The National Prosecuting Authority (NPA) claims former Steinhoff executives Stéhan Grobler and Ben la Grange were generously paid to manipulate the financial statements of Steinhoff International Holdings Limited (SIH) and Steinhoff International Holdings NV (SINV).

The accusation is detailed in a 92-page indictment against former director Grobler and La Grange, the former chief financial officer. The charges against them include racketeering, three counts of fraud totalling R21 billion, manipulating financial statements, and failing to report fraudulent activities. Both are out on bail.

In the indictment, the NPA describes how the Steinhoff Group falsified profits through two elaborate schemes – the TG Group fraud and the BNP Paribas commission transactions. Together, the schemes allegedly generated more than R20.7bn in fake profits from 2014 to 2016.

The NPA claims the TG Group fraud aimed to inflate the Steinhoff Group’s financial position and profits by treating loans as assets and fictitious payments as revenue, without corresponding costs. The BNP Paribas commission transactions, like the TG Group fraud, were fraudulent transactions processed through SIH’s accounting systems.

Read: How the Steinhoff Group propped up its profits

On 7 August 2015, SIH proposed a scheme whereby shareholders would exchange their SIH shares for shares in SINV, making SIH a subsidiary of SINV. The scheme was approved on 7 September 2015, establishing SINV as the holding company from 2016 onwards. SIH’s JSE listing ended on 7 December 2015, and SINV shares began trading on the Frankfurt Stock Exchange and the JSE.

According to the indictment, the main purpose of the “enterprise” was “to manipulate and inflate the AFS of SIH and SINV and consequently to publish false information relating to the financial health and performance of the Steinhoff Group”.

“The aforementioned acts were committed to ensure that the true state of the financial health and performance of the Steinhoff Group and its subsidiaries was concealed from persons who had an interest in the financial health and performance of the Steinhoff Group,” the indictment states.

Section 1 of the Prevention of Organised Crime Act defines an “enterprise” as including “any individual, partnership, corporation, association, or other juristic person or legal entity, and any union or group of individuals associated in fact, although not a juristic person or legal entity”.

The indictment notes that Markus Jooste, the chief executive and executive director of the Steinhoff Group, played a major role in the management of the enterprise. It further claims that Grobler, who was also the head of treasury of the Steinhoff Group, and La Grange were involved in the enterprise from at least June 2013.

Both Grobler and La Grange were also members of the executive committee of SINV. The executive committee was established, according to the 2016 annual financial statements, “to assist the management board with the fulfilment of its duties”.

The executive committee consisted of the three management board members – Jooste, La Grange, and Danie van der Merwe – and other group executives (including Grobler).

Before being appointed as acting chief executive in December 2017, Van der Merwe served as Steinhoff’s chief operating officer. He stepped down as acting CEO at the end of December 2018.

The indictment states that the 2014 SIH AFS and 2015 SIH AFS were approved and issued by, inter alia, Jooste, Grobler, and La Grange.

The 2016 SINV AFS were approved by, inter alia, Jooste, Grobler and La Grange, and issued by Jooste, La Grange, and Van der Merwe.

Grobler is accused of creating documentation to support fictitious transactions that inflated and falsified the AFS of SIH and SINV. Grobler, on the instruction of Jooste, was allegedly involved in the drafting of the “contracts” with the TG Group shell companies.

He is also accused of routing payments from the Steinhoff Group to its operating entities to create the false impression that payments were made by the TG Group.

La Grange is accused of having participated in the creation of documentation as support for the fictitious transactions.

‘Handsome remuneration’

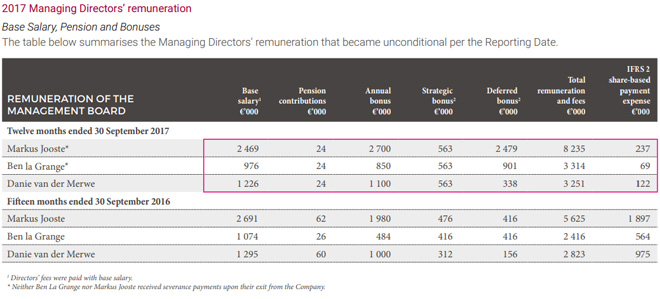

The NPA claims that during the 2015 to 2017 financial years, Grobler and La Grange “were handsomely remunerated for their efforts”.

According to the indictment, their remuneration was made up of three components:

- a base salary;

- annual bonuses, known as performance bonuses and strategic/project bonuses, linked to the profitability of the Steinhoff Group, and the performance of the executive concerned; and

- shares in the listed holding company (SIH or SINV), which vested annually.

“Since above-mentioned bonuses were linked to the reported profitability of the Steinhoff Group, which in turn was a major determinant of the SIH or SINV share price, it was clearly to the benefit of the accused (Grobler and La Grange) that the apparent profitability of the Steinhoff Group was continually inflated by the TG Group fraud,” the indictment states.

Grobler resigned from the group in February 2018 but was retained under a consultancy contract, which was later revoked.

