South Africans are still feeling the financial strain of high interest rates, despite a slowdown in inflation. This has led to increased reliance on credit, a shift towards value-driven purchases, and early withdrawals from retirement savings.

These trends are highlighted in the SpendTrend25 report, released last week by Discovery Bank and Visa. Now in its third year, the report provides an in-depth analysis of consumer spending patterns between 2019 and 2024, based on credit card data from Discovery Bank clients and the wider South African population.

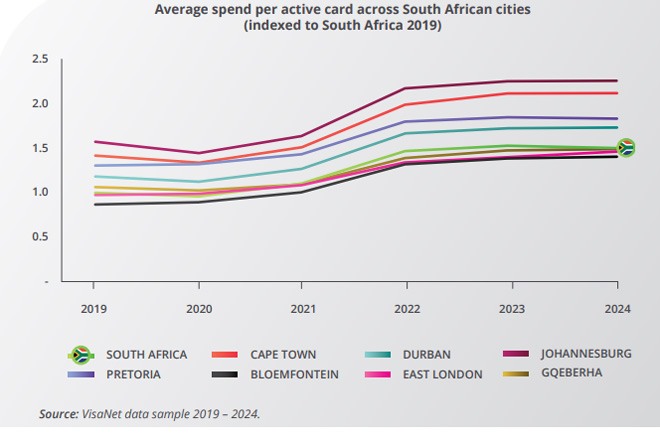

The report tracks spending behaviour across seven major metropolitan areas – Cape Town, Durban, Johannesburg, Pretoria, Bloemfontein, East London, and Gqeberha – offering regional insights into how consumers are adapting to financial pressure.

To complement the data, Discovery Bank and Visa commissioned an independent public survey of 1 000 high-income South Africans who actively use credit cards. The survey aimed to uncover deeper consumer insights into spending habits, payment preferences, and broader financial behaviour.

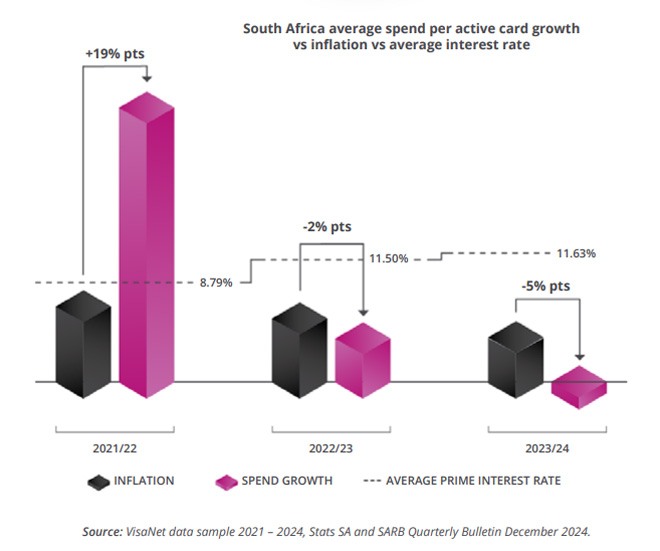

Despite lower inflation, the report found that consumer spending remained muted, constrained by high borrowing costs and stagnant income growth. Inflation fell from 6% in 2023 to 4.4% in 2024. Yet, average consumer spend growth remained flat, with spending per active card trailing inflation by five percentage points.

“This growing gap suggests that factors beyond prices – like income constraints and rising expenses – are shaping consumer spending habits,” the report notes.

High interest rates place strain on consumers

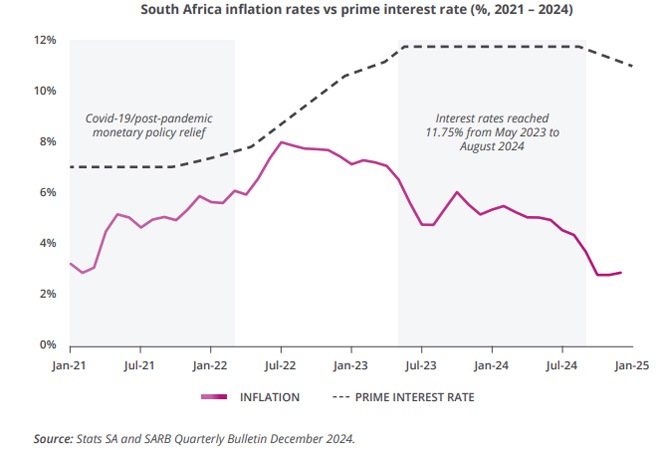

Although inflation eased in 2024, high interest rates – with the prime lending rate holding steady at 11.75% for most of the year – continued to put pressure on household finances. As a result, many consumers had less disposable income, despite the more stable price environment.

Interest rates, which reflect the cost of borrowing, play a key role in consumer behaviour. When rates are high, borrowing becomes more expensive, often leading to reduced spending.

According to the report, overall spending remained subdued, with little change in per-card expenditure between 2023 and 2024.

Secondary cities, including Bloemfontein, East London, and Gqeberha, bucked the trend slightly, showing modest growth. Spending rose by 4.3% in East London, 1.2% in Bloemfontein, and 1% in Gqeberha.

However, primary cities recorded a slight decline, which weighed down national figures.

Because these urban centres account for the bulk of total spending, overall growth across South Africa remained flat.

Reliance on credit and a shift toward value-based spending

South African consumers are increasingly relying on credit and tapping into their retirement savings to manage day-to-day expenses, according to the report.

