.”

Sager provides these tips on how to find a reliable debt counsellor:

- Ensure the debt counsellor is part of a reputable association, such as the National Debt Counselling Association.

- Make sure you feel comfortable and not pressured into the process. Take a few days to consider your options.

- Ask whether you can visit the counsellor’s office to verify their premises.

- Look into the counsellor’s track record and seek recommendations from previous clients.

- Confirm the counsellor’s National Credit Regulator registration number, office location, phone numbers, and website legitimacy.

- Ask about the debt cousellor’s payment methods and clearance success rate.