In a September 2023 judgment in Steinhoff International Holdings NV and Others v Grobler and Other, the primary issue was a claim for the recovery of remuneration, including bonuses and share incentives paid to Grobler. The total amount sought to be recovered exceeds R270 million.

According to the judgment, Grobler is alleged to have held various roles within Steinhoff, including senior executive and director of Steinhoff International Holdings (Pty) Ltd (SIHPL).

He also served as a senior executive and member of the governance and sustainability committee at SINV, a company based in the Netherlands. Additionally, Grobler was the company secretary of SIHPL from 6 December 1999 to 23 September 2011. He held positions such as group treasurer of the Steinhoff Group, supervisory director, and at times managing director of Steinhoff Europe AG (SEAG), an Austrian company.

During his tenure in these roles, Grobler received various forms of compensation, including base salaries, performance bonuses, strategic and project bonuses, relocation bonuses, and participation in share incentive schemes.

The remuneration paid to Grobler by the companies involved was detailed as follows in the judgment:

- SAHPL: R238 176 671

- SEGS: €1 370 000

- SEAG: €315 000

La Grange resigned as CFO and managing director in January 2018.

According to the audited results for the year ended 30 September 2017, he earned a base salary of €976 000, an annual bonus of €850 000, a strategic bonus of €563 000, and a deferred bonus of €901 000 for the 12 months ended 30 September 2017.

In addition to the remuneration paid to them by Steinhoff, Grobler and La Grange also received the benefit of dividends on SIH or SINV shares held directly or indirectly by them during the 2014 to 2017 financial years.

“These shares were partially, but not wholly, awarded to the executives concerned in terms of the SIH/SINV share incentive scheme,” the indictment states.

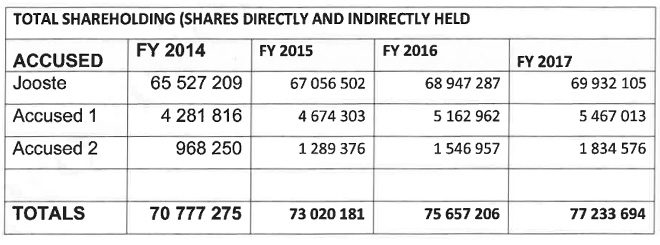

The table below shows the number of SIH or SINV shares held by Jooste, Grobler (Accused 1) and La Grange (Accused 2) at each financial year-end.

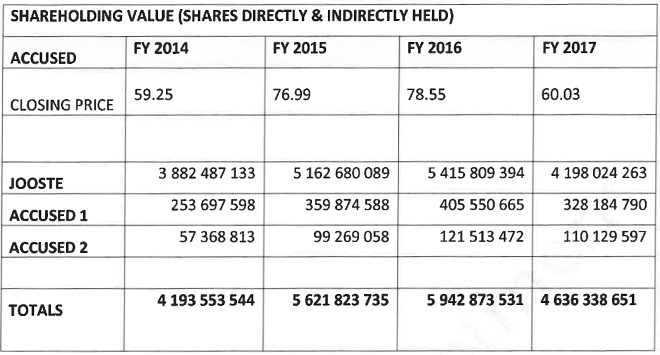

The number of shares shown above had the total values in rand, at the end of each financial year, shown in the table below.

In terms of Steinhoff International Holdings’ dividend policy, the company declared dividends annually. Moonstone searched for the dividends approved and declared by the board for financial years 2014 to 2017. For the financial year 2014, the board approved a cash dividend from retained earnings of 150 cents per share. A cash dividend of 165 cents per share was declared in 2015 and 2016, respectively.

According to the audited results for the year ended 30 September 2017, “given the ongoing liquidity position of the Company and Group, the Management Board, with the approval of the Supervisory Board, has resolved not to propose dividend on Ordinary Shares until further notice”.

Shareholders were, however, entitled to decline the dividend or any part thereof and instead elect to receive a capitalisation issue alternative (an offer of free additional shares to existing shareholders).

Based on the amounts listed in the total shareholding table, had Grobler chosen to accept the cash dividends per share for 2014, 2015, and 2016, he would have received a total of R22 654 211.25. Similarly, La Grange’s total would have been R6 132 324.45. Jooste’s combined dividend earnings for those three years would have amounted to R322 697 065.35.

The NPA claims the inflated profits of the Steinhoff Group due to the TG Group fraud led to discretionary bonuses paid to Grobler and La Grange being based on exaggerated profit numbers. Similarly, the shares in SIH (2014 and 2015) and SINV (2016 and 2017) that vested with Grobler and La Grange through the Steinhoff share incentive scheme were calculated using these inflated profit figures.

“The result was that the accused received materially more by way of bonuses and vested shares than they were entitled to,” the indictment reads.

In an affidavit, La Grange stated his intention to plead not guilty to the charges, maintaining his innocence. Grobler has also expressed his determination to clear his name.

Both are set to appear in court again in early October.