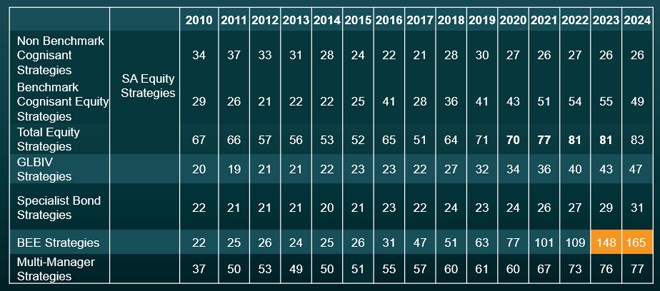

The latest Manager Watch Survey indicates that black economic empowerment (BEE) is playing a significant role in shaping retirement fund investment strategies, as well as the increase in allocations to multi-managers.

Alexforbes last week released the 30th edition of its Manager Watch Survey of Retirement Fund Investment Managers. It said the 2024 publication “marks three decades of data collection and industry analysis, tracking trends that continue to shape investment decisions across the country”.

The publication includes 30 comprehensive surveys – 15 balanced, 14 specialist, and one multi-manager – and discloses key trends in asset manager performance, broad-based black economic empowerment (B-BBEE) credentials, investment strategies, and environmental, social and governance (ESG) integration.

The number of asset managers participating in the survey grew by 5.7% in 2024 to 92, while the number of investment strategies increased by 6.4% to 796. The BEE survey saw the largest year-on-year increase in strategies, rising by 11.5% to 165.

“More and more managers are wanting to have the credentials of being a BEE manager – majority black-owned. It is now a critical decision-making criterion for many of our largest retirement funds, particularly those in the public sector and the SOE space,” Janina Slawski, the head of investment consulting at Alexforbes, told a media briefing last week.

Slawski said the increase in the number of managers participating in the survey was to some extent a result of more assets being allocated to smaller managers. “We have incubation and BEE managers coming through who are starting to receive these allocations.”

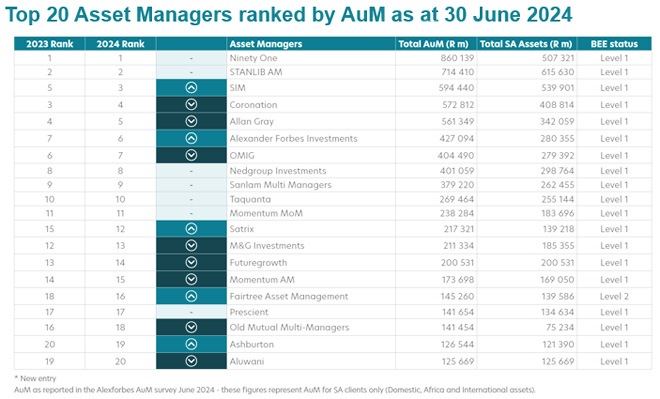

Ninety One retained its position as South Africa’s largest single asset manager, with a 4% increase in assets under management compared to the previous year: AUM of R860 billion in June 2024 compared with R823bn in June 2023 (South African clients only).

Stanlib Asset Management held onto second place, with a 10% increase in assets, from R649bn to R714bn.

A reshuffle occurred in third position as Sanlam Investment Management (SIM) surged ahead with a 20% asset growth to R594bn, overtaking Coronation Fund Managers (R572bn) and Allan Gray (R561bn). SIM’s growth was the result of its acquisition of Absa’s asset management business.

Multi-manager Alexander Forbes Investments moved up to sixth place after a 10% rise in assets, overtaking Old Mutual Investment Group.

Slawski said there is a trend of increasing allocations to multi-managers

According to the June 2024 Alexforbes assets under management survey, multi-managers have significantly gained ground on single managers over the past five years. In 2019, multi-managers managed 15 cents for every R1 managed by single managers. By 2024, this had almost doubled to 29 cents.

Slawski said the increasing allocation to multi-managers is, to some extent, linked to small retirement funds moving into umbrella funds – effectively, instead of running their own investment strategies, they are investing into a multi-managed solution.

Satrix moved up from 15th to 12th position, highlighting the trend of increasing allocations to passive managers.

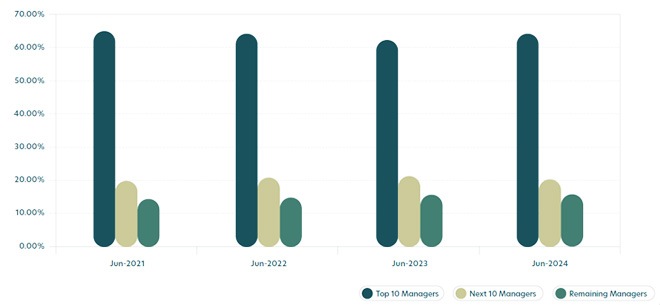

Higher allocations to smaller managers

Another significant trend – although slightly reversed in the past year – is the decrease in the percentage of assets managed by the top 10 managers, with more assets going to smaller managers.

Slawski said this was linked to the importance of BEE in funds’ investment decisions – more and more smaller BEE managers are setting up and receiving allocations. At the same time, it is a normal trend in markets across the world where very large asset managers cannot necessarily invest significantly in mid to small cap stocks.

“We do find clients interested in allocating to smaller managers because they can be more nimble. They can take sizeable positions in small caps, whereas larger managers struggle to do that.” However, she reiterated that this trend is substantially linked to the importance of BEE.