“The prime rate cut in September 2024 offered some relief, but the slow recovery has led many to rely on value-based spending, two-pot retirement withdrawals, and increased credit use to cope. Consumers are spending less, despite prices stabilising,” the report states.

Although inflation has cooled, financial pressure remains high – and credit use is on the rise. The number of credit cards in use across the country has surged by 53% since 2020, according to the Global Data Payments Report 2024.

More cards are being issued and new credit limits are rising, but average spending per active card has remained largely unchanged.

“This suggests that consumers are distributing their spending across multiple payment methods, rather than significantly increasing their credit card usage,” the report notes.

In effect, credit card numbers are growing faster than total spend, leading to a lower average spend per card.

Several factors are driving this trend:

- More consumers are holding multiple cards but using each less frequently.

- New credit users are entering the market with lower spending limits.

- People are increasingly managing their spending strategically to maximise rewards and benefits.

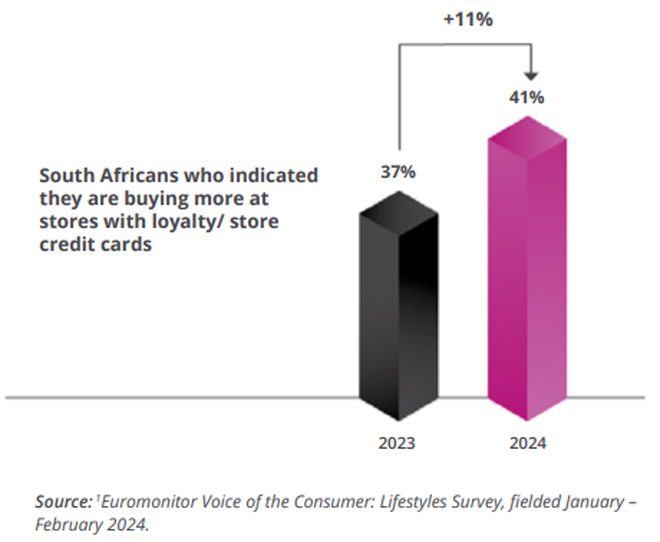

The report found that more than 80% of consumers now engage more actively with their credit card benefits than they did a year ago. In a sign of growing price sensitivity, 86% of respondents said everyday costs continue to climb, prompting more shoppers to seek savings through loyalty programmes and store credit cards.

As a result, 41% of consumers now shop more often at stores where they can earn loyalty points or use store credit.

When deciding which credit card to use, 84% said they prioritise cards that offer rewards or cashback, while 82% look for those with low fees and interest rates.

“Consumers value benefits that maximise their spending power,” the report concludes.

Millions tap into retirement savings as financial strain persists

The introduction of the two-pot retirement system in September last year has given South Africans early access to the savings portion of their retirement funds. By 31 January, the South African Revenue Service had received 2 664 279 applications for tax directives related to withdrawals from the system’s savings withdrawal benefit. Of these, 2 403 379 applications were approved, resulting in a total gross payout of R43.42 billion.

According to data from Discovery Corporate and Employee Benefits, the bulk of these early withdrawals have gone toward essential living costs. About 24% was spent on housing or vehicle-related expenses, 21% was used to settle short-term debt, 20% went to education – likely school fees – and 11% was directed toward daily living expenses.

“This reveals how long-term savings are being used to cover immediate costs, even as inflation eases,” the report notes. “While many South Africans are under financial strain, using retirement savings on short-term needs is a concerning trend. The unsustainability of this financial behaviour makes education on long-term financial management crucial across all income groups.”

Discovery’s data shows a strong correlation between financial behaviour and the ability to preserve retirement savings. Its Vitality Money programme, designed to reward good financial habits, assesses clients on five core behaviours: saving adequately, managing short-term debt, maintaining appropriate insurance cover, staying on track for retirement, and managing property investments responsibly.

Research linked to the programme shows that improving these behaviours leads to greater financial resilience and long-term independence.

“Higher Vitality Money statuses generally indicate better financial habits, and Discovery Retirement Fund members with a higher Vitality Money status are less likely to withdraw from their retirement savings,” the report notes.

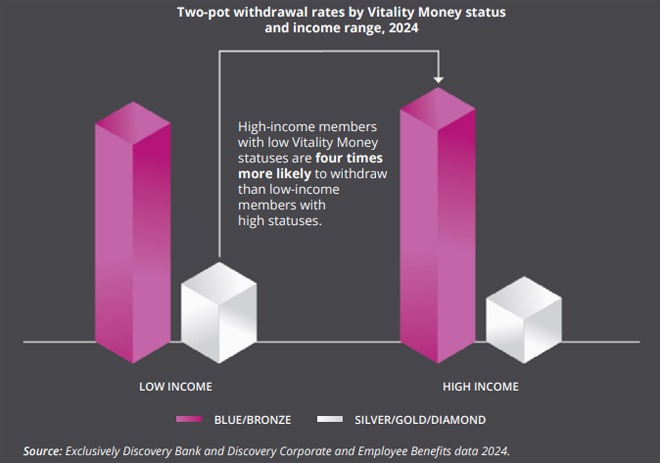

Interestingly, income alone is not a reliable predictor of whether individuals dip into their savings. The data shows that high-income earners with poor financial habits – reflected by low Vitality Money statuses (Blue and Bronze) – were four times more likely to make withdrawals than lower-income earners with stronger financial statuses (Silver, Gold and Diamond).

“Withdrawal rates were higher among high-income members with low Vitality Money statuses than among lower-income members with higher statuses,” the report states, challenging assumptions about wealth and financial behaviour.

Read the full report here.