The beleaguered Road Accident Fund (RAF) could save about R3 billion a year by rejecting opportunistic loss of income claims from individuals who suffered only minor injuries in a motor vehicle accident.

This is according to actuary and damages expert Gregory Whittaker in a recently published research study titled “Road Accident Fund loss of income claims for non-serious injury: a local and international comparison”.

The study, conducted for the Actuarial Society of South Africa (ASSA), found that loss of income compensation from the RAF for non-serious injuries is excessive by local and international standards.

Included in Whittaker’s research are claims statistics for the financial year ended 31 March 2021, released by the RAF in terms of the Promotion of Access to Information Act. The statistics show that loss of income settlements for the period totalled R18.4bn, of which about 14% was paid to individuals with non-serious injuries.

The RAF paid R22bn in loss of income claims in the financial year ended 31 March 2023.

Whittaker says in the absence of exact figures, assuming 14% of total loss of income claims was paid for non-serious injuries, this equates to R3bn.

One of the key changes introduced by the Road Accident Fund Amendment Act, which came into full effect on 1 August 2008, was to prohibit compensation for non-pecuniary loss (general damages not quantifiable in monetary terms, such as pain and suffering) for non-serious injuries.

He points out, however, that the same exclusion was not applied to loss of income claims from individuals who suffered minor injuries in a car accident. According to Whittaker, this has led to widespread abuse of the system, costing taxpayers billions of rands every year.

New trend in RAF claims

Compounding the problem, he says, is a new trend where pre-Amendment Act claims for minor injuries have now turned into claims involving future loss of earnings related to minor to moderate head injuries.

Whittaker says the research shows there has been a significant increase in the number of loss of income settlements made by the RAF over the years.

“In the financial year ending 31 March 2008, the RAF made 5 957 individual claims payments in respect of loss of income, whereas in the financial year ending 31 March 2023, the RAF made 20 957 individual claims payments in respect of loss of income.”

Closing the gap for opportunistic claims

Whittaker recommends amending the RAF Act to do away with the provision that allows individuals with minor injuries to submit loss of income claims.

“A simple amendment of removing compensation for non-serious injury and hence aligning this to the treatment of compensation for non-pecuniary losses would result in a saving to the fiscus of some R 3bn a year in compensation payments.”

He adds that such an amendment would also reduce by about 25% the number of RAF cases in the courts, resulting in substantial savings in expert witness costs.

He further recommends that legislators address the “substantial mismatch” between compensation provided in terms of the Compensation for Occupational Injuries and Diseases Act (COIDA) and the RAF.

The research found that, in the financial year ending 31 March 2021, the biggest claim paid for a non-serious injury claim by the RAF was about 25 times the maximum claim paid under COIDA for a non-serious injury claim with a whole person impairment of 30%.

Whittaker recommends the establishment of a central government body responsible for determining fair compensation to individuals, whether injured in a car accident or at their place of work. He adds that such a central body should also be tasked with determining how the compensation regime should function.

He says these steps would help address the worsening financial situation of the RAF.

Whittaker says he hopes the research will contribute towards achieving a more equitable system of compensation for victims of road accidents, whereby more resources can be allocated to those who are seriously injured.

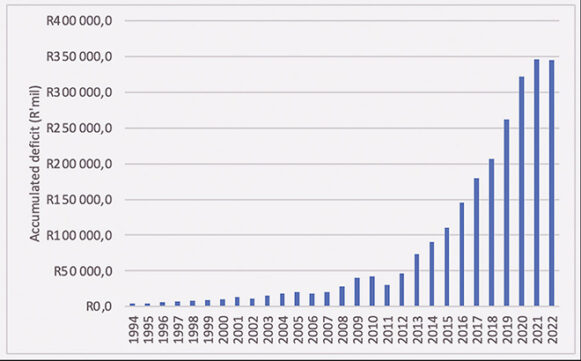

RAF’s accumulated deficit from 1994 to 2022

At the end of the 1994 financial year, the deficit of the RAF stood at R3.8bn. By the end of March 2022, the deficit had grown to R344.8bn.

Whittaker says that although the extraordinarily high rate of road accidents in South Africa is the primary cause of the dire financial position in which the RAF finds itself, several interventions can significantly reduce the burden on the RAF.

The Minister of Transport, Sindisiwe Chikunga, released the 2023/24 festive season road statistics at a media briefing held at the N1 Grasmere Toll Gate, Gauteng, on 24 January.

The preliminary results show a 2.3% decline in the number of fatal crashes compared to the same period last year. The data indicates that most of those who died were between the ages of 25 and 44.

Chikunga said that, during the period under review, 1 184 fatal crashes were recorded compared to 2022/23 when 1 212 crashes were recorded.

“The period shows that human factors contributed 80.8% of the crashes, environmental factors contributed 10.4% as a result of heavy rainfall and storms, while vehicle factors contributed about 8.8%.

“According to the statistics, 40.9% of those who died were pedestrians, passengers accounted for 33.6%, drivers accounted for 24.6%, and cyclists accounted for 0.8%,” Chikunga said.

The minister said most fatalities were recorded on Sundays, which is a new trend.