B-BBEE and ESG

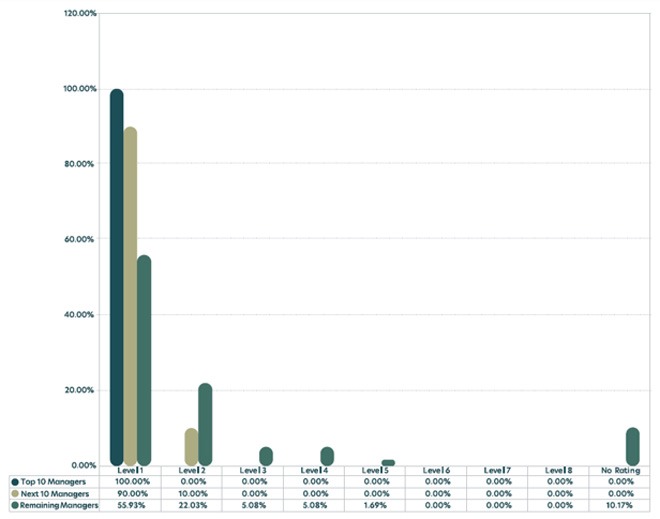

The 2024 AUM survey showed that 52 of the 79 asset managers surveyed are rated as Level 1 B-BBEE contributors, up from 51 the previous year.

All the top 10 asset managers, and all but one of the top 20, achieved Level 1 status. This, Alexforbes said, underlines the industry’s ongoing commitment to transformation and inclusive growth.

Slawski said Alexforbes has noted that whereas previously quite a few managers were not rated at all, many now have BEE ratings, even if they are starting at Level 5.

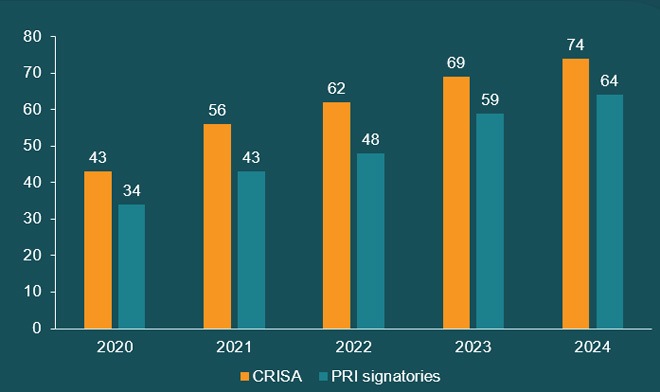

ESG continues to gain traction among local asset managers. The number of signatories to the Code for Responsible Investing in South Africa (CRISA) grew by 32%, from 56 in 2021 to 74 in 2024. Similarly, the number of asset managers signed up to the United Nations’ Principles for Responsible Investment (PRI) rose by 49% over the same period, reaching 64.

“Generally, when we work with managers for our clients, we expect all to ascribe to CRISA,” Slawski said. “But there is an expense and quite a lot of effort involved in PRI, so not all of the smaller managers will assign to PRI, but it’s very pleasing to see that that number is also increasing substantially.”

Performance and asset allocations

All the managers in the SA Best Investment View (BIV) category (large multi-asset investment mandates) had positive returns for the 12 months to the end of December 2024, with 8 out of the 13 managers beating the BIV median of 15.1%. The best performer in the domestic BIV category was ClucasGray, which returned 19.4% for the year.

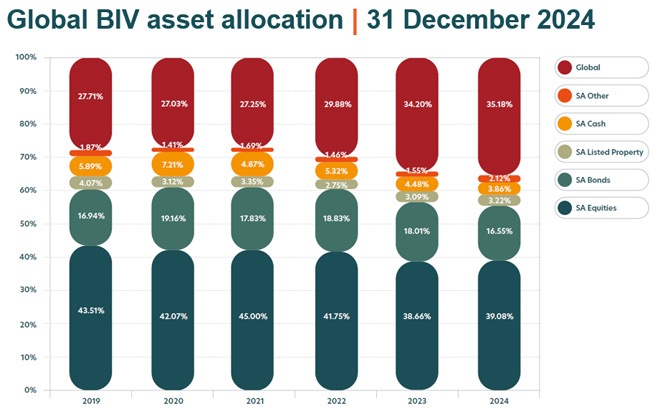

Allocations to the major asset classes have been stable over the past six years. Slawski noted the low percentage allocated to alternative assets, such as infrastructure and private equity. Liquidity remains a key concern for funds allocating in this space.

The Global BIV category of the Manager Watch survey recorded a median return of 14.8% for the year to the end of December.

Among the 44 asset managers that participated in this category in 2023 and 2024, 24 managers increased their global exposure, while 20 reduced it. Notably, three managers expanded their global allocation by more than 10 percentage points, indicating a strategic shift towards international investments. By December 2024, 39 out of 47 managers held more than 30% of their portfolios in global assets, with 10 exceeding the 40% mark.

Slawski said the larger average exposure to global assets since 2022 is a result of the South African Reserve Bank raising the prudential limit for institutional investors’ offshore investments to 45%.

The average international exposure of asset managers in the survey increased to 35.2% in December 2024, compared to 34.2% in the previous year. This marked a steady rise from 29.9% in December 2022 and 27.3% in December 2021, highlighting an ongoing trend of increasing global allocations. However, five managers had exposure below 30% by a margin greater than 5%, suggesting a more cautious approach.

Slawski noted that the switch into global assets has mainly been at the expense of South African equity.