Updated POPIA compliance: data breach reporting must be online

From 1 April, all security breaches must be reported solely via the Information Regulator’s online portal, not by email.

From 1 April, all security breaches must be reported solely via the Information Regulator’s online portal, not by email.

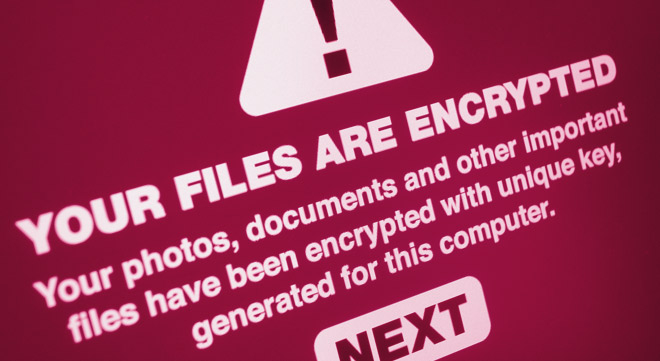

Cyber insurance and practical measures can shield a business from devastating data breaches and ransomware attacks.

With the Joint Standard on Cybersecurity and Cyber Resilience set to take effect in June, trustees could be held personally liable for losses due to data breaches.

Improper data handling could lead to expensive claims, and stronger enforcement of POPIA is critical to preventing future litigation, say legal experts.

The Allianz Commercial Cyber Security Resilience report shows that the costs associated with certain data privacy breach claims can match or surpass those of ransomware incidents.

SMMEs serving critical infrastructure and global corporations, as well as those in regulated industries such as insurance, healthcare, banking, and credit monitoring, are particularly vulnerable.

The International Trade Administration Commission explains why it delayed notifying the public of the attack for almost four months.

LockBit, the cybercriminal group allegedly responsible for the attack, was the subject of a take-down operation by global law enforcement agencies.

The commission urges clients to monitor transactions on their credit cards.

The loss equated to more than 20% of the company’s annual profit, based on the exchange rate at the time of the incident.

The 13th Allianz Risk Barometer reveals that deepfake video technology, aimed at facilitating phishing scams, is now readily available online, priced as low as R377 a minute.

Notifications