Inspiring young minds to embrace financial literacy at an early age is no small feat, but Foord Asset Management’s charming series of books make it engaging for children as young as four.

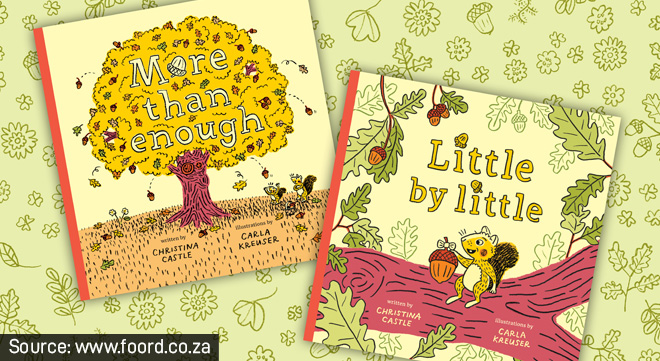

The books form part of Foord’s innovative Teach Your Child to Invest financial literacy initiative. The books, More Than Enough (2019) and Little by Little (2021), were written by Christina Castle, Foord’s brand and communications manager.

Christina says the books are designed to help children aged four to seven, along with their guardians, start understanding essential concepts about money, saving, and investing.

And come March 2025, the third instalment will be released. While Christina remains tight-lipped about the specifics, she says: “It’s still a secret, so I can’t share too much about it. What I can say is that it has been written and it is now in illustration.”

One of the primary goals of the book series is to start a much-needed conversation about money, saving, and investing early on.

“Many adults battle to do that and fail to have a healthy relationship with money or understand the importance of saving and investing,” says Christina. “This age group is old enough to grasp these simple yet important concepts that we cover in the books. What is important is that we don’t talk about money and there is no hint of greed. The concepts in these books apply not just to saving and investing but to other areas of life as well.”

The inspiration behind this initiative comes from Foord’s long-standing commitment to education through corporate social investment. Christina elaborates: “The book series was the original idea. Turning the idea into an initiative gave it the direction, structure, and longevity it needs.”

Christina’s background in marketing and communications gave her the insight to craft stories that not only educate but entertain. “A children’s book is a beautiful, authentic medium to gently teach a concept over and over again in an entertaining way.”

Foord has taken steps to maximise the books’ reach. Over 150 000 copies have been distributed locally (and abroad), with a focus on disadvantaged communities. “We work with NPOs and other organisations to maximise our reach as much as possible,” shares Christina.

A key partner, Avocado Vision, has designed a teaching programme around the first book, which will soon be rolled out in rural areas.

The first book introduces Anele, a lovable squirrel, and her mom, while the second brings in her lively best friend, Mpumi the woodpecker, along with the cranky yet wise Old Mr Tortoise. The playful and quirky characters help deliver key messages in a way that resonates with both children and adults.

Christina shares that the inspiration for the book’s characters and setting came naturally from the humble acorn.

“Foord has always used the acorn as part of its identity. ‘Mighty oaks from little acorns grow.’ It just seemed fitting (and beautiful) to tell the stories around the acorn. The characters are just a natural and fun fit,” she explains.

Writing these books has been a rewarding process for Christina, who combines her love for storytelling with her copywriting background. “The toughest and most important part for me is getting the concept and storyline right,” she says. “I love playing, fooling around with and making up words. It is imperative to work closely and collaboratively with an illustrator who you trust and respect.”

In this case, Christina partnered with Carla Kreuser, with whom she shares a strong creative synergy.

Carla is an award-winning graphic designer, illustrator, and creative director. Her freelance design and illustration projects often overlap as she explores the playful visual dance that forms between pictures and words on a page.

Carla and Christina have collaborated on many design projects over the years and created three picture books together so far – the two books in the series and The Giving Bowl (2020).

Carla says she loved Christina’s idea of a picture book that makes financial literacy accessible to kids.

“Our aim was to produce a quality product that kids would (hopefully) treasure and that would be a joy for both kids and grown-ups to read and re-read.

More Than Enough introduces kids to the idea of money, but Christina and Carla deliberately chose not to show any money in it – the acorn becomes the metaphor for money and wealth.

Carla says she had a lot of fun bringing Anele’s squirrel home and the imaginary forest world to life – filling it with oak trees, flowers, mushrooms, autumn-coloured leaves and small, gentle, mainly tree-dwelling creatures. As the series progressed, new areas of the forest needed to be imagined – both above and below the ground.

“I illustrated the stories in a friendly, simple, expressive style. I always imagine the characters on the page as if they’re on a stage, moving across my spreads. I’m curious about what happens behind and around them – hiding small details, like acorns falling or woodpeckers snacking on mushrooms, that kids can discover when re-reading the stories.”

Parents and teachers can visit Foord’s website to download the books or enjoy them through read-along audio in English, Afrikaans, isiXhosa, and isiZulu. The site also features two YouTube links where the stories are narrated. For those who prefer hard copies, they are available from Foord free of charge.

Christina says for them it was important to ensure that as many children throughout South Africa can access the books. And to read them in their mother tongue.

“It’s a work in progress. What started as a ‘good idea’ has certainly turned into something much greater than we expected. There is such a need for financial literacy, and we are just excited and proud to be part of this important journey,” she says.

For more information, email info@foord.co.za

Boost your career prospects with MBSE’s accredited qualifications

With more than a decade of experience in insurance and financial planning training, MBSE is an accredited private higher-education institution registered with the Department of Higher Education and Training, and an accredited skills development provider for the Quality Council of Trades and Occupations.

MBSE’s qualifications are recognised by the FSCA. It is also an approved education provider of the Financial Planning Institute of Southern Africa and the Insurance Institute of South Africa, ensuring recognition of its qualifications in South Africa’s financial services market.

The online education provider offers a range of qualifications, short courses, Class of Business Training, and CPD courses aligned to the needs of the financial services sector.

Apply today at www.mbse.ac.za.

For more information, contact us at help@mbse.ac.